Free Tax Preparation for low income individuals or families

- Income Tax

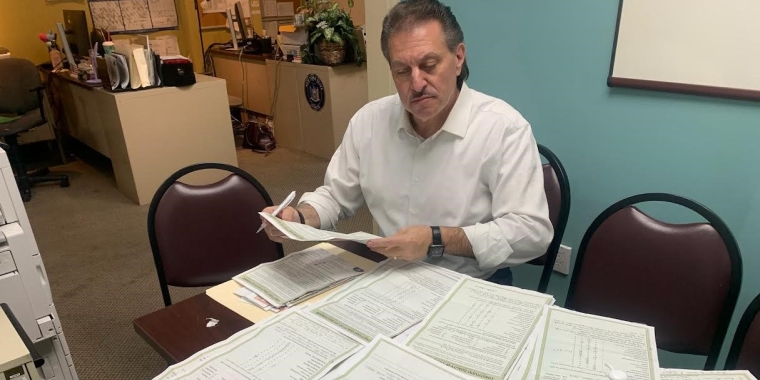

NYS Senator Joseph P. Addabbo Jr.

Food Bank For New York City

The City University of New York

invites you to

Free Tax Preparation

Friday, March 16, 2012

10 AM to 4 PM

Majestic Marquise

88-03 101 Avenue

Ozone Park, NY 11416

* Qualified people will get their taxes completed for FREE.

To qualify you must have the following:

• If filing jointly with a spouse, both of you must be present

with photo IDs.

• Social Security cards or ITIN (or copies) for you and your

spouse if filing jointly and anyone you are claiming on

your tax return, or a letter from the Social Security

Administration.

• W-2s for all jobs you held in 2011.

• Form 1099-G if you received unemployment

insurance in 2011.

• Form 1099-INT if you received interest from a bank

account in 2011.

• Form 1098-T if you paid tuition.

• Form 1098-E if you paid student loan interest.

• If you are claiming child care expenses, amount you paid

and child care agency’s ID or name and Social Security

number of the babysitter.

Income limits

• $50,000 with dependents

• $18,000 without dependents

DIRECTIONS: By Bus: Q8 runs along 101st Avenue. Take to 88th Street.

Q24 runs along Atlantic Avenue. Take to 88th Street and walk south along 88th

Street three blocks to 101st Avenue.

Food Bank For New York City

212-894-8060

NYS Senator Addabbo Jr.’s office

718-738-1111

We do not prepare the following returns: Itemized returns; Schedule C (Profit or Loss from Business - except limited Schedule C for child care providers and

taxi drivers); Complicated & Advanced Schedule D (Capital Gains and Losses); Schedule E (Rents & Losses); Form SS-5 (request for Social Security Number);

Form 2106 (Employee Business Expenses); Form 3903 (Moving Expenses); Form 8606 (Nondeductible IRAs); Form 8615 (Minor’s investment income).

How a Bill Becomes Law

Learn More-

Senator has new policy idea

-

Idea is drafted into a Bill

-

Bill undergoes committee process

-

Senate and Assembly pass bill

-

Bill is signed by Governor