Steps To Economic Recovery

James L. Seward

October 8, 2009

The governor recently ordered $500 million in across the board cuts to 2009-2010 state agency spending. The directive focused on each agency’s non-personal service budget; in other words, operating costs outside of salary and benefits. The targeted expenses include things like travel, printing, vehicles, leases, energy, postage, consultant contracts and equipment. It is a step in the right direction, but it is only a step.

Each and every elementary school student at some point learns how to read and construct a pie chart. Well, if we were creating such a chart to illustrate the steps to economic recovery needed in New York, state agency spending cuts would represent only a small sliver.

The state is staring at a current year deficit approaching $3 billion. Clearly $500 million isn’t going to plug the hole. Additional strategies are needed to make New York whole and position the state for future improvements.

Back in the spring, when the governor was huddled behind closed doors concocting the disastrous state budget, my senate colleagues and I released our own Better Plan. Our proposal included a number of strategies aimed at lowering state spending, boosting economic development and cutting taxes for cash strapped families. The governor ignored the plan and instead saddled us with a record spending state budget that costs families across upstate New York an additional $2,400 this year and completely disregards our struggling small businesses.

The increased spending included in the state budget, fueled in part by billions of dollars in federal stimulus money, has not produced the economic recovery we were promised. In fact, the resulting higher taxes are driving more people from our state and effectively discouraging businesses from even glancing our way.

If the governor wants to revive our state and fill the pie chart then I strongly suggest he examine the Better Plan. It is chock full of cost cutting measures like reducing state agency spending, consolidating redundant or underutilized agencies and freezing state purchases of recreational lands. The proposal also calls for an increased crackdown on Medicaid fraud, a move which could save the state millions of dollars. In addition, just in case similar spending hikes are considered in the future, the plan includes a state spending cap that would shut down out of control state spending sprees.

A nice slice of revenue would also help fill up the pie. Back in December Governor Paterson signed into law a measure requiring the collection of state taxes for cigarettes sold on Indian reservations to non-Indians. That measure could bring an estimated $500 million into the state coffers, but the governor has failed to enforce the law he signed, so to date not one thin dime has been collected.

The revenue side of the pie chart would also fill up with increased economic development. More business would help generate spending and provide the state with additional tax dollars. Policies to assist our small upstate businesses, support our farmers and attract new manufacturers to New York have been completely forgotten. The Better Plan includes initiatives aimed at making our business landscape more attractive. Increasing the availability of low cost power, job training services and job creation credits are just a few examples.

We also need to focus on tax relief. By rolling back some of the most onerous new taxes and fees imposed under the state budget, our hard working families and individuals will have more of their own money to spend. In many cases this will allow them to pay for necessities like food, medicine and clothing. At the very least this will reduce dependence on government services that are also stretched thin.

A small sliver of pie, like the one proposed by the governor, just isn’t good enough anymore. Instead, we need a full serving of common sense cost cutting measures, tax relief efforts and sustainable economic development provisions to fill up the pie chart and move New York forward.

Share this Article or Press Release

Newsroom

Go to NewsroomMohawk Valley Nine Pledge Support for Remington

September 28, 2020

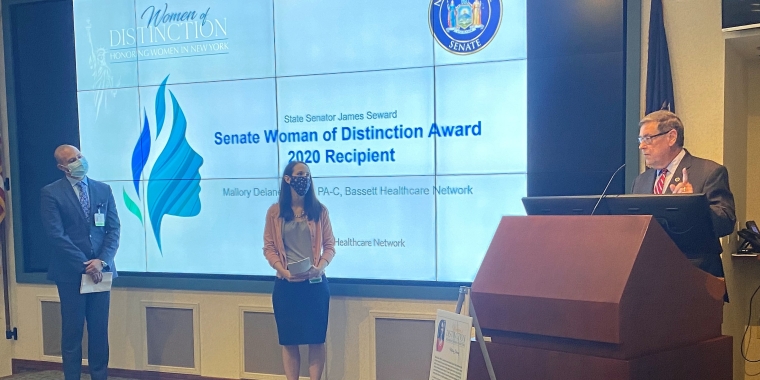

Senator Seward Pays Tribute to Senate Woman of Distinction

September 8, 2020