MTA Bailout is a Massive New Mandate That Hurts Suburban Communities

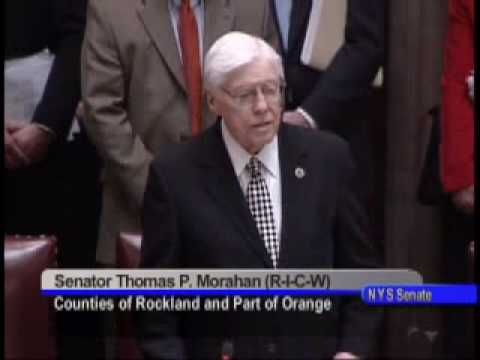

Thomas P. Morahan

May 8, 2009

NYC Legislators are praising a deal on an MTA bailout. While they talk a lot about “One New York,” the reality is they always put New York City first.

Almost ten years ago suburban commuters were targeted with a commuter tax. New York City-oriented legislators at that time tried to ignore the fact everyone who works in New York contributes to the city treasury—directly, through sales taxes on purchases in the city, and indirectly, through a broad array of city taxes paid by the firms that employ commuters and profit from their productivity.

We defeated the commuter tax and are now faced with a $1.5 billion jobs tax pushed through with NYC-oriented legislators. It will be devastating for businesses, not-for-profits, hospitals, local governments and school districts in suburban communities like Orange and Rockland. The newly enacted payroll tax is a tax on jobs that will cause businesses to lay off workers and hurt New York’s ability to recover from the national economic recession.

The $2.2 billion MTA bailout plan in truth is a massive new mandate that will drive up property taxes, increase taxes on businesses and cause the loss of jobs throughout the MTA region. The bill would do little to reform the bloated and wasteful spending of the MTA.

Suburban commuters will be hit particularly hard by the higher fares.

After $10 billion in new taxes from the budget and the MTA bailout plan, how will we finance the rest of the MTA capital plan that is left unfunded today? Higher fares? Service cuts? More taxes? What about our road and bridge needs?

I believe that we should not have to pay one more dime to bail out a transit system that has been poorly managed for decades, and that is why I voted against this legislation.

Share this Article or Press Release

Newsroom

Go to NewsroomMorahan Returns to Senate Floor

April 8, 2010