Bonding for state contracts available for small business, Minority Women-owned Business Enterprises

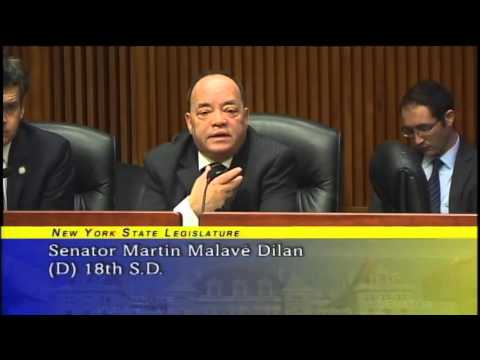

Martin Malavé Dilan

March 2, 2012

The New York State Surety Bond Assistance Program provides critical credit, training and technical assistance support to qualified New York small businesses or Minority Women-owned Business Enterprises (MWBEs) to help them secure surety bonds for State contracting.

Who is Eligible

New York State small businesses or MWBEs bidding on construction or transportation projects that need assistance securing bid or performance bonds for specific projects are eligible. Businesses that have never been bonded or require increased bonding capacity are encouraged to apply. Applications can be submitted by either the contractor or bonding agent.

How it Works

Eligible businesses can apply to the program before or after seeking surety bonding. If a surety company requires collateral support in order to issue a bond, the Surety Bond Assistance Program may provide the necessary collateral support to qualifying businesses in the form of an Irrevocable Letter of Credit of up to 30 percent of the base contract amount. The maximum contract size is limited to $2 million. For those qualified contractors not bond-ready, but will bid for a State contract within a year, there is training and technical assistance available, facilitated by the Dormitory Authority of State of New York and the Small Business Development Center network statewide.

How Do I Apply

For more information or to get an application, visit http://esd.ny.gov/BusinessPrograms/BondingAssistance.html or Ms. Huey-Min Chuang, Senior Director of Business & Economic Development, at (212) 803-3238 or BAP@esd.ny.gov.