Greater Tax Deductions for K-12 Teachers

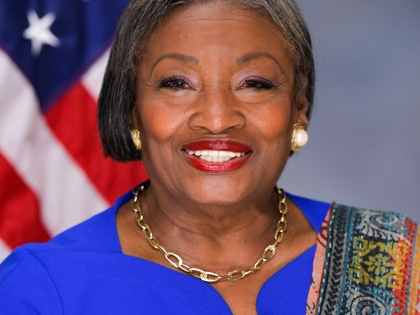

Andrea Stewart-Cousins

June 13, 2013

A bill that would increase the deduction amount that teachers at public or non-public schools can claim on their income tax return was announced today. Because many of our teachers selflessly spend hundreds of their own hard-earned dollars on supplies for their classrooms and students, they should not be taxed for using their own money to provide better public services to New York's children.

Teachers can currently claim up to $250 in classroom expense deductions on their federal tax returns, however, the average teacher spends $589 per year on classroom expenses, leaving them unable to deduct more than half of their expenses. Senate Bill S.3626 would amend the current law to allow teachers to deduct up to $450 of their out-of –pocket costs per year.

Share this Article or Press Release

Newsroom

Go to NewsroomCampaign For Summer Job Youth Action Day

January 28, 2014

Family Planning Advocates of NYS Day of Action Rally

January 27, 2014

American Red Cross Winter Storm Tips & Checklists

January 27, 2014