Legislation Supporting Reservists & National Guard Members

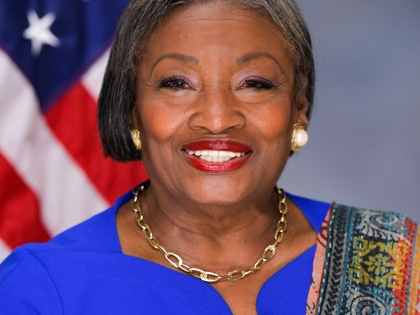

Andrea Stewart-Cousins

June 6, 2013

The Senate Democratic Conference supported legislation allowing local governments to grant a 5% tax reduction to long-term veterans of the National Guard or any of the reserve branches of the United States Military.

Specifically, this bill (S.553B) gives any municipality in the state the authority to create a 5% local property tax exemption for all Reservists and National Guard members who have received their standard “20-year letter,” which informs them of their eligibility for military retirement benefits.

Share this Article or Press Release

Newsroom

Go to NewsroomElmsford Little League Opening Day

April 16, 2016

Earth Day 2016 Poster Contest: District 35

April 14, 2016

UAW Region 9A Local 2325 Rally

April 8, 2016