Straightforward Tax Relief Applications for Senior Citizens

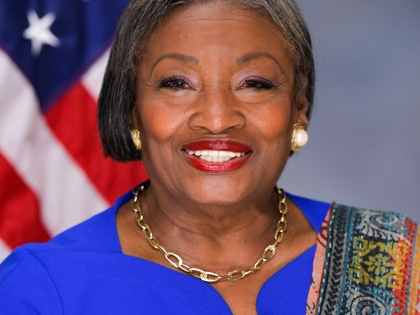

Andrea Stewart-Cousins

June 15, 2013

A simplified application process for senior citizens seeking the enhanced school tax relief exemption has been announced. Many of New York’s senior citizens live on a fixed-income and rely on their tax exempt status to afford their cost of living. Under current law, senior citizens applying for tax exemption status must complete the full STAR form every year, a long and complicated process, even if their eligibility information remains the same as in the previous year. Senate Bill S.2937 will require the tax commissioner to prepare the form for the applicant in some cases, and provide a simplified application process, especially for those whose eligibility information has not changed, making the process faster, cheaper, easier, and less stressful for all parties involved.

Share this Article or Press Release

Newsroom

Go to NewsroomPublic Authorities Reform Act of 2009

March 8, 2010

Comments on "Not-For-Profit" Legislation

March 8, 2010

Health Care Proxy Legislation

March 8, 2010