January is Financial Wellness Month

Eric Adams

January 7, 2013

Dear Constituents:

January is Financial Wellness Month. It is a perfect time to examine our budgets, bank statements, and checking accounts, determine how we can make our dollars go further, and work towards making our dreams come true. Particularly during these times of economic hardship, I encourage everyone to take a moment to evaluate where he or she is financially as 2013 begins and consider goals to attain by the time it ends. This endeavor is tremendously important for your family, whether you are a senator or a bio-technician; whether you work full-time or part-time; whether you are an employee or an entrepreneur. Improve your situation or not, financial wellness, or lack thereof, will have a major impact.

To attain financial wellness, you must be aware of and comprehend the features of your individual financial situation, be able to handle its day-to-day aspects, and be prepared for changes. You should be proficient at managing the capital you have and be capable of developing strategies for maintaining and enhancing your wealth. You should know exactly where your money comes from and where it goes.

Good advice for everyone is to remain free of debt, or escape debt as swiftly as possible. At the end of 2008, Americans' credit card debt had reached $972.73 billion, and the average outstanding credit card debt for households possessing a credit card was $10,679! (source: http://www.creditcards.com)

It is imperative that people not spend beyond their means, even with their credit cards, and attempt to pay monthly debt off on time and in full to avoid late fees and interest charges! If one is trying to get out of debt, try hosting a “money-party” and trade ideas with friends on what works and doesn’t work. Share resources with your neighbors and listen to those you trust. Beware of scams and false advice online, but know that there is a wealth of good information out there! Local community-based organizations like the Center for Family Life sponsor programs to assist families.

A common and important aspiration of many families is to send their kids to college. Here are a few tips on saving for college:

- The sooner you start saving, the better

- You may be able to take two federal tax credits - the Hope Credit and Lifetime Learning Credit - in the years you pay tuition

- You don’t have to save the full tuition amount ahead of time

- Approval for college loans is more lenient than for other loans

Buying a home is also a widespread dream, and an achievable one. Here are some starting tips:

- If you buy, plan on staying put for a significant period

- Aim for a home you can afford

- If you can’t put down the usual 20%, you may still qualify for a loan

- Before you begin house-hunting, get pre-approved for a mortgage

(Source: money.cnn.com)

Of course, there are just basic pointers. You should consult professionals for more concrete, detailed advice.

A helpful website might be http://wordsofwellness.com/Financial_Wellness.htm, but remember to get second opinion before making any major decisions.

I wish everyone a prosperous and joyous year!

Very truly yours,

Eric Adams

NYS Senator

District #20

Share this Article or Press Release

Newsroom

Go to NewsroomHalloween Party in the 20th Senatorial District

November 4, 2013

November is National Diabetes Awareness Month

November 1, 2013

November Constituent of the Month: Specialist Veronica Reid

November 1, 2013

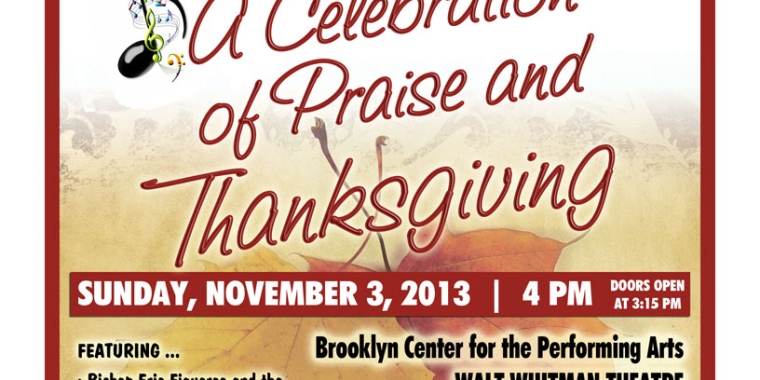

A Celebration of Praise and Thanksgiving

October 29, 2013