New Law Allow School Districts To Create Property Tax Exemption For Veterans

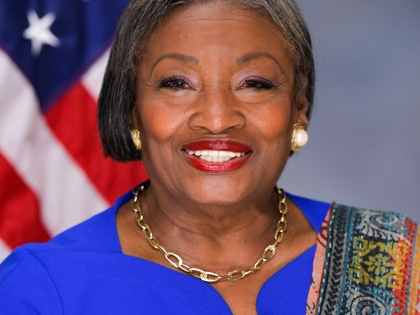

Andrea Stewart-Cousins

February 12, 2014

In June of 2013, Senator Stewart-Cousins proudly voted for legislation that authorizes school districts to grant property tax exemptions to veterans who live within their jurisdictions. The bill passed both houses of the Legislature unanimously and was signed into law by Governor Cuomo on December 18th.

In a statement about the new law, Senator Stewart-Cousins said "As the daughter of a World War II veteran, I know first-hand the pride that veterans feel toward their service to our country. I also appreciate the importance of honoring the sacrifices that veterans have made in the course of their service. Providing school districts the option to create a property tax exemption for veterans is the least we can do to show our deep appreciation."

Prior to this law, the property tax exemptions available to veterans were not applicable to school taxes. As a result, veterans often had to pay back the school tax portion of the exemptions they were receiving, which could have cost as much as four hundred dollars for an average single family homeowner. This new law extends the property tax exemptions for veterans to school taxes.