Senator Bonacic Supports Legislation to Compensate New Yorkers Affected by by Payment Delays in State's STAR Program

February 14, 2017

(Albany, NY)- State Senator John J. Bonacic (R/C/I-Mt. Hope) joined his colleagues in voting in support of legislation today that would compensate taxpayers who are owed money by the state after last year’s changes to the School Tax Relief (STAR) Program. The bill (S3505) enables taxpayers who have applied for STAR but who do not receive accurate reimbursement payments from the state in a timely fashion to be paid interest for each day their check is late.

“It’s unconscionable that New York taxpayers should have to wait months to receive their STAR rebate checks,” said Senator Bonacic. “This bill passed unanimously because my colleagues and I realize that it is unacceptable for the Department of Taxation and Finance to continue to experience delay’s in getting these payments out.”

Last year’s budget changed the current STAR program by phasing out direct payments to school districts on behalf of eligible homeowners and converting STAR exemptions into a refundable property tax credit for new homeowners. The conversion applied to people who purchased their primary residence after the 2015 STAR application deadline or did not apply for the exemption by the 2015 STAR application deadline.

The credit was paid in the form of checks that were supposed to have arrived in the mail by September 30, 2016. However, multiple reports and many constituent complaints indicate that numerous checks arrived late or with the wrong amount of money. The Senate estimates the average basic STAR benefit is $840 per eligible homeowner and the average senior STAR benefit is $1,555, and many property owners need that money to pay their taxes on time.

Share this Article or Press Release

Newsroom

Go to Newsroom

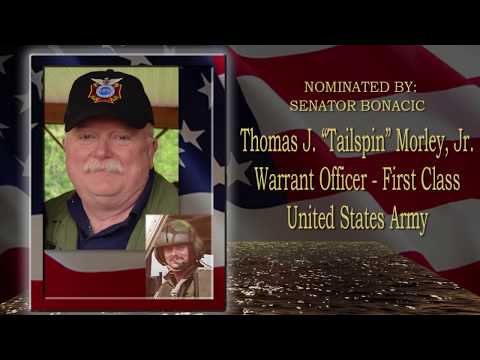

Thomas J. "Tailspin" Morley, Jr.

May 15, 2018