O’Mara, Senate advance ‘Affordability Agenda' to combat high taxes, including phased-in state takeover of local Medicaid costs

May 8, 2018

-

ISSUE:

- Tax relief

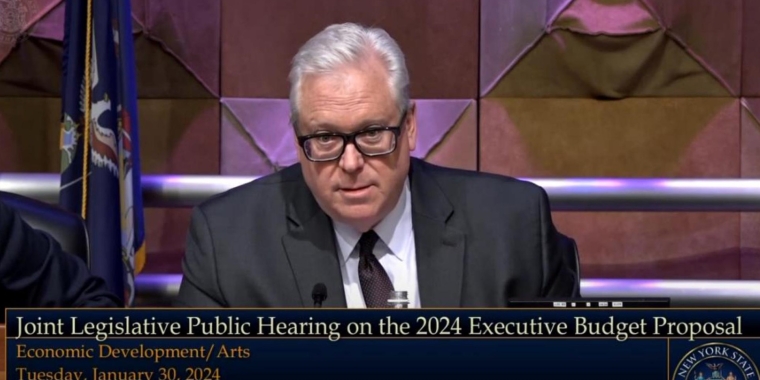

Albany, N.Y., May 8—State Senator Tom O’Mara (R,C,I-Big Flats) this week joined his Senate colleagues to approve a broad-based “Affordability Agenda” aimed at reducing New York State’s high tax burden.

“Governor Cuomo began his tenure back in 2011 by stating that New York State cannot survive as the tax capital of America. I agreed one-hundred percent but eight years down the road, we still have not done enough to get our residents and businesses out from under one of the nation’s heaviest tax burdens. The Senate’s focus in 2018 has been to make this state more affordable and that begins with lower taxes.”

Earlier this year, the Senate acted on two pieces of legislation that O’Mara co-sponsors and that are central to the Senate’s “Affordability Agenda.” One measure (S1207) would make permanent the two-percent cap on local property tax increases established in 2011. A second proposal calls for establishing a permanent two-percent cap on annual growth in state government spending (S365).

The largest savings from today’s action would come from two initiatives that require the state to assume the local share of Medicaid payments. Since the enactment of the Medicaid program in 1965, counties and the city of New York have been required to share in both its cost and administrative operation. The state is responsible for program design and, over the course of several years, the overall administration of the program has been gradually shifting to the state. The counties’ Medicaid share is currently capped at 2015 levels and the current local contribution amount to the state for Medicaid is a combined statewide total of $7.63 billion.

The Senate approved legislation (S8411) that would reduces the local Medicaid contribution by 20 percent a year over five years for all counties outside New York City. The counties must then enact dollar-for-dollar reductions in property taxes, resulting in direct taxpayer savings of up to $451 million in the first year alone, and $2.3 billion when fully effective.

A second piece of legislation (S8412) calls for reducing counties’ contributions by 10 percent a year over 10 years and again requires that $2.3 billion in cumulative savings to be returned dollar-for-dollar back to property taxpayers.

O’Mara said that the Senate Affordability Agenda also includes additional broad-based tax relief actions including:

> lower property taxes, including a 25-percent increase in the size of current property tax rebate payments, freezing school property taxes at current levels for senior citizens, and phasing in the elimination of school property taxes for seniors over the next decade;

> lower energy taxes, including the elimination of the two-percent Gross Receipts Tax on utility bills;

> lower taxes on retirement, including doubling the current exemption on pension income; and

> significantly reducing existing unfunded mandates on local governments and amending the State Constitution to ban any future unfunded mandates.

Share this Article or Press Release

Newsroom

Go to Newsroom