Senate approves legislation O'Mara co-sponsors to increase tax credit for farmers

June 6, 2018

-

ISSUE:

- agriculture economy

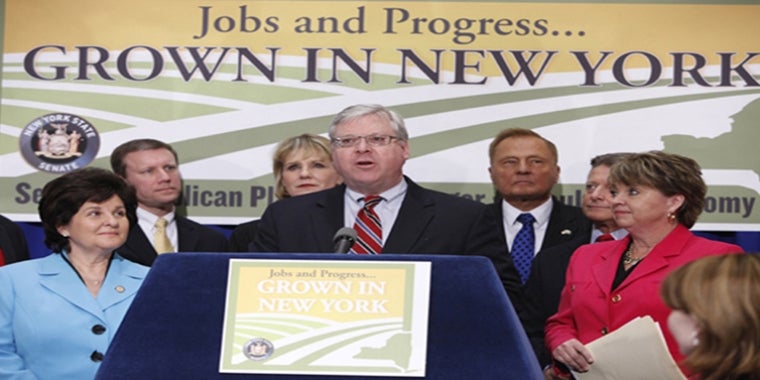

Albany, N.Y., June 6—The New York State Senate today approved legislation co-sponsored by Senator Tom O’Mara (R,C,I-Big Flats) to reduce the tax burden imposed on New York’s farmers by substantially increasing the “Farm Workforce Retention Credit.”

“Studies continue to recognize New York as the state with one of the highest tax burdens in the nation. It remains an unfair and unreasonable burden on individual taxpayers, families, farmers, employers and workers. We have to keep taking tax relief actions like these for our farmers, small business owners and every other taxpayer. This legislation in particular increases an important tax credit for farmers,” said O’Mara, a member of the Senate Agriculture Committee.

O’Mara voiced strong concerns over the higher minimum wage approved as part of the 2016-17 state budget and continually pointed to the negative and potentially devastating impact the higher wage would have on New York farms, small businesses, school districts, not-for-profits, human services providers and others.

The legislation (S2905) O’Mara co-sponsors would significantly increase the Farm Workforce Retention Credit approved as part of the 2016-17 state budget that allows eligible farm employers to claim a refundable tax credit for each farm employee who is employed for 500 or more hours each year. Under the legislation, the phased-in tax credit would double to $600 per eligible farm employee in 2018, $800 in 2019, $1000 in 2020, and $1,200 in 2021.

The legislation now goes to the Assembly.

Share this Article or Press Release

Newsroom

Go to Newsroom