State lawmakers join restaurant industry reps, local restaurant owners to oppose elimination of minimum wage tip credit and call on Governor Cuomo to hold Southern Tier hearing

April 12, 2018

-

ISSUE:

- Minimum Wage

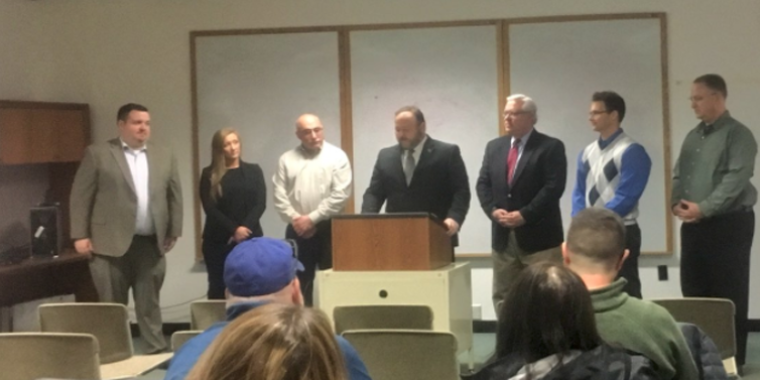

Corning, N.Y., April 12—State Senator Tom O’Mara (R,C,I-Big Flats), Assemblyman Phil Palmesano (R,C,I-Corning) and Assemblyman Chris Friend (R,C,I-Big Flats) today joined statewide representatives of the restaurant industry and area restaurant owners in Corning to oppose the elimination of New York State’s minimum wage tip credit.

The group held a news conference in the Gaffer District Conference Room and called on Governor Andrew Cuomo to scrap plans to eliminate the minimum wage tip credit in New York State. The lawmakers were joined by Melissa Fleischut, President & CEO of the New York State Restaurant Association; Tammy Timmerman, Cortland County President and Recording Secretary of the Empire State Restaurant & Tavern Association; Mike Sorge, Owner of Sorge’s Restaurant in Corning; and Mike Sullivan, President of the Hill Top Inn Restaurant in Elmira.

In his State of the State message in January, Cuomo announced that the state Labor Department would hold hearings in 2018 to “evaluate the possibility of ending minimum wage tip credits in New York State.” The hearings soliciting input from workers, businesses and others begin on April 20 on Long Island and will continue until late June with additional hearings scheduled for Watertown, Syracuse, Buffalo, Albany and New York City. The Syracuse hearing is scheduled for Monday, April 30, beginning at 10:00 a.m. at the SUNY College of Environmental Science and Forestry. On Tuesday, May 8, a hearing will be held at the SUNY Erie City Campus beginning at 10 a.m. Anyone interested in attending and/or speaking at any of the Labor Department hearings can find more information and pre-register at on the department’s website: www.labor.ny.gov. Written testimony can be submitted to hearing@labor.ny.gov before July 1, 2018.

In 2016, New York State began implementing a phased-in, $15-per-hour statewide minimum wage. Currently across the upstate region, the hourly minimum wage is $10.40. For tipped workers upstate -- for example wait staff at area restaurants -- the state sets a minimum “cash wage” that is currently $7.50 per hour paid by employers combined with a $2.90 credit or allowance for tips that the employee receives from customers. Combined, this system ensures employees a statutory minimum wage of $10.40 per hour. If an employee’s tips, combined with the cash wage, fail to reach the minimum hourly wage, employers are required to make up the difference.

Eliminating the tip credit will force employers to pay the full minimum wage, thereby significantly increasing business costs. Opponents further believe that the elimination of the credit will result in business closures, job losses, lower wages for workers overall, and higher prices for customers.

In a joint statement, O’Mara, Palmesano and Friend said, “Our concern is that Governor Cuomo has already made up his mind and these hearings are nothing more than a smoke screen that will be used to move forward on eliminating the tip credit. That move would be devastating to employers, wait staff and consumers across the Southern Tier and Finger Lakes regions, and throughout upstate New York. It would work against the employees who depend on these jobs to make a decent living. It would eliminate jobs in communities where jobs are already hard to find. It would drive restaurants, taverns and other establishments out of business. It would raise prices for customers. It’s a bad idea.”

The area legislators and restaurateurs also believe that the Cuomo administration should hold a hearing in the Southern Tier, where they argue that the elimination of the tip credit would make regional employers even less competitive with their counterparts across the border in the state of Pennsylvania.

In a recent letter to Cuomo opposing any move to eliminate the tip credit, O’Mara, Palmesano and Friend wrote, “As you are well aware, the tourism and hospitality industry in the regions we represent is central to the strength and vitality of our local economies. Consequently, the impact of the tip credit is particularly acute here and, especially along the Southern Tier border with Pennsylvania, it is central to the competitiveness of our businesses and economic opportunities for our workers. First and foremost, then, we encourage you to ensure that the state Department of Labor conducts one of its upcoming hearings examining the possible elimination of the tip credit directly in the Southern Tier. We believe it is critical that you and your administration hear firsthand from the region’s employers, workers and consumers – and we are happy to do whatever we can to help facilitate a Southern Tier regional hearing.” [see attached copy of the letter above]

Melissa Fleischut, President & CEO of the NYS Restaurant Association, said, "The tip credit is a vital economic tool for the restaurants of New York and eliminating it would do irreparable harm to an industry that already survives on razor thin profit margins. Eliminating the tip credit has proven to be bad for employees, bad for employers and a failed policy when enacted in other locations. New York already lags behind the rest of the country in restaurant industry growth and if this proposal is adopted, we will fall even further behind. We like to say that New York is home to the best restaurants in the world, I fear that those days will come to an end if we say goodbye to the tip credit."

Scott Wexler, Executive Director of the Empire State Restaurant & Tavern Association, said, “The proposal to eliminate the tip credit makes no sense. Under the current system tipped workers typically earn $15 to $25 per hour including their cash wages and tips. But eliminating the tip credit puts all of that at risk. While tipped workers’ cash wages may go up, experience shows this will cause workers’ tips to decline and the added cost to business owners will result in fewer jobs for tipped workers. This doesn’t sound like a good deal for anyone.”

Mike Sorge, Owner of Sorge’s Restaurant in Corning, said, “Governor Cuomo appears ready to scrap a wage system that has been in place and worked well for employers, tipped employees and customers for decades, and replace it with a system that will only produce fewer jobs, lower wages, higher prices and a host of other negative consequences for upstate communities and economies. To say the least, it would be a misguided move if Governor Cuomo eliminates the tipped wage. On behalf of my restaurant, my staff and my customers, I am strongly opposed to the elimination of the wage tip credit.”

Mike Sullivan, President of the Hill Top Inn Restaurant in Elmira, said, “We are concerned with the Governor’s approach and benighted solutions to our industry labor issues. When industry leaders like Danny Meyer work to balance the disproportionate wage issues between tipped and untipped employees, Governor Cuomo looks to exacerbate the problem. Current labor laws also don’t allow tip pooling so that even if the front of house employees wanted to tip out the kitchen staff, they can’t. I hope the Governor enjoys cooking his own meals when he goes out. He’ll have plenty of people to serve him, just nobody to cook the food.”

Share this Article or Press Release

Newsroom

Go to Newsroom