O’Mara: Is Cuomo staying focused on right priorities?

January 15, 2019

Albany, N.Y., January 15—State Senator Tom O’Mara (R-C-I, Big Flats) today said Governor Andrew Cuomo’s 2019 State of the State message and proposed state budget “prioritize liberal politics over lower taxes.”

Today in Albany, the governor delivered his ninth State of the State address to the Legislature and, at the same time, unveiled a roughly $175-billion proposed spending plan for the state’s new fiscal year beginning on April 1. O’Mara stressed that Cuomo’s plans are stocked with significant policy proposals being pushed by extreme-left liberals and progressives statewide and nationally including voting reform, gun control, legalizing marijuana, criminal justice reform, and expanded rights for illegal immigrants, among many others.

O’Mara warned that the vision Cuomo is laying out for the future of New York could spell even harder times ahead for state and local taxpayers, and already hard-pressed upstate communities.

“Governor Cuomo’s new direction for New York State, working hand in hand with a State Legislature under one-party control, could produce billions of dollars of short- and long-term spending requiring billions of dollars in new taxes, fees, and borrowing for future generations of state and local taxpayers,” O’Mara said. “The short-term pursuit of a hard-left, liberal political agenda appears to be the priority over a long-term, sustainable future for upstate, middle-class communities, families, workers, and taxpayers.”

O’Mara added, “New York remains one of the highest-taxed states in America. We are one of the most overregulated states in the nation. Our local governments and local property taxpayers continue to foot the bill for one of the country’s heaviest burdens of unfunded state mandates. Still, the Cuomo vision does not emphasize broad-based, lower taxes for workers and employers. Nothing about the pitfalls of overregulation or the drain of unfunded state mandates on counties and local property taxpayers, or the glaring need for workforce development. What about the high cost of living that is driving people, especially young people, out of Upstate New York?”

O’Mara said that he would keep working with his legislative colleagues across the Southern Tier and Finger Lakes regions to keep attention focused on unfunded state mandates, job-killing state regulations, and a state and local tax burden that hurts family budgets and keeps New York’s business climate one of the worst in the nation.

“I’ll keep on stressing that New York government needs to stay focused on taking action after action to revitalize Upstate manufacturing job growth and relieve the crushing burdens of unfunded state mandates, overregulation, and high taxes. It begins and ends with addressing these priorities. At this point I don’t believe the governor’s new direction for New York State is focused enough on the root causes of Upstate’s decline, which means high taxes, overregulation, and unfunded state mandates that keep local property taxes high. I was hoping to hear more of a focus on these broad-based economic and fiscal priorities for our local communities, economies, farmers, manufacturers, and taxpayers,” O’Mara said.

The next step in this year’s budget adoption process is for state legislators, local leaders, and the public to begin analyzing the details of the new Cuomo plan and assessing its impact on specific programs and services. Full details on the governor’s budget proposal will be available on the state Division of the Budget (DOB) website. The Legislature’s fiscal committees – the Finance Committee in the Senate, and the Assembly Ways and Means Committee – will soon begin a series of public hearings on the Cuomo plan. The legislative hearings will continue through February and will be livestreamed on the State Senate website.

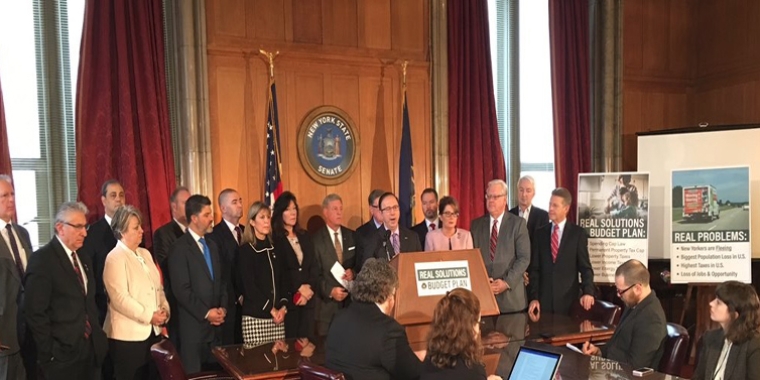

Prior to the governor’s address this afternoon, O’Mara joined his Senate GOP colleagues at the Capitol to unveil the conference’s “Real Solutions” plan calling for the enactment of a permanent two-percent cap on state government spending, making New York’s two-percent property tax cap permanent, comprehensive mandate relief and regulatory reform, and broad-based tax relief including lower business, energy, income, and property taxes.

Share this Article or Press Release

Newsroom

Go to Newsroom