Senator Carlucci Reminds Some Residents Further Action is Required to Receive a Stimulus Check

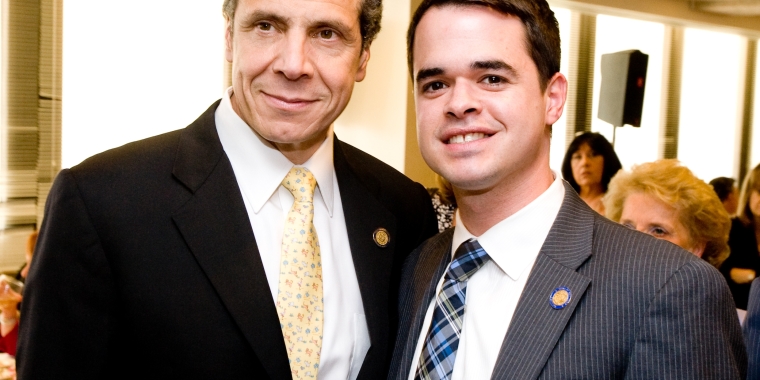

Senator David Carlucci

April 11, 2020

(New City, NY) – Some Americans will receive a coronavirus stimulus check this week. The Internal Revenue Service said they sent out the first round of checks on Saturday. For financially strapped Americans, this check could mean rent gets paid or food is put on the table. Stimulus checks are supposed to be directly deposited into your bank account or come in the mail, but there has been a lot of confusion as to whether low-income Americans, seniors, and people with disabilities will receive a check.

Originally, the White House said vulnerable populations who typically do not file an annual tax return would have to do so to receive a payment. Senator David Carlucci (D-Rockland/Westchester) sent a letter to U.S. Treasury Secretary Steven Mnuchin calling for that decision to be reconsidered on behalf of our most vulnerable. However, Mnuchin back-tracked, and then said our most vulnerable would not have to file a tax return to receive a check of up to $1,200.

Seniors whose sole source of income is Social Security do not need to file a tax return. Currently, there are more than 15 million Americans on Social Security who do not file an annual tax return, according to the Center on Budget and Policy Priorities. And only about 60 percent of tax filers in recent years have given the IRS direct-deposit information. Additoinally, SSI recipients with no qualifying children do not need to take any action in order to receive their $1,200 economic impact payment.

However, Carlucci points out that the IRS has now advised certain people that they must go online, set up an account through the IRS and Free File Alliance, and enter their Social Security number, name, address, and dependents to receive a stimulus check.

Those who must take further action, include people whose income level does not require them to file a tax return, meaning some SSI recipients with qualifying children, under age 17, to ensure they get an additional $500 for each child they have, veterans who receive disability compensation, those who receive a pension, and people who receive survivor benefits from the Department of Veterans Affairs. Residents who fall into one of these categories can enter their information here: https://www.freefilefillableforms.com/#/fd/EconomicImpactPayment to ensure they receive a stimulus check.

“There will certainly be people unable to access the internet, unable to set up the account, and those who are unaware they even have to do this,” said Senator David Carlucci. “We need to get the word out about who needs to take action and who does not. We have seniors on Social Security, calling my office every day concerned that they have never provided direct deposit information to the IRS. I want residents to know they can always call my office with questions, and we will make sure their information gets to the IRS if necessary.”

No further action is required to receive a stimulus check if an individual receives:

· Railroad Retirement

· SSDI benefits

· Already has filed a 2019 federal income tax return

· Had a 2019 gross income exceeding $12,200 ($24,400 for a married couple) or other reasons required you to file a 2019 federal tax return

· You were married at the end of 2019 and are not submitting information with your spouse

· You were not a U.S. citizen or U.S. permanent resident in 2019

If residents are unsure if they need to take further action, they can contact Senator Carlucci’s office at (845) 623-3627.

Share this Article or Press Release

Newsroom

Go to Newsroom

Three Way Ethics Reform Package Agreement

June 6, 2011