Senator Brooks Proposes Plan to Restore and Expand Star Program

Senator John Brooks

February 18, 2020

On January 21, 2020, Governor Andrew Cuomo introduced his version of the FY 2021 Budget for the State of New York. Presented within the budget are various economic and funding proposals dealing with a wide variety of issues. What is conspicuously absent however, is any mention of renewing what has popularly become known as the Star Property Tax Freeze Credit.

For homeowners across New York there are few state programs with a more immediate and positive impact than the STAR Property-Tax Freeze Credit. STAR provides rebate checks to homeowners in districts that comply with the 2 percent property tax cap, and for many it is a desperately needed barrier against onerous property tax bills. This year a key component of the STAR program that has provided property tax relief to the most overtaxed homeowners is expiring.

For the typical hard working middle-class homeowner in NY, the average award under the program of around $500 is real money in a time when wages are flat and tax bills seem only to rise. Young people are fleeing Long Island and NY because of the housing affordability crisis; families are finding it harder and harder to own homes due to oppressively high property tax rates combined with higher and higher costs of living. Each year, the STAR Rebate was a welcomed relief at the end of the year and now it is being allowed to expire.

We cannot let a program that gives relief to 2 million New York homeowners (more than four out of every five) expire without a fight. Most of us who are qualified homeowners earning less than $275,000 annually will face tough financial circumstances without the credit, therefore, I pledge to lead the fight to renew and expand the STAR Property-Tax Freeze Credit in the coming budget for all homeowners in need.

RESTORE:

There is no debate that New Yorkers pay some of the highest taxes in the nation, and the small amount of tax relief from various programs that they do receive is important. This year, a key component of the STAR program which has provided property tax relief to the most overtaxed homeowners is expiring. Year after year, this important program gave families relief in the form a check, averaging around $500. I believe that hard working New Yorkers deserve to see this program extended in this year’s budget.

EXPAND:

Not only do I believe that New Yorkers should continue to receive their STAR benefits, but I will push to see that the program is expanded in this year’s budget by introducing a bill in the Senate that provides an additional $1.7 Billion in property tax relief to the most overtaxed homeowners in New York.

Trump Has Increased Taxes in NY by $15 Billion

Even though the great recession is behind us, we know that the going has not been easy; families are running tight budgets, and Trump’s SALT cap, which raised taxes on New Yorkers by as much as $15 Billion only made matters worse. Under my plan your property taxes will not only go down, but will bring many residents back under the SALT cap thereby avoiding the penalty imposed by the Trump tax cuts.

Senate Bill 1707: Every New Yorker Deserves an Affordable Place to Live

The housing affordability crisis in New York is more than a lack of available apartments or homes for low and middle-income people. It is a dearth of communities where people feel their financial future is bright, where they are not afraid of their next month’s rent or mortgage payment. S.1707 seeks to protect New York homeowners from housing costs that they feel are out of their control. It is a revenue-neutral tax shift that provides relief to mortgage payers on the hook for growing school district budgets. Importantly, it does so without cutting a single dollar from schools in their communities or indeed any other.

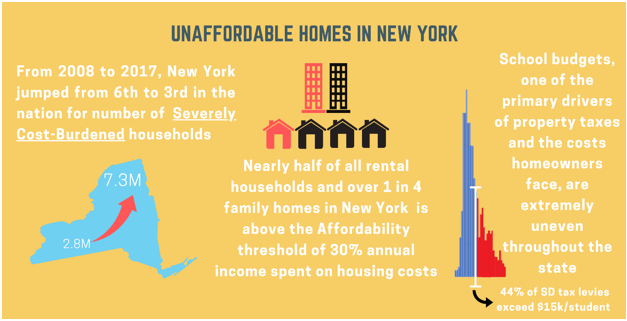

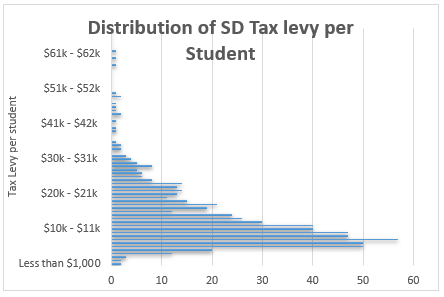

Housing Cost Inequality

For homeowners, one of the main drivers of unaffordable housing in New York is growth in property taxes. School budgets, which determine local property tax levies, are one of the best indicators of the unequal distribution of property tax burdens. Between 2008 and 2017, the monthly median cost of property taxes increased by 28.4%. Over the same period the median household income for homeowners only increased by 2.1%.

It is important to note that payment of these tax levies is not shared equally. Homeowners, 54% of the statewide population, bear these costs entirely. The concentration of high living costs is made worse by uneven geographic distribution and the need to pay for the most expensive state education system in the country.

S1707: Last year was a historic session for the New York State legislature. We delivered on our promise to provide needed reforms to protect the financial security of renters, but fell short on addressing systemic issues of education funding and the needs of many others struggling with high costs of living. The Residential Property Tax Relief Act for public education is the only proposal that addresses the linkages between our systems of public education funding and high costs of living for New York’s homeowners.

Methodology: The reform act will serve as a 3-year bridge period until a systemic overhaul of our education and property tax funding system is addressed. A partner bill, S1687, establishes a study to provide recommended solutions. This act will shift the cost burden of funding public education to a model based on financial ability (income) rather than perceived wealth (property taxes). This act shall be in effect through 2024.

The act sets up a calculation for tax relief payments to school districts in need. The allocation is based on the proportion of the district’s education spending currently paid by residential property taxes. Thresholds for each school year have been established to qualify for these relief payments.