New York's Historic Budget

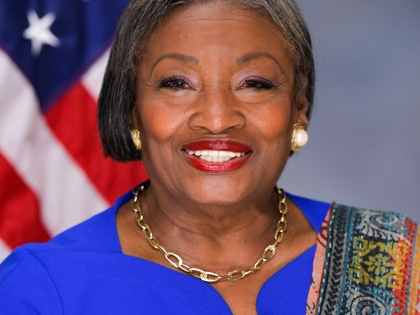

Andrea Stewart Cousins

April 18, 2021

-

ISSUE:

- Budget

Dear Neighbor,

The Senate Majority passed the 2021-22 New York State Budget last week, along with the New York State Assembly. The budget makes historic investments in education, the environment, and our economic recovery.

Despite many challenges this year due to the COVID-19 pandemic, the Senate Majority delivered tax breaks for working- and middle-class New Yorkers, while ensuring that millionaires and billionaires pay their fair share. And we made sports betting legal. With added revenue, we will provide vital support and services for families and small businesses working to recover from the COVID-19 pandemic and ensure significant increases in funding for our schools.

We allocated $29.5 billion to New York’s schools with every school district guaranteed a minimum of 60 percent of owed foundation aid, and 100 percent of foundation aid by the end of three years. Approximately 75 percent of education funding was targeted to high-need school districts like Yonkers. We also expanded Full Day Pre-K to 210 school districts outside of New York City with the understanding that Pre-K will be universal in three years. And, we worked to make college more affordable.

We were truly driven by a commitment to long-term equity and prosperity for all, and we accomplished a great deal. I am proud of the strides we made, and this budget makes New York better for all. In the remaining months of session, the Senate Majority will continue to deliver results that are reflective of our progressive values and priorities.

Thank you,

Andrea Stewart-Cousins

New York State Senator, 35th District

President Pro Tem, Majority Leader

HISTORIC INVESTMENT IN OUR SCHOOLS

Listen to my remarks on the budget by clicking here.

- Increased Funding - $29.5 billion for schools with a $1.4 billion increase in Foundation Aid, all schools in the 35th district will see an increase.

- Delivering Equity - a commitment made to fully fund Foundation Aid over the next three years to help our schools with the greatest needs.

- Full Day Pre-K - provided $105 million to expand full-day prekindergarten to an additional 210 districts outside of NYC.

- Higher Education - invested over $7.7 billion, an increase of $283 million, prevented significant cuts to SUNY, CUNY, and independent colleges, increased the maximum award under the TAP program by $500, eliminated the TAP Gap in four years.

- Bridging the Digital Divide - provided legislation through the budget to ensure low-income families will have access to high-speed internet for $15 per month.

TAX BREAKS FOR MIDDLE-CLASS

- Property Tax Relief - delivers $440 million for 1.3 million New Yorkers earning under $250,000 based on the proportion of their income spent paying property taxes, income tax credits will range between $250 and $350.

- Personal Income Tax - ensures $400 million in middle-class personal income tax cuts are not delayed.

RELIEF FOR SMALL BUSINESSES & RESTAURANTS

-

Small Business Grants - NYS invested $1 billion for small businesses, in addition to $2.3 billion from the federal government.

- $800 million in small business grants, and $200 million in tax credits.

- Tax Credit For Restaurants - provides $35 million for restaurant owners to claim a $5,000 tax credit for each full-time worker they hire after March 31, 2021, up to 10 workers.

FUNDING FOR NONPROFITS

Please note these are only a few of the many funding allocations in the budget.

- $2 million for United Way of New York State to fund 2-1-1, which residents can call seeking information on everything from vaccines, housing, to food assistance.

- $1 million for ArtsWestchester ReStart the Arts Program

- $230,000 for Westchester Jewish Community Services for mental health, behavioral health, and special education services.

- $75,000 for Catholic Charities Community Services Archdiocese of New York.

- Legal Services of the Hudson Valley

- $400,000 for Housing and Kinship

- $380,000 Veterans and Military Families

- $90,000 Domestic Violence

HOUSING & RENTAL ASSISTANCE

- Emergency Rental Assistance Program - $2.3 billion in federal funding allocated to pay up to a year’s rent and utilities for tenants in debt to their landlords, and $100 million in state funds for tenants and landlords ineligible for the federal money. (excluded workers can qualify for this program)

- Homeowner Assistance - $600 million in federal and state funding, including restoring $20 million a year for the Homeowner Protection Program for the next 3-years, which helps families stay in their homes who have fallen behind on a mortgage.

- Property Tax Circuit Breaker - to provide relief to low-and middle-income households that are overburdened by their property taxes.

- Increase Affordable Housing - $100 million to convert hotel and vacant property into affordable housing.

HELPING IMMIGRANT COMMUNITIES

The budget created a $2.1 billion fund, which recognizes the contributions of the undocumented workforce and provides one time assistance to those who lost their jobs or income during the pandemic and received no federal or state help. It should not be lost on anyone, the vital contributions the undocumented workforce are making to our State. These are neighbors, friends, caretakers, and so much more. The nation’s economy has long been built on the backs of our undocumented workforce and their essential labor has helped keep our nation going through this pandemic.

Criteria for eligibility:

- Individuals who are eligible will have to apply with the state Department of Labor; however, the application process has not launched yet.

- The application will ask for proof of identity, residency, and work-related eligibility. All applicants must show proof of residency before March 27, 2020, meaning you must have been a resident of the State prior to the pandemic and lost income due to the pandemic.

Other Highlights

- Legal Services - $10 million for the Liberty Defense Fund to provide free legal services and screenings to help undocumented New Yorkers.

SUPPORTING FAMILIES, CHILDCARE

- Tax Credit Programs - expanded to incentivize employers to provide child care.

- Federal Funding - the Senate Majority allocated $2.4 billion in federal funding to childcare services:

- $1.26 billion for stabilization grants for providers

- $291 million to provide 12 months of eligibility for services to families

- $225 million to expand increased access to child care for low income families

- $100 million for child care deserts

- $39 million to support the Quality Star NY program to provide improvements to the child care system

- $25 million for essential workers

- Kinship Caregivers - $1.9 million in additional funding for the Kinship Care Program to help grandparents, relatives or friends caring for children.

IMPROVING HEALTHCARE FOR NEW YORKERS

- Protecting Medicaid - restored $415 million in proposed Medicaid cuts for hospitals and healthcare providers.

- Expanding Medicaid Services - provides postpartum coverage for women on Medicaid from 60 days to one year.

- Investing in Public Health Programs - restored $113 million in proposed cuts to public health programs, while adding $81 million in public health funding.

- Prescription Drugs - community health programs can continue through 340b to purchase prescription drugs at a discounted price and, in turn, provide services like food and housing assistance to lower-income New Yorkers.

INVESTING IN ROADS, BRIDGES, AND METRO NORTH

- Repairing Infrastructure- $100 million increase to municipalities through the CHIPS Program to support the construction and repair of highways, bridges, highway-railroad crossings, and other facilities.

- Extreme Winter Recovery - $100 million in new funding through the program to support the construction and resurfacing of roads and bridges.

- Further Road Rehab - $50 million in state funds for PAVE-NY to municipalities to support the rehabilitation and reconstruction of local highways and roads.

- Metro North Improvements - restored MTA funds in the budget, totaling $138 million, which will be critical in getting New Yorker’s back to work.

- Broadband Service- directed the Public Service Commission to publish a detailed map of broadband access in the State and conduct a study on the availability, reliability and cost of broadband.

CARING FOR OUR SENIORS

- Nursing Home Accountability - repealed corporate immunity to nursing homes.

- Nursing Home Staffing - requires nursing homes to spend at least 70% of their revenue on direct patient care and 40% on resident-facing staffing, with $64 million for increased staffing.

- Paid Sick Leave Law - included in the budget and will ensure working family caregivers won’t lose their jobs or their pay to provide unpaid care to an older loved one.

- Insulin Costs Capped - a $100 cap set on each type of insulin per month in NYS.

COMMUNITY SAFETY

- Community Violence Intervention Act - declares gun violence a public health crisis and creates a funding source for community and hospital-based violence intervention programs.

- Securing Communities Against Hate Crime Program - allocated $25 million for a second year in a row so nonprofits and religious organizations can apply for grant money to protect communities from hate.

- Ending Anti-Asian Hate - an additional $10 million in grants that will be distributed to community and social service groups to help address bias and curb crimes committed against Asian-Americans.

- Supporting Our Youth - $250,000 for the Association of NYS Youth Bureaus.

- Community Policing - $2.3 million for Westchester County Policing Program.

PROTECTING OUR ENVIRONMENT

-

Protect Natural Resources - We passed the Environmental Bond Act, which will appear on the ballot in the 2022 general election and provides record funding to improve water quality, reduce flood risk, and protect parks by reducing the impacts of climate change.

- Continued Funding - $40 million for solid waste programs, $90 million for parks and recreation, $151 million for open space programs, and $19 million for climate change and adaptation program.

- Tax Credit - extends tax credit for brownfield redevelopment projects subject to COVID-related delays.

STANDING UP FOR LABOR

-

Creating New Green Jobs - through the Environmental Bond Act, we will create as many as 65.000 jobs by injecting $6.7 billion in spending on climate change mitigation, clean water, and other projects.

- Prevailing Wage and Project Labor - agreement requirements for construction on renewable-energy projects that are 5 megawatts or larger.

- Operations and Maintenance Work - a requirement that system owners on projects 5 megawatts and larger enter into labor peace agreements.

- Made in the USA - a requirement that covered projects buy American steel and iron where feasible.

- Incentivize Going Green - provisions to procure New York State renewable energy equipment and supplies.

FUNDING FOR MENTAL HEALTH & BEHAVIORAL HEALTH

- Raise for Mental Health & Behavioral Health Workers - those who care for our most vulnerable will receive a raise based on the cost of living.

- Addressing Veterans & PTSD - restored $4.5 million for the Joseph P. Dwyer Program and added $495,000, program helps veterans with Post Traumatic Stress Disorder and Traumatic Brain Injury prevent a mental health crisis.

- Home & Community Based Services - includes $11 million in appropriation authority to localities, which will award grants to strengthen and enhance home and community-based services.

- Combating Substance Abuse - restores $2 million for substance abuse prevention and intervention specialists.

PEOPLE WITH DISABILITIES

- Rejected Cuts to Nonprofits who Coordinate Care for Disabled - restored $20.8 million for Care Coordination Organization rates.

- Legal Assistance - restored $1.5 million in additional funding for the Disability Advocacy Program (DAP).

- Medically Fragile Children - a two-year pilot program was authorized to allow Elizabeth Seton to keep medically fragile young adults in their place of care until they are 35-years of age so they are not transferred to adult nursing homes when they turn 21.

- Special Olympics - fought to restore $150,000 for the special Olympics, previously cut by the Governor.

SUPPORTING THE ARTS

- Art Nonprofits - provides additional $40 million directed specifically to the Arts and Cultural Organization Recovery Grant Program to help the non-profit arts sector in New York State recover from effects of the COVID-19 pandemic.

- Attracting Musical & Theatrical Productions - a musical and theatrical production credit was extended for regions outside New York City for an additional four years, through January 1, 2026. The bill also increased the annual tax credit cap from $4 million to $8 million.

Share this Article or Press Release

Newsroom

Go to Newsroom