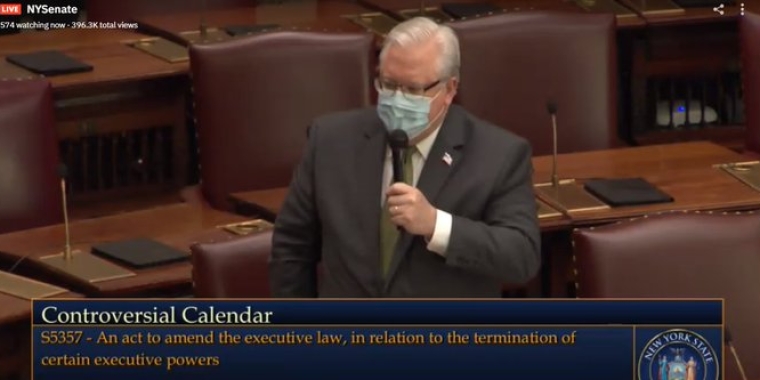

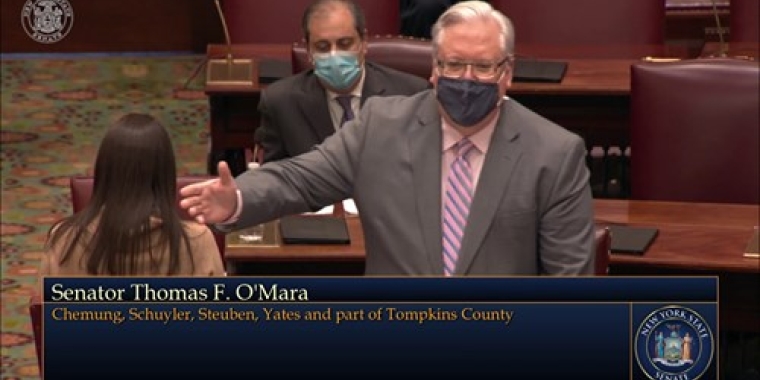

State Senate Republicans unveil plan to ‘Reset NY’s Restaurant & Hospitality Industry’: O’Mara co-sponsoring legislation to provide assistance to ‘cornerstone of our regional economies’

January 26, 2021

-

ISSUE:

- covid-19 recovery

Albany, N.Y., January 26—State Senator Tom O’Mara (R,C,I-Big Flats) and the Senate Republican Conference today unveiled a package of legislation to help “Reset New York’s Restaurant and Hospitality Industry.”

O’Mara said, “New York State’s restaurant and hospitality industry, including across the Southern Tier and Finger Lakes regions, has been devastated by the COVID-19 pandemic. This industry is an absolute cornerstone of our regional economies, a foundation of the tourism sector and a lifeline for thousands upon thousands of area business owners, workers and families. Governor Cuomo’s ongoing executive orders have brought this industry to its knees and it is time for the Legislature to act as a voice of common sense and fairness in reopening of local economies and restoring local jobs.”

The cornerstone of the legislative package advanced by the Senate GOP today includes comprehensive legislation, co-sponsored by O’Mara, to provide relief. It would:

> exempt small businesses from being penalized with higher unemployment insurance rates due to layoffs resulting from COVID-related, government-mandated closures. The exemption would extend for a period of one year from when they are permitted to return to full capacity;

> prohibit internet-based food delivery services from charging higher fees than they charged on or before March 1, 2020;

> provide small businesses additional time to pay monthly sales and payroll taxes, as well as business and property taxes;

> offer interest-free loans or lines of credit to small businesses;

> provide a one-year extension for renewal of liquor licenses; and

> provide businesses a 90-day grace period to pay any fees or penalties owed to state and local agencies.

Senate Republicans are also advancing additional legislation that would:

> direct the revenue received by fines imposed by the State Liquor Authority (SLA) into a Business Relief Fund;

> provide for a credit on liquor license renewals for the amount of time bars and restaurants were forced to be shut down due to the COVID-19 pandemic;

> create a limited state sales tax exemption for the sale of food and drink at restaurants and taverns from state sales and compensating use taxes and granting municipalities the option to grant such limited exemption;

> provide a voluntary income tax check-off box that will direct funds into a Business Relief Fund; and

> create an employee retention tax credit, modeled after the Federal Employee Retention Credit, to help employers keep workers on payroll.

Share this Article or Press Release

Newsroom

Go to Newsroom