Report on the Adopted New York State Budget

April 13, 2022

Dear Friends,

I am pleased to share that the Senate, Assembly and Governor have completed the FY 2022-2023 New York State Budget. Below is a summary of some of the most significant accomplishments in the budget. As your State Senator, I was proud to fight for - and win - additional investments in education, criminal justice reforms, commitment to making child care more affordable and accessible, expanding full day pre-K for 4 year olds, additional tax breaks as New Yorkers struggle to recover from the pandemic, the opportunity for Empire City Casino in Yonkers to become a full casino, and other significant investments for our community. Like prior budgets, this budget authorized the use of state capital funds for major projects, including funding to partially pay for a new stadium for the Buffalo Bills. I would have liked to see stronger protections for the community, and other stakeholders in the budget language, and greater contribution from the Bills themselves, but unfortunately that was not included in the final agreement. I will continue to push for stronger protections when public funds are appropriated, and far greater transparency in the process.

Continuing a Historic Investment in Education

Foundation Aid: As Chair of the Senate Education Committee, I am pleased to share that we continued to build on last year’s historic investment by appropriating the second year funding of $1.5 billion owed under Foundation Aid, the formula that determines the amount the state pays for every public school. This year, every district will receive approximately 80% or more of the amount owed, or a minimum increase of 3% for every public school district in New York State. By the end of next year’s budget, every district will reach 100% of the amount owed under the Foundation Aid formula.

Full Day Pre-K for 4 Year Olds: We expanded full day Pre-K for 4 year olds across New York State by adding $125 million. More school districts in our community including including Katonah-Lewisboro, Bedford, Eastchester, Bronxville, Harrison, Mamaroneck, New Rochelle, Byram Hills, Rye Neck, Rye, Blind-Brook and White Plains will benefit directly from $100 million of this funding. Tuckahoe, Port Chester and Yonkers may be eligible to serve more Pre-K children under the $25 million grant program which prioritizes economically disadvantaged students and may also be used to convert half day programs to full day ones.

In addition, I am proud that the budget provides:

- An 11% tuition increase for special education schools including Special Act School Districts, 853 schools and 4410 preschool providers.

- $12.2 million increase in funding for 4201 schools serving deaf and blind students, $2 million more than Governor Kathy Hochul’s proposed budget.

- $50 million in new funding for student mental health services in schools and BOCES and for expansion of summer learning, after-school or extended day and year programs, responding to the needs of students as we recover from COVID closures.

- $1.5 million increase in Adult Literacy Education funding.

- $500 million in funding available to school districts through the Environmental Bond Act for electric school buses and necessary infrastructure to transition to an all-electric fleet by 2035 to protect student health and help achieve our climate goals.

Criminal Justice Reforms

I strongly supported the criminal justice reforms we adopted several years ago, as we sought to make sure our system of justice was not determined by the wealth of an accused person before trial. At the same time, I have heard from, and listened to, my constituents and law enforcement personnel who suggested we needed specific improvements to the laws to deal with legitimate concerns about public safety. I have supported many of these reforms, and am pleased that among other changes, we could accomplish the following:

- adoption of stronger provisions to ensure that those who are charged with repeated criminal conduct are brought before a judge who will be empowered to order bail or other appropriate options, given the gravity to the offense, to ensure the person charged returns to court;

- expansion of the list of charges involving guns that can be brought before a judge promptly for pre-trial determinations as opposed to a mandatory desk appearance ticket;

- enhanced funding and judicial discretion where defendants appear to need mental health treatment at arrest or arraignment; and

- modified discovery rules to ensure that non-material discovery omissions do not result in automatic dismissal of charges.

As you may know, I have continued to speak and meet with police leadership, police unions, the district attorney’s office, community organizations, public defenders, and criminal justice advocates to help craft a resolution that could be successfully passed and signed into law.

New Downstate Casino Licenses

This budget authorizes three new casino licenses downstate which will generate millions of dollars in taxes to directly support education. I am hopeful that one will go to Empire City Casino by MGM Resorts at Yonkers Raceway to create over 1,200 permanent jobs and thousands of construction jobs for lower Westchester and the Bronx, and provide a major boost to our downstate economy.

Expanding Access to Child Care

This budget will greatly expand eligibility for child care subsidies for thousands of working families across the state. Families earning up to 300% of the Federal Poverty Limit (FPL), which is about $83,250 for a family of four, will now have access to these subsidies, which is an increase from the previous threshold of 200% of the FPL. That means more working parents in Westchester will be able to afford quality child care.

Additionally, reimbursement rates for child care providers will be increased and staff will receive much-needed raises.

Hurricane Ida Relief Fund

Our district was devastated by Hurricane Ida last September and many did not receive sufficient aid to address their losses through insurance or FEMA.

I am proud to announce that our efforts were successful to secure a $41 million fund which will use Federal dollars to help those who are still dealing with Hurricane Ida losses that were not otherwise covered.

Fair Pay for Home Care

Our home care workers are unsung heroes and deserve to be compensated appropriately for the critical work they perform, largely for elderly and disabled New Yorkers. The chronic low wages they receive has led to an industry labor shortage that is unacceptable and the fear that those at home will be forced into nursing homes because they cannot find caregivers.

While I am disappointed we could not do as well as we hoped, I am glad we are beginning to address this in the budget, as we raised the minimum wage for home care workers by $3.00 per hour – $2.00 per hour this year and by an additional $1.00 per hour in the following year. I will continue to fight for even higher wages for these workers, as I believe still more needs to be done to retain and attract these workers and ensure they are paid a living wage. As a proud sponsor of the Fair Pay for Home Care bill, I vow to continue the fight for these workers – and those that they care for.

Tax Breaks

The budget provides an array of tax cuts and new tax benefits to New Yorkers that I strongly support:

Gas Tax Holiday: From June 1 through the end of the year, state motor fuel taxes will be suspended to lower gas prices by approximately $0.16 per gallon.

New STAR Tax Credit:

- The budget creates a one-time refundable personal income tax credit for Tax Year 2022 for homeowners who receive the basic or enhanced STAR exemption or credit and have incomes of $250,000 or less.

- The amount of the credit is a percentage of a homeowner’s existing STAR benefit, with the percentages scaled to provide the largest tax benefit to those with the lowest incomes.

The budget adds a one-time 25% enhancement of the New York State earned income tax credit, providing up to $200 million to low- and middle-income New Yorkers.

The budget speeds up the phase-in of scheduled middle-class tax cuts to give New Yorkers the full benefits of these tax cuts earlier than anticipated.

The budget extends and enhances the hire-a-vet tax credit for three years by increasing the maximum credit for hiring a disabled veteran full-time or part-time.

Creating a tax credit for small businesses COVID-related expenses.

In conclusion, after a tumultuous year in Albany, I am proud we adopted a budget that reflects our commitment to economic recovery, speaks to the needs of our children and families, addresses concerns about public safety and gun crimes, confronts rising prices at the pump, and restores faith in our government and its ability to meet the needs of our communities.

I will continue to listen to – and fight for – all of my constituents, as is my reputation. It is my honor to serve you, and I look forward to briefing all of the communities I serve on the budget, and the work ahead.

As always, if there is anything my office can do to assist you, please email me at smayer@nysenate.gov or call (914) 934-5250.

Warm regards,

Shelley B. Mayer

State Senator

37th District

Share this Article or Press Release

Newsroom

Go to NewsroomCity and State NY: The 2023 Power of Diversity: Women 100

November 13, 2023

Mid Hudson News: Cerebral Palsy center gets grant for facility

November 12, 2023

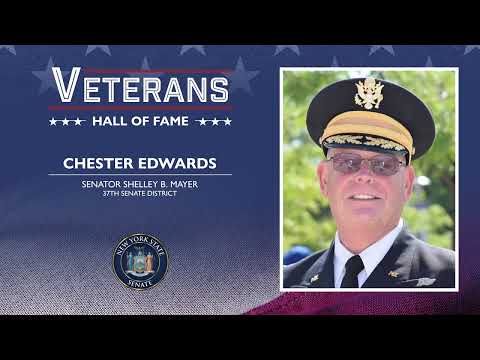

Senator Mayer 2023 Veteran Hall of Fame

November 9, 2023