Governor Signs Young Bill To Slash Sales Taxes In Chautauqua County

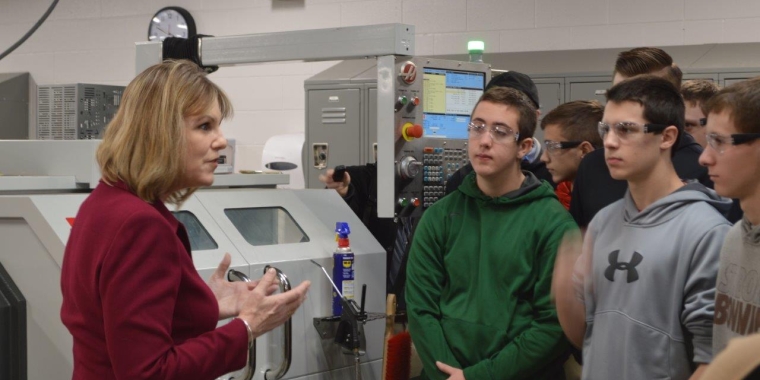

State Senator Catharine "Cathy" Young (R,I,C - Olean) today announced that Governor George Pataki has signed the Chautauqua County sales tax bill, which will decrease the county sales tax on clothing and footwear priced under $110.

"I’ve been fighting to enact this legislation for the past several months and I was very pleased to guide it through the Senate," Senator Young said. "Roadblocks to the bill’s passage had been removed by Chautauqua County and now it is a win-win situation for area consumers and the local economy."

"It was crucial for the County Executive to assure that all villages, town and cities losing revenues they receive from the sales tax will be held harmless by the county and I greatly appreciate Mark Thomas’ commitment," Senator Young said.

Currently, the local governments get a percentage share of the County’s tax. The County has promised to reimburse the local municipalities for any reduction in their sales tax revenues.

"Cutting the sales tax but raising local property taxes would have been unacceptable," she said.

Senator Young’s legislation allows Chautauqua County to exempt clothing and footwear from local sales tax. Merchants find themselves at a competitive disadvantage due to the proximity of neighboring Pennsylvania, which does not have sales tax on clothing and footwear. In an effort to stimulate our local economy, the County will now be able to aid local merchants by lowering their portion of the sales tax. This provision will not affect the state sales tax on clothing and footwear.

"Reducing sales taxes in Chautauqua County is a common sense approach to encourage the economy," Senator Young said. "Working together, we’ve provided genuine tax relief for New York’s overburdened taxpayers. While we have made progress, much remains to be done. This legislation will not only ease the tax burden on hard working residents, it will foster a positive atmosphere for economic growth."

Chautauqua County is unique in the State in that it is bordered on two sides by the state of Pennsylvania. Because of the proximity to this sales tax-free neighbor, Chautauqua retailers have experienced a notable drop in business that has not rebounded since the repeal of the state and local sales tax exemption in 2003. With the enactment of this legislation, retailers will benefit from a "leveled playing field" and consumers will no longer be burdened with this regressive tax on the purchase of everyday necessities.