Senate Approves Plan To Address Energy Costs

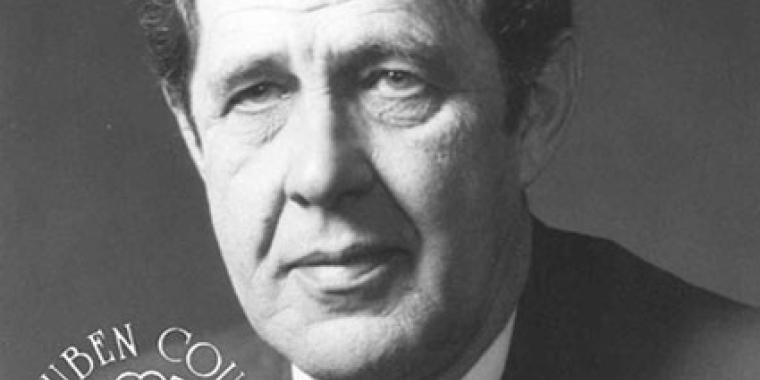

Albany, N.Y.-- "New York State can take some actions of its own to help address this energy crisis, and the Senate will do everything we can to keep attention focused on the need for action," said State Senator George H. Winner, Jr. (R-C, Elmira), who joined his Senate colleagues in a special legislative session at the Capitol yesterday to approve a plan he co-sponsors to cap the state and local sales tax on gasoline and to deliver New York’s current gas tax windfall to a program to assist fixed-income seniors meet what are expected to be record increases in home fuel heating costs this winter.

"New York State’s gas tax windfall must be returned to consumers who are hard-pressed to meet the rising cost of energy," said Winner, a member of the Senate Energy and Telecommunications Committee.

The centerpiece of the Senate energy plan is a cap on the state and local sales tax on gasoline that would save consumers about $90 million through the rest of this year, and $400 million annually if gas prices remain near $3 per gallon and all localities participate. Winner said that the Senate is proposing to roll back the state and local sales tax on gas and replace it with a fixed state-local levy. The move would provide motorists with an immediate savings on fuel purchased at more than $2 per gallon by capping the sales tax on gasoline at a taxable value of $2 per gallon. Unlike the existing tax, the new levy would not rise as prices increase, thereby eliminating any future tax revenue windfalls to state and local governments. The cap covers the local sales tax on gas unless a local government votes to opt out of it.

The Senate is also proposing to use the windfall in state sales tax collections, resulting from the increased sales taxes on higher-priced gas, to provide rebate checks to senior citizens to help offset winter heating costs. Specifically, the Senate’s legislation creates a new "Senior Heat" program to provide direct, one-time rebate checks of $200 to provide an estimated $140 million in assistance to at least 640,000 New York seniors, those who are currently eligible for the Enhanced STAR property tax program, in meeting their increased energy bills this winter. Enhanced STAR is available to seniors 65 years and older who own their own homes and earn under $64,500 per year. The Senior Heat program would also provide a $100 refundable state tax credit to eligible senior citizens who rent and pay for their heat. The Senate program is to be funded with revenues from the gas tax windfall, now projected at $42 million, but estimated to grow to $100 million or more by the end of the fiscal year.

In addition to soaring gas prices, the price for natural gas and heating oil has risen dramatically since last winter. According to the state Energy Research and Development Authority (NYSERDA), the average fuel oil price rose from $1.76 per gallon one year ago to $2.72 per gallon last week -- a 55- percent increase. New York homeowners consume an average of 800 gallons of fuel oil each winter. Utilities are already projecting record increases in natural gas costs.

The Senate energy plan also includes measures to:

> provide a tax credit for the production of bio-fuel products;

> extend tax credits for the purchase of alternative fuel vehicles;

> extend property tax exemptions for alternative energy facilities;

> provide a sales tax exemption on Energy Star products, home insulation and newly installed alternative energy systems; and

> provide tax credits for the purchase of commercial fuel cell generating equipment.

The Senate’s plan must be approved by the Assembly and signed by Governor George Pataki before becoming law.