Senator Saland Sponsors Legislation Which Passes The Senate To Protect Consumers From Unnecessary Charges

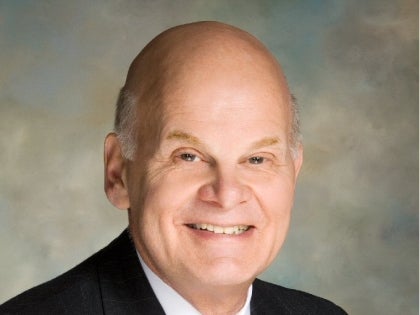

Senator Steve Saland (R,C Poughkeepsie) today announced that two bills he has sponsored to protect consumers from unnecessary charges have passed the Senate. The first bill (S.5736A) would prohibit a creditor from charging a consumer an additional rate or fee for any payment option chosen by the consumer. The second bill (S.4225A) would end the practice of credit card protection plans that charge consumers a fee, but provide no meaningful protection.

S.5736A

There have been recent cases where those who choose certain payment options, such as mailing in a payment, have been charged an additional fee to receive a paper bill in the mail. While some companies prefer electronic payment, consumers may not have access to a computer or may be uncomfortable transmitting their payment information via computer.

"This problem was brought to my attention after I saw a television news report which questioned why one of the major phone carriers would impose a paper billing charge to customers who pay by mail," said Senator Saland. "Senior citizens are particularly impacted by these fees. This bill would end this practice and give consumers flexibility in payment without concern that additional fees will be charged." The bill has been sent to the Assembly.S.4225A

This bill would end the practice of plans that charge consumers a fee but provide no meaningful additional protection than that already provided for under federal law. These plans charge consumers approximately $8 a month.The legislation would require companies which offer credit protection services to disclose current federal law and regulations regarding consumer credit and debit card liability, as well as consumer rights under the Fair Credit Billing Act.

"This bill makes certain that consumers are given all the information they need to make an informed choice when considering credit card protection plans," said Senator Saland. "It will enable consumers to avoid needlessly paying for protection services already required by federal law."

The bill has passed the Assembly and will next be sent to the Governor