Senate Majority Proposes $2.4 Billion Property Tax Relief Plan

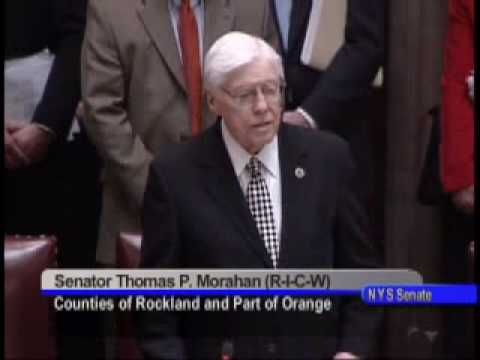

Senator Thomas P. Morahan, in an effort to reduce the enormous burden of some of the highest property taxes in the country, announced that he and the members of the Senate Majority Conference today proposed the REBATE-NY plan, a comprehensive, 24 point plan to provide more than $2.4 billion in school and municipal property tax relief over the next three years, including direct rebate checks to property taxpayers, expanding the STAR program and the property tax circuit breaker, and encouraging consolidation of local government services. The Senate plan would save property taxpayers approximately $1.4 billion in the 2006-07 State fiscal year.

"This plan is focused on reducing property taxes, which are among the highest in the nation, and represent the largest tax burden for millions of New Yorkers. Providing substantial property tax relief through this plan will be the Senate’s top priority in the next session," said Senator Morahan .

Highlights of the 24 point plan include:

$1.9 billion in direct rebate checks to property taxpayers;

Adjusting the STAR exemption to account for increased property assessments, saving property taxpayers an additional $250 million;

Enhancing the property tax circuit breaker for homeowners to save an additional $100 million;

Limiting school budgets to one district vote, saving taxpayers approximately $150 million; and

Expanded municipal shared services program

. "Local taxpayers in the lower Hudson Valley, including Rockland and Orange Counties, and across the state are in need of significant property tax relief. This plan would give relief to struggling homeowners in the form of direct rebates and would also control costs at the local level that impact property taxes. When fully phased in, our plan would save local property taxpayers $2.3 billion in school and municipal taxes,"said the senator.

A soon-to-be released report by Global Insight found that, based on the 2002 Census of Governments, local property taxes in New York State averaged $3,750 per household, exceeded only by the states of Connecticut and New Jersey. When combined with local sales, income and other taxes, the local tax burden in New York averaged $6,377 per household, the highest in the continental US and more than twice the national average of $2,952.

Property taxes have increased by 19.6 percent over the 1997-2002 period in New York, reflecting an increase in local government expenditures by 30 percent. School tax levies alone have increased by an average annual rate of 7.7 percent since 2001. Over the previous three years, county officials have pointed fingers at Albany as the root cause of ever increasing property taxes, blaming increased growth in Medicaid and pension payments as the need to increase property taxes at times by double digit rates of growth.

However a closer examination of local government expenditures outside of the City of New York indicate that on average, local government expenditures attributable to Medicaid averaged 2.6 percent or about $1.4 billion of the $54.6 billion total local government spending in 2002. Education spending, of which slightly less than one-half is funded by the state, accounts for 49.8 percent of all local spending, a total of $27.2 billion. Local government spending on all other services such as highways, water, public protection, sanitation, etc. add up to 47.6 percent of local government spending for a total of $26 billion. Therefore, while Medicaid costs may be growing faster than other local government costs, it represents a much smaller share of the overall local tax burden, far surpassed by all other local government spending and public education.

In addition, the Global Insight report found that in 2002, local government spending was up to $4 billion higher in New York than the average of ten states delivering similar services. These costs are due to New York’s multi-jurisdictional approach to delivering local government services as well as a higher cost of delivering these services, requiring $2.3 billion in additional local taxes and $1.7 billion in additional state support.

REBATE - NY

Tax Savings Proposals

Ÿ Tax Rebate Checks;

Ÿ STAR Exemption Annual Adjustment;

Ÿ Voter Initiative Tax Rate Cap;

Ÿ One School Budget Vote;

Ÿ Local School Finance Reform Commission;

Ÿ Expanded School Report Card;

Ÿ Smaller Smarter Government Program;

Ÿ Expanded State Circuit Breaker for Homeowners;

Ÿ Reversible Mortgage Linked Deposit Program;

Ÿ STAR Exemption Annual Adjustment; and

Ÿ Income Tax Credit for Volunteer Firefighters in Lieu of Property Tax Exemptions

1Cost Savings

Ÿ Consolidation of School Districts; and

Ÿ School Superintendent Sharing

Accountability/Results

• Municipal Shared Services, Smaller Smarter Government Program;

Ÿ Require Board of Elections to Oversee Budget Votes;

Ÿ Shorten the Term of School Board Members to Two Years;

Ÿ Truth-In-Voting;

Ÿ Whistle Blower Protections;

Ÿ Expanded School Report Card;

Ÿ Special Education Audits;

Ÿ Performance Assistance Support Services Aid (PASS);

Ÿ Alternative Certification for Superintendents;

Ÿ Increase Aid to Municipalities for reevaluation from $5 per parcel to $15 per parcel;

Ÿ Biennial Justification of a Property Tax Exemption; and

Ÿ Clarify Statutory Definitions for Property Tax Exemptions

SENATE MAJORITY REBATE-NY

PROPERTY TAX RELIEF PLAN

Create a New Property Tax Rebate Program -- $1.9 Billion in Savings

To provide immediate taxpayer relief, the Senate Majority calls for a $1.9 billion property tax rebate program to be phased in over three years. Under the rebate program property taxpayers would receive an additional 75 percent of their current STAR property tax credit in the form of a direct rebate check. Under this initiative, a taxpayer would receive a rebate check for a portion of school taxes paid on a primary residential home. The value of this rebate would be based on taxes paid in the previous school year and would begin with rebate checks in September 2006 based upon school taxes paid for the 2005-06 school year. The value of the rebate would be calculated as a percentage of the homeowner’s benefit from the STAR program.

"The reports of homeowners, particularly senior citizens struggling to keep up with the rising property tax burden, are becoming all too familiar," said Senator Steve Saland, Chair, Senate Education Committee. "Under our tax rebate program every homeowner would realize property tax savings through receipt of a rebate check refunding a portion of their paid school property taxes. Building on the success of STAR, this program will provide a welcome relief to families across New York State."

The property tax rebate check amounts would be based on the following percentage of STAR benefits:

Percent of STAR Savings in Rebate Check

STAR Exemption Annual Adjustment -- $250 Million in Savings

Currently, the income eligibility for seniors to receive enhanced STAR automatically increases to reflect the cost of living, but the STAR exemption levels do not. Over time as property assessments go up, the portion of school taxes covered by STAR decreases. Increasing the current $30,000 basic and $50,000 enhanced STAR exemption annually to reflect the growth in the median New York State home value will offset the school tax impact of assessment increases. State taxpayers will save $250 million per year through this initiative.

Voter Initiative Tax Rate Cap

This proposal authorizes voters to initiate a cap on increases to the school property tax rate. Voters would be required to obtain signatures at least equal to 25 percent of the total number cast in the previous school year’s budget vote to place a cap on the school tax rate on the ballot. If the voters approve a limit in the growth on the school tax rate, then that limit would remain in effect for three years unless revoked by voters in a separate initiative. The specific limit on the tax rate would be set by the voter initiated proposition.

Local School Finance Reform Commission

Establish a Blue Ribbon Local School Finance Reform Commission to review rising school budget costs and various local school financing alternatives. The Commission will be made up of 11 members appointed as follows: three by the Governor, three by the Senate Majority leader, three by the Speaker of the Assembly, one each by the Minority leaders of the Senate and Assembly. Anyone can serve on the Commission provided that one appointment each by the Governor, Senate Majority Leader, and Speaker must be a person who is expert in the field of school finance. The Office of Real Property Services in conjunction with the Department of Taxation and Finance and the State Education Department would perform the necessary analysis on behalf of the Commission on the sources and reasons of rising school budgets as well as the impact on taxpayers, the school districts and the State of shifting school financing from property taxes to other tax sources. This Commission would be required to present the Legislature and the Governor with a final report including their recommendations to reduce rising costs and local school finance alternatives by December 31, 2006.

Municipal Shared Services - $50 million in savings

Focusing on the non-school tax side of the property tax problem is an expanded shared services program, "The Smaller, Smarter Government Program," providing up to $50 million in incentives and technical assistance to foster inter-municipal cooperation. While this program is available for the merger and consolidation of all government services and local governments themselves, the initial focus would be on shared administrative services as well as on infrastructure maintenance such as transportation.Single School Budget Vote - $150 million in savings

Current law authorizes school districts to conduct a second school budget vote when the first school budget vote is defeated. If the school budget vote is defeated a second time, a contingency budget is activated. To allow taxpayers to control property tax increases resulting from school budget increases, a proposal which limits school districts to a single budget vote is included. This initiative creates a strong incentive for school districts to propose realistic and responsible budgets. In the event the school budget is defeated, a contingency budget cap is triggered, requiring school districts to limit their spending to the lesser of 120 percent of C.P.I., or four percent, over the prior year’s spending. The contingency budget cap is 3.2 percent for 2005-06. This proposal would have saved taxpayers $150 million if in effect in 2005.

Municipal Shared Services - $50 million in savings

Focusing on the non-school tax side of the property tax problem is an expanded shared services program, "The Smaller, Smarter Government Program," providing up to $50 million in incentives and technical assistance to foster inter-municipal cooperation. While this program is available for the merger and consolidation of all government services and local governments themselves, the initial focus would be on shared administrative services as well as on infrastructure maintenance such as transportation.

Require Board of Elections to Oversee Budget Votes

School board members control billions of taxpayer dollars. To improve accountability, boards of elections should conduct school budget and board elections. In most school budget elections, voter registration rules are loose compared to the registration requirements under the Election Law.

Shorten the Term of School Board Members to Two Years

This proposal would create greater opportunities for local voters to express their opinions through their vote on school board candidates.Expanded School Report Card

Current law requires that school boards annually prepare a property tax report card, make it publicly available and transmit this report card to the State Education Department. This "report card" would be expanded to require a comparison of various expenses among school districts of similar size and a multi-year analysis of an individual school district’s expenses to increase accountability. In addition, school districts are required to mail to each qualified voter a "six day notice". Under an enhanced "six day notice" taxpayers would be provided with an estimate of their tax bill, total school district spending and tax levy under the proposed budget and under a contingency budget. Furthermore, the six day notice and school property tax report card will include the amount of unexpected surplus funds.

Truth-In-Voting

The Truth-In-Voting program contains two proposals designed to enhance school district accountability to taxpayers. First, school districts will be required to hold public votes on Bond resolutions for capital projects on the same day as the statewide uniform budget vote date (Third Tuesday of May). Second, school districts will be required to publicly divulge the contents of a contingency budget when the proposed budget is presented to the taxpayers of the district. This information will include which programs will be reduced or eliminated under a contingency budget.

Whistle Blower Protections

This provision would authorize employees of school districts, BOCES, and charter schools, who may have reasonable cause to suspect that the fiscal practices or actions of an employee violate any local, state, federal law, rule or regulation relating to financial practices, shall have immunity from civil liability and shall also be protected from retaliatory action by their employer. This provision ensures that school district employees and district officers have the necessary protections when they step forward to expose illegal or inappropriate fiscal practices.

Consolidation of School Districts

This provision would significantly enhance the current Reorganization Operating Aid formula. Reorganization Operating Aid, which is currently $15 million, provides a short-term financial incentive for school districts to merge. Currently school districts which merge receive a 40 percent increase in operating aid for five years. However, after a merger this incentive aid is phased out over an additional ten year period. The Enhanced Reorganization Aid would continue the current 40 percent increase in operating aid for five years after a merger. In addition, all reorganized districts would continue to receive at least 20 percent of operating aid in Reorganization operating aid permanently.

Also, districts which document long-term savings as a result of the merger, would receive $1 in additional Reorganization Incentive aid for every $1.50 saved. The total amount of Enhanced Reorganization aid would be capped at 40 percent of operating aid. It is estimated that this program would provide an additional $10 million in Reorganization aid to school districts when fully phased-in.

In addition, it is proposed that an update of the 1958 Commissioner’s Master Plan for School Reorganization be performed. This update would examine school districts’ financial viability including whether districts should consolidate or remain as a separate unit of government.

School Superintendent Sharing

Currently, each school district is required to appoint their own superintendent. However, many small school districts could share a single superintendent if given the option. This proposal would allow school boards to share a superintendent, and therefore the cost. The cost and time sharing arrangements would be negotiated between the involved school boards. A superintendent would not be able to be shared by any more than three school districts. Districts with less than 1,000 enrolled pupils would be eligible to share superintendents. 191 of the State’s 677 school districts have fewer than 1,000 enrolled pupils.

BOCES Business Management of School Districts/Consolidation of Central Services

At present, school districts are able to avail themselves of BOCES for assistance in their business practices. BOCES would be encouraged to provide additional financial oversight and assistance to school districts’ businesses offices.

Special Education Audits

The percentage of children in special education has increased significantly over the last fifteen years. In 1988, approximately nine percent of students were classified as special education students. By 2003, 12 percent of children in public schools were classified as needing special education. This proposal requires the State Department of Education to undertake programmatic audits of schools with high special education classification rates.

Performance Assistance Support Services aid (PASS)

Under the PASS program school districts which increase student performance on State exams by at least ten percent would receive additional state aid. This state aid is designed to recognize and reward districts which are able to significantly improve student academic performance. Districts would be measured based upon student performance on Grade 4 and Grade 8 math and English exams as well as Regents exams. It is estimated that PASS would provide an additional $25 million in school aid for the 2006-07 school year.

Alternative Certification for Superintendents

Currently even a highly qualified person must hold a State Certification for School Administration in order to serve as a school superintendent although the Commissioner of Education can provide a waiver from these provisions. There are qualified persons who are dissuaded from service by the current process. The Senate Alternative Superintendent Certification program would allow a person to serve as a school superintendent if they have a postgraduate degree and five years experience as a senior manager of a large corporation or organization. This program would also help address the looming superintendent shortage by increasing the pool of potential candidates for vacant superintendent positions.

MUNICIPAL Property Taxes

Smaller Smarter Government Program

In SFY 2005-06, a $2.75 million Shared Services program was enacted. This program awards grants