Senate Passes Legislation Permitting Exemption Of Senors 75+ To Receive Total Exemption From School Property Taxes

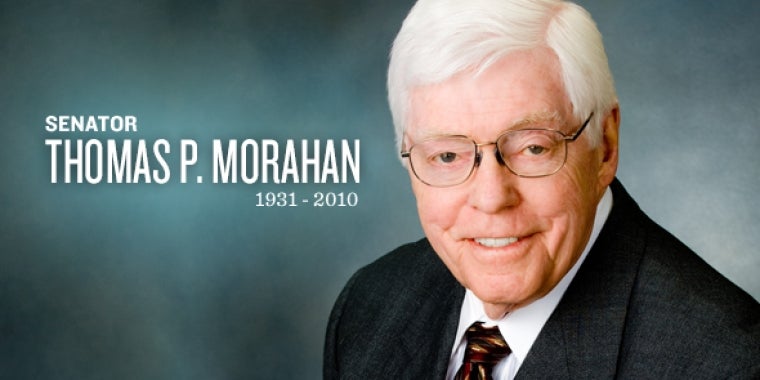

The New York State Senate today announced passage of legislation, sponsored by Senator Thomas P. Morahan ,that would amend the real property tax law, permitting people 75 years of age or over to be totally exempted from real property taxation for school tax purposes.

"Seniors in New York who own their homes are facing an ever increasing tax burden. Many of these seniors have limited income which makes school taxes even more difficult to bear. This legislation will exempt senior homeowners who have no children in school and who have lived in the school district for thirty years or more from having to pay school taxes," said Morahan.

The legislation (S6273) would add a new section to the Real Property Tax Law, permitting a governing board of a municipality to grant a total exemption from real property taxation for school tax purposes in certain instances for persons 75 years of age or over. The legislation also requires that the owner must meet the Enhanced STAR income limit.

The bill was sent to the Assembly.

#####