Senator Parker Lends Support For Plan To Solve Foreclosure Meltdown

Brooklyn, NY -- State Senator Kevin Parker (D-Brooklyn) has voiced support for a package of Senate Democratic proposals to protect borrowers from foreclosures.

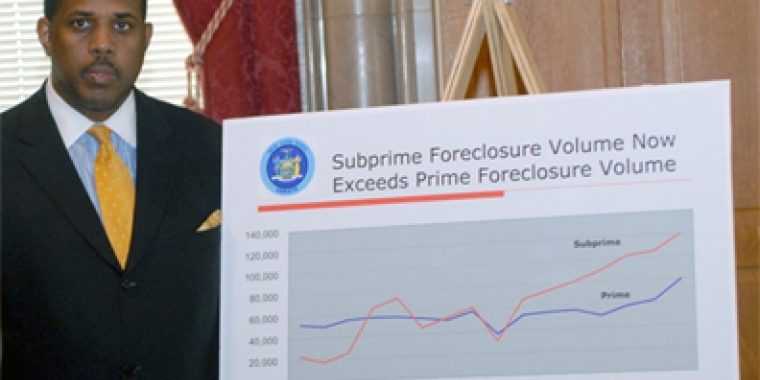

According to a report recently released by the SenateMinority Conference, more than 20 percent of the sub-prime mortgage loans originated in 2005 will end in foreclosure, causing more than 28,000 New York families to face the prospect of losing their homes.

Dramatic statistics like these prompted the SenateMinority to announce the Predatory Lending Mitigation Program -- a plan to help families victimized by predatory lenders.

"A whole industry has emerged that preys on economically disadvantaged individuals in the quest to turn a quick buck," said Senator Parker. "What gets ignored is the fact that many borrowers cannot afford the price of high-cost loans sold to them, setting them up for failure."

"Failing mortgages cost us all as foreclosed properties overburden the housing market and this affects values. More troubling, however, is the devastating financial toll on hardworking New Yorkers. It can take years to recover," he added.

Senator Parker and his colleagues proposed several measures that will protect consumers from predatory lending practices. In an effort to help borrowers who have already been victimized by questionable -- and perhaps unethical lending practices -- the SenateMinority called for an immediate voluntary six-month moratorium on foreclosures of sub-prime loans in New York.

The moratorium is coupled with a planned series of statewide public hearings to solicit input from victims of predatory lending, the banking industry and housing experts whose testimony will help give shape to policy solutions.

The SenateMinority also proposed measures to help consumers avoid the pitfalls of predatory loans. One bill, sponsored by Senate Democratic Leader Malcolm A. Smith (D-Queens), would bar the State from doing business with banks that partake in predatory lending practices. Another would provide training and assistance to borrowers seeking a loan.

"Predatory loans are unethical. Targeting people who are naïve in order to rob them of their dreams is unconscionable, and New York State should not be doing business with banks that engage in such practices," Senator Smith said.

Sub-prime loans are loans offered to individuals whose credit history prevents them from securing a low-rate loan. A typical sub-prime borrower has a low credit score and a history of late payments, charge-offs or bankruptcies. Since they are considered at high risk of default, they receive less-than-favorable terms, including higher interest rates, regular fees or an upfront charge.

In some cases, sub-prime borrowers are drawn in by a low introductory rate which then sharply increases within a few years making it difficult, if not impossible, to keep up with monthly payments. The borrower can lose their home unless they can refinance their loan or sell the house.

Not all sub-prime lenders engage in predatory practices and some provide a valuable service to people who would not otherwise be able to qualify for a mortgage loan.