Senate Passes $6 Billion, Two Year Property Tax Relief Plan

The New York State Senate today passed a three part plan (S.1) to significantly expand the Senate-initiated property tax relief rebate program to provide $2.6 billion in property tax relief this year and $3.4 billion in 2008.

The plan would triple the size of direct property tax rebate checks in the first year, give voters greater input on local property tax rates, and establish a Blue Ribbon Commission to make reforms to help reduce property taxes.

"The Senate Majority is fighting to provide property tax relief because we recognize how hard New Yorkers have to work just to pay their property taxes," Senate Majority Leader Joseph L. Bruno said. "The number one priority of the Senate is to provide greater property tax relief to the hardworking, overburdened taxpayers of New York State.

"Last year, we provided approximately $875 million in direct property tax relief. The rebate program was very successful," Senator Bruno said. "However, there were two concerns -- the size of the checks and the ability of taxpayers to affect local tax rates. This plan addresses those concerns by tripling the size of the average rebate check and establishing a process that will allow local taxpayers to have more say in controlling local tax rates. We are building on what we accomplished last year and continuing to return the state’s sizable budget surplus to the taxpayers."

A report commissioned by the Senate last year, conducted by Global Insights, found that local taxes per household in New York ($6,377) are the highest in the country and more than two times the national median ($2,952). Also, the Tax Foundation recently issued a report which studied property tax burdens in the 775 largest counties in the country. All six of the New York downstate suburban counties were in the top 25 highest property taxed counties in the country.

More

"We started to put real property tax relief into the hands of hardworking taxpayers last year, but we need to expand on that effort," said Senator Owen H. Johnson (4th Senate District, Babylon), Chairman of the Senate Finance Committee. "In my district on Long Island, many homeowners are being hit with higher tax bills year after year. Taxpayers need help and this legislation will ensure that they get the help they need and deserve."

The three-part Senate property tax relief plan includes:

TRIPLE PROPERTY TAX REBATE CHECKS -- REBATE PLUS

The total value of the Rebate-NY program in 2006 was approximately $875 million, which included $200 million for income tax credits for New York City residents. The Rebate Plus plan would triple the current rebate/credit program across the state in 2007 and would approximately quadruple it in 2008. The Rebate Plus plan would provide $2.6 billion in tax relief in 2007-08 and $3.4 billion in 2008-09. (A county by county list of average rebate checks for seniors and non-senior taxpayers is attached).

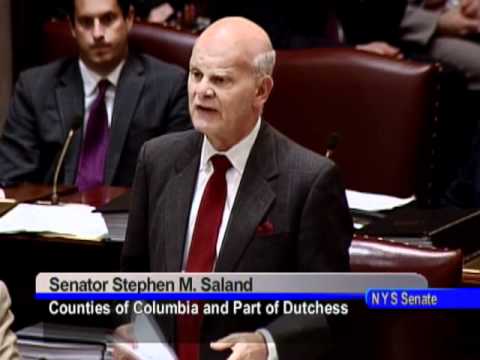

"It is clear that homeowners and in particular, senior citizens, who are struggling to keep up with the ever increasing burden of property taxes need ever greater relief," Senator Steve Saland (R-C, Poughkeepsie), Chairman of the Senate Education Committee, said. "With this new plan the Senate is expanding our effort to provide property tax relief while maintaining our commitment to providing quality education to our state's students. This property tax relief plan will put even more money back where it rightfully belongs, into the pockets of the hardworking men and women of our state."

In 2006, rebate checks averaged approximately $175 for non-seniors and $300 for seniors. Under the expanded Rebate Plus plan, in 2007 the rebates would average $525 for non-seniors and $900 for seniors.

The Rebate Plus program can be paid for with the State budget surplus. The Senate Finance Committee estimates that New York State will end this fiscal year with a sizable surplus.

Voter-Initiated Tax Rate Limits

This proposal would give voters a greater say in local tax rates by allowing them to collect signatures to limit the growth in the local school and municipal tax rates. If a sufficient number of signatures are collected, a proposition would be placed on the ballot at the next school budget vote. The petition would set the type of limits on the tax rate. If approved, the limits on increasing the tax rate would be in effect for one year.

"New Yorkers are unhappy about skyrocketing property taxes and this proposal would give voters the ability to take the issue into their own hands, limit growth in the tax rate and keep their property taxes down as much as possible," said Senator Bruno.

"Local control is critical to ensuring that issues closest to the people are decided by those directly affected by the decisions made," said Senator Kenneth LaValle (R-C-I, Port Jefferson). "This proposal would allow the taxpayer to settle on a tax rate and programming that local residents can afford, while maintaining a quality of education that is acceptable to the community."

More

Blue Ribbon Commission on Property Tax Reform

The Senate’s property tax relief plan would establish a Blue Ribbon Commission to examine and make recommendations on specific areas of reforms for local governments and school systems with the goal of reducing the property tax burden in New York State.

The Commission will report at the end of calendar year 2007 on a reform plan for schools and local governments to lower local tax burdens with a focus on enhanced accountability, alternative financing methods, governance options, property assessment plans, and tax containment policies. The Commission would also be charged with examining possible alternatives to the real property tax for funding schools and changes to the property assessment system.

Members to the eleven-member Commission would be appointed as follows: three each by the Senate Majority Leader, the Governor, the Speaker of the Assembly, and one by each of the Minority Leaders.

"The goal of our commission is to examine this issue statewide and offer a comprehensive plan that promises long-term, meaningful property tax relief," said Senator Betty Little (R-C-I, Queensbury), Chair of the Senate Local Government Committee. "Every aspect of the property tax system needs to be scrutinized. Alternatives need to be proposed. The commission, which will be bipartisan and include representation of the Senate, Assembly and Governor, offers a strong opportunity to develop a consensus by the end of 2007."

Senator Bruno said that the plan benefits every region of the state, and as with state education aid, he assured that no region would be impacted disproportionately relative to the level of property taxes they pay.

The bill was sent to the Assembly.