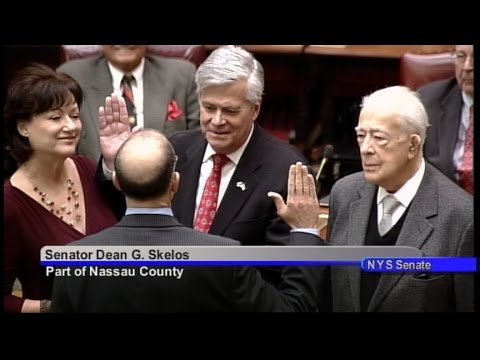

Senate Passes Property Tax Cap Legislation

The New York State Senate today passed property tax legislation and mandate relief bills designed to reduce costs for schools and ensure adequate resources for New York State’s students.

"Enacting a property tax cap is a good starting point, but it is only one piece of the puzzle," said Senate Majority Leader Dean G. Skelos. "We also passed measures to provide help for school districts who are dealing with rising costs that force property taxes to increase -- including rising pension and energy costs. New Yorkers are facing challenging economic times. The measures we passed today in our special session will provide much-needed relief to taxpayers and is the beginning of the process of reducing property taxes. And at the same time, reconfirms the Senate’s commitment to ensuring our students and schools have the resources they need."

"It is clear that homeowners who are struggling to keep up with the ever increasing burden of property taxes need greater relief," Senator Steve Saland (R-C, Poughkeepsie), Chairman of the Senate Education Committee, said. "My Senate Majority colleagues and I made property tax relief our top priority this year. By passing the property tax cap and mandate relief legislation, we will ensure much-needed relief while maintaining our commitment to providing quality education to our state's students."

The Senate passed the Governor Paterson’s Program Bill that would place a cap on the growth of school property taxes at four percent or 120 percent of Consumer Price Index (CPI), whichever is less. In addition, the Senate passed a bill that includes several savings proposals and mandate relief measures in order to reduce costs for school districts and ensure greater relief for the taxpayers. The bills passed today will have no impact on the 2008-09 State Budget.

Measures included in the omnibus legislation include:

> relief from increasing pension costs;

> increased aid for construction of "green" schools and energy conservation improvements;

> incentives for consolidated services between school districts;

> school superintendent sharing;

> a ban on unfunded mandates; and

> a moratorium on property reassessments.

The legislation reconfirms the Senate’s previous commitment to education aid, providing $3.3 billion in foundation aid over the next three years in order to provide a sound basic education and meet CFE requirements.

The Senate also passed a resolution calling on the federal government to provide additional funds for federal unfunded mandates, including the No Child Left Behind Act which requires school districts to meet costly testing and reporting requirements.

"The high cost of living -- from food to gasoline to property taxes -- is taking its toll on hardworking, overburdened taxpayers," said Senator Jim Alesi (R-Perinton). "The time for action is now. We need to move forward and we need to have the Democrat controlled Assembly give serious thought to a tax cap. They represent the same people that I represent; tax payers and homeowners who need real relief."

"Upstate New Yorkers need, and are looking for, relief from the escalating costs of living," said Senator Joe Robach (R-C-I, Rochester). "Our property tax relief plan is one step in the right direction to help working men and women and people on fixed incomes from this, the most onerous tax. While we will continue to do more to ease the burden of property taxes, this legislation is in direct response to the will of the people."

"High property taxes coupled with a surge in home foreclosures have created a perfect storm where the dream of home ownership is at risk," said Senator Caesar Trunzo (R – Brentwood). "The property tax cap is a step in the right direction towards providing New Yorkers with the relief to keep this dream a reality."

"The State Senate understands that financial challenges lay ahead -- the main reason we must enact a property tax cap now," said Senator Dale Volker (R-C-I, Depew). "These financial challenges cannot be wished away. Rather, we need to tighten our belts, get down to business, and make sure our taxpayers are protected from tax and spend policies that force businesses to leave our region and place undue financial pressure on our homeowners. This property tax cap proposal will contain costs for property taxpayers and I believe this responsible tax relief proposal is just one arrow in the quiver. We need to look at additional ways to reduce duplication, waste and unfunded mandates that can cause financial difficulties for both school districts and taxpayers alike."

Property Tax Cap

The legislation passed today (S.8736) would cap the school property tax levy growth at four percent, or 120 percent of the inflation rate, whichever is less.

The bill allows for voters to approve a tax levy that exceeds the cap if 55 percent of voters approve it. If a school district received an increase in State aid of over five percent, 60 percent of the voters must approve the override vote.

Under the legislation, voters could also place a stricter tax cap on their local school district. The underride proposal would be placed on the ballot by voters if they wish to adopt a tax increase less than the cap, or no tax increase at all.

School districts that propose an increase that is less than the cap would be authorized to bank the excess taxing authority, up to 1.5 percent, for tax increases in future years.

Savings Proposals and Mandate Relief

Rising pension and energy costs place an additional burden on school districts, making it more difficult to keep increases in property taxes low. The Senate passed omnibus legislation (S.8737) to address these issues and reduce costs for school districts.

Pension Costs -- In order to provide school districts relief from increasing pension costs, the state would take over increased costs above four percent. However, no school district shall receive more than 40 percent of the total funding. $100 million would be provided in the 2009-10 State Budget to offset increased costs above the four percent cap. This proposal is similar to the cap on local Medicaid costs that has saved counties hundreds of millions of dollars.

Energy Savings -- In order to help school districts with rising energy costs, the legislation includes the following measures:

> each school building would be required to undergo an energy audit by NYSERDA/NYPA, which would include recommendations for alternative energy plans. Schools that implement these recommendations would receive a 65 percent reimbursement for costs through building aid;

> additional incentives could be offered for the construction of "green" school buildings and the use of alternative energy sources; and

> authorize school districts to construct joint facilities with other municipalities and public benefit corporations.

In addition, the legislation provides school districts with more flexibility in providing transportation services to help them save money. Currently, school districts are restricted from extending transportation contracts beyond CPI growth. However, CPI is not reflective of true transportation inflation, especially with escalating fuel costs. Allowing schools to use an adjusted transportation CPI will help school districts decrease their contractual costs by allowing them to renew their transportation contracts without going through an expensive bidding process.

BOCES Management/Consolidated Services -- The legislation would allow school districts to contract with BOCES for maintenance services, including lawn mowing, heating and air conditioning, repair, and trash collection. When implemented as a comprehensive package, this measure will provide savings to school districts and relief to taxpayers.

Currently, the incentives given to school districts to consolidate services decrease after five years, and disappear entirely after fifteen years. This legislation provides a permanent operating incentive for shared services, provided that in the first two years, the districts show cost savings to the Commissioner and keep the reorganized tax levy lower than the tax levy of the two districts combined in the year prior to consolidating. In addition, after three years, the reorganized school district would be required to use 50 percent of the incentive operating aid to reduce the tax levy.

Under current law, each school district in the state must appoint their own Superintendent. This bill would allow small school districts, with an enrollment of less than 1,000 students, to share one superintendent across a maximum of three districts.

Mandate Relief -- The legislation includes several measures to limit the ability of the State to impose mandates that lead to increased costs and taxes, including:

> a ban on unfunded mandates on localities or school districts which will cost over $1 million, except in emergency situations, or for federal compliance;

> delaying the effective date of any regulation that has fiscal implications that is adopted after school budgets are voted on until the school year for which the next school budget will be approved for;

> eliminating numerous required reports that are no longer relevant to help schools reduce paperwork; and

> establishment of a Blue Ribbon Commission on Mandates to determine costs associated with mandates; establish alternative solutions to costly mandates; identify mandates that could be consolidated; and determine the true savings of mandate relief proposals. The Commission would be composed of eleven members -- three each appointed by the Governor, Majority Leader of the Senate, and Speaker of the Assembly and one each by the Minority Leader of each house -- and would be required to report their findings to the Governor and the Legislature by March 31, 2009.

Moratorium on Reassessments -- In order to deal with uncertainty in assessments and housing values, this legislation places a two-year moratorium on property reassessments. In addition, the bill would create an 11-member commission to recommend a statewide, uniform assessment code.

The bills were sent to the Assembly.