Legislature Enacts Final State Budget

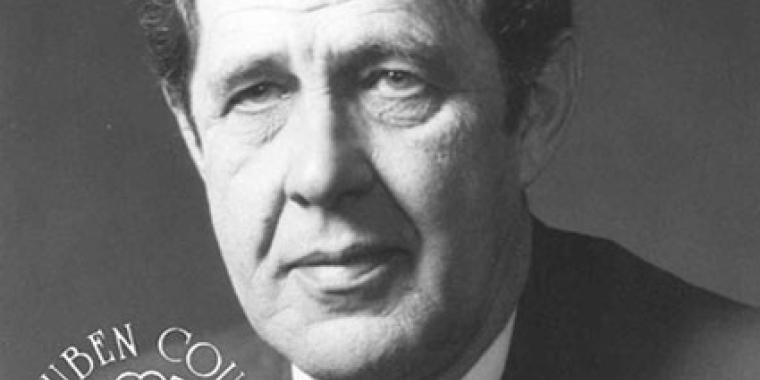

Albany, N.Y.--State Senator George Winner (R-C-I, Elmira) said today that even though the final 2008-09 New York State budget "was put together during unforeseen economic and startling political circumstances, it continues a strong commitment to fundamental responsibilities in education, health care and transportation."

Winner noted that lawmakers were forced to enact this year’s budget in the midst of upheaval throughout the nation’s economy and within New York government itself with the resignation of former Governor Eliot Spitzer and the ongoing transition to a new governor, David Paterson.

Winner’s comments came as the Senate and Assembly adopted the final pieces of this year’s state spending plan. He released the following statement:

"We faced a tough budget during a period of unprecedented chaos at the Capitol. Eliot Spitzer’s resignation and the transition to Governor David Paterson’s administration slowed down the process.

"The national economic downturn is inflicting across-the-board pain on citizens and governments alike. New York government faces a significant budget deficit this year, and an uncertain financial future.

"We’re going to continue to confront difficult decisions to maintain strong commitments to existing programs and services. It must remain an overriding priority that the choices made don’t keep adding to the burden on local property taxpayers.

"Former Governor Spitzer had proposed tax hikes that were aimed right at upstate motorists. The Senate said, ‘No way.’ I’m proud of that rejection. It‘s one of the highlights of this year’s budget and should be a cornerstone for our strategy moving forward. The proposed upstate tax hikes would have raised the costs of gas and car insurance at a time when expenses are rising for everything under the sun.

"Overall, I’m hopeful this budget can lay the foundation for a more sensible fiscal future in New York government."

Specific highlights of the budget include:

-- increased aid, of up to 9 percent, to the region’s cities, towns and villages;

-- the rejection of an executive budget proposal to eliminate state reimbursement for youth detention. The state currently provides a 50-percent reimbursement to counties for costs associated with youth detention in secure and non-secure facilities. If counties had been required to cover the full cost for youth detention, it would have cost them $13.7 million this year and $27.4 million in 2009;

-- the rejection of an executive budget proposal to increase the county share of welfare costs from the current 50 percent to 52 percent, a shift that would have cost counties an additional $8 million this year and $11 million in 2009;

-- funding for highway, bridge and mass transit projects statewide, including a total of $363 million for the Consolidated Local Street and Highway Improve Program (CHIPS). The 2008-09 CHIPS funding represents a $51 million increase in aid over last year;

-- the rejection of an executive budget proposal to remove 92 New York State Police "school resource officers" (SROs) from school districts across the state and at least eight Southern Tier-Finger Lakes region schools;

-- a $1.8 billion increase in aid to local school districts across New York;

-- the rejection of an executive budget proposal for a huge increase, from $5 to $20 this year, in the Motor Vehicle Insurance fee on every vehicle registered in New York. The Motor Vehicle Insurance fee is collected annually from insurance policy holders for each insured motor vehicle. Under current law the fee is scheduled to drop to $1 annually on July 1, 2008;

-- the rejection of an executive budget propsal to effectively do away with a Senate-initiated cap, enacted in 2006, on any state sales tax on gasoline over $2 by consolidating the tax into the Petroleum Business Tax (PBT). Under the executive’s proposal, the PBT, motor fuel excise tax and the sales tax on fuel would have been combined under the PBT. The move would have meant that the existing state sales tax cap and the fixed-rate motor fuel tax would be indexed the same as the existing PBT. The state Division of the Budget estimated the change would increase gasoline taxes by nearly $56 million annually, which could have resulted in even higher prices at the pump; and

-- the restoration of $245 million in health care funds, including $168.9 million to hospitals, nursing homes and home care.