Iberdrola Targets Some $2 Billion For Renewable Investments In New York State

Global energy leader Iberdrola SA announced today that it hopes to invest approximately $2 billion in renewable energy in New York State over the next five years if the company's proposed acquisition of Energy East clears the final regulatory hurdles in New York State and the transaction closes.

In its official filings with the New York Public Service Commission (PSC) in conjunction with the acquisition of Energy East, Iberdrola has already committed to invest a minimum of $100 million in renewable energy if its efforts to acquire Energy East are successful. Today’s announcement sets a new target investment that is above and beyond the binding commitment made in that proceeding.

At an Albany news conference announcing the new target, Xabier Viteri, CEO of Iberdrola Renewables, Pedro Azagra, Director of Corporate Development, and Terry Hudgens, Director of Iberdrola Renewables USA, were joined by a bipartisan group of state legislators as well as statewide business leaders. Together they urged the PSC to approve the transaction because it would boost the upstate New York economy, help the state achieve its renewable energy goals and bring the world’s largest wind energy company to Upstate.

The proposed transaction has already received approval from regulators in all other affected states as well as the federal government. Those approvals came with minimal conditions.

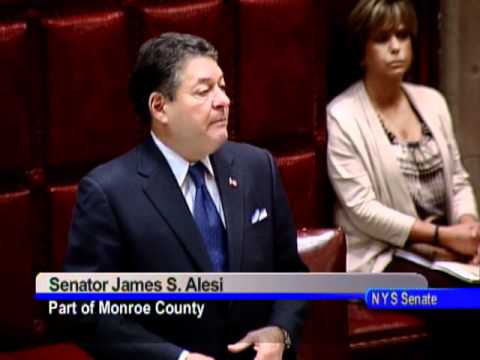

Joining Mr. Viteri were Senator James Alesi (R-Monroe), Senator George Maziarz (R-Niagara), and Assemblyman Joseph Morelle (D-Monroe) as well as Kenneth Adams, president and CEO of the Business Council of New York State, and Brian McMahon, executive director of the New York State Economic Development Council. In addition, a leading national environmental group, the Natural Resources Defense Council, has endorsed the proposed transaction in official filings with the PSC.

"Iberdrola has helped many countries meet their renewable energy goals and benefit from our high-tech investments and the new 'green-collar' jobs that result from this kind of investment," said Mr. Viteri, who noted that Iberdrola would locate its New York headquarters in Rochester. "We want to continue that practice in the U.S. and in the Empire State.”

"We are developing almost 6,000 megawatts of renewable energies worldwide between now and 2010, and at a time when demand for wind turbines is high, we have already secured all the turbines necessary for our U.S. wind farms in that period,” he said. “That means we can deliver on our promises.”

Mr. Azagra noted Iberdrola’s record of investing heavily in areas where it does business and recounted that shortly after it acquired Scottish Power, Iberdrola announced plans to invest some $4.65 billion in the United Kingdom. And Iberdrola has announced global investment plans for 2008-2010 totalling $27.6 billion, an investment plan that is nearly two and a half times the companies' investments from 2004 through 2006. Almost half of that new investment commitment is renewables.

“In addition to Iberdrola’s significant investments of the last few years and for the near future, the company has maintained a solid financial position with an “A” category credit rating level by Standard and Poors,” Mr. Azagra said. “Iberdrola is committed to the countries in which it operates and to the communities it serves. And we hope the New York State Public Service Commission approves this transaction with reasonable terms so we can bring the benefits of our record and our investments to New York State."

"It is imperative that companies that are willing to invest in New York State do not meet the numerous bureaucratic roadblocks like the ones experienced by Iberdrola," said Senator Alesi, chairman of the Senate Committee on Commerce, Economic Development and Small Business and member of the Senate Committee on Energy and Telecommunications. "Iberdrola is one of the world’s leading energy companies and its continued investment in our area will bring much-needed economic development to the region. Iberdrola delivers on its energy promises, makes huge investments, and generates economic activity in the process. Clearly this deal is a win-win for New York State and particularly Upstate."

"Iberdrola's investment targets are music to the ears of the hard-working men and women of Niagara County and all of western New York," said Senator Maziarz. "The Upstate economy needs the kind of investment that Iberdrola is targeting, and I consider it crucial that New York State find a way to get this done."

Kenneth Adams, president and CEO of The Business Council of New York State, said the Empire State cannot afford to lose this opportunity to other states.

”This is an unusual development opportunity for New York, and an unusually attractive one," Mr. Adams said. "A major global powerhouse wants to do business in New York State, target investments of approximately $2 billion as a result, and promise more than $200 million in up-front benefits to boot. What's not to like?"

"New York's developers know that the world's business leaders often consider New York unattractive for business because of high costs and regulatory hurdles," said Brian McMahon, executive director of the New York State Economic Development Council (NYSEDC). "If New York spurns this opportunity, we risk telling the world that we're just not serious about improving our business climate. We cannot afford to do that."

In its official filings with the New York Public Service Commission (PSC) in conjunction with the acquisition of Energy East, Iberdrola has already committed to invest a minimum of $100 million in renewable energy if its efforts to acquire Energy East are successful. Today’s announcement sets a new target investment that is above and beyond the binding commitment made in that proceeding.

At an Albany news conference announcing the new target, Xabier Viteri, CEO of Iberdrola Renewables, Pedro Azagra, Director of Corporate Development, and Terry Hudgens, Director of Iberdrola Renewables USA, were joined by a bipartisan group of state legislators as well as statewide business leaders. Together they urged the PSC to approve the transaction because it would boost the upstate New York economy, help the state achieve its renewable energy goals and bring the world’s largest wind energy company to Upstate.

The proposed transaction has already received approval from regulators in all other affected states as well as the federal government. Those approvals came with minimal conditions.

Joining Mr. Viteri were Senator James Alesi (R-Monroe), Senator George Maziarz (R-Niagara), and Assemblyman Joseph Morelle (D-Monroe) as well as Kenneth Adams, president and CEO of the Business Council of New York State, and Brian McMahon, executive director of the New York State Economic Development Council. In addition, a leading national environmental group, the Natural Resources Defense Council, has endorsed the proposed transaction in official filings with the PSC.

"Iberdrola has helped many countries meet their renewable energy goals and benefit from our high-tech investments and the new 'green-collar' jobs that result from this kind of investment," said Mr. Viteri, who noted that Iberdrola would locate its New York headquarters in Rochester. "We want to continue that practice in the U.S. and in the Empire State.”

"We are developing almost 6,000 megawatts of renewable energies worldwide between now and 2010, and at a time when demand for wind turbines is high, we have already secured all the turbines necessary for our U.S. wind farms in that period,” he said. “That means we can deliver on our promises.”

Mr. Azagra noted Iberdrola’s record of investing heavily in areas where it does business and recounted that shortly after it acquired Scottish Power, Iberdrola announced plans to invest some $4.65 billion in the United Kingdom. And Iberdrola has announced global investment plans for 2008-2010 totalling $27.6 billion, an investment plan that is nearly two and a half times the companies' investments from 2004 through 2006. Almost half of that new investment commitment is renewables.

“In addition to Iberdrola’s significant investments of the last few years and for the near future, the company has maintained a solid financial position with an “A” category credit rating level by Standard and Poors,” Mr. Azagra said. “Iberdrola is committed to the countries in which it operates and to the communities it serves. And we hope the New York State Public Service Commission approves this transaction with reasonable terms so we can bring the benefits of our record and our investments to New York State."

"It is imperative that companies that are willing to invest in New York State do not meet the numerous bureaucratic roadblocks like the ones experienced by Iberdrola," said Senator Alesi, chairman of the Senate Committee on Commerce, Economic Development and Small Business and member of the Senate Committee on Energy and Telecommunications. "Iberdrola is one of the world’s leading energy companies and its continued investment in our area will bring much-needed economic development to the region. Iberdrola delivers on its energy promises, makes huge investments, and generates economic activity in the process. Clearly this deal is a win-win for New York State and particularly Upstate."

"Iberdrola's investment targets are music to the ears of the hard-working men and women of Niagara County and all of western New York," said Senator Maziarz. "The Upstate economy needs the kind of investment that Iberdrola is targeting, and I consider it crucial that New York State find a way to get this done."

Kenneth Adams, president and CEO of The Business Council of New York State, said the Empire State cannot afford to lose this opportunity to other states.

”This is an unusual development opportunity for New York, and an unusually attractive one," Mr. Adams said. "A major global powerhouse wants to do business in New York State, target investments of approximately $2 billion as a result, and promise more than $200 million in up-front benefits to boot. What's not to like?"

"New York's developers know that the world's business leaders often consider New York unattractive for business because of high costs and regulatory hurdles," said Brian McMahon, executive director of the New York State Economic Development Council (NYSEDC). "If New York spurns this opportunity, we risk telling the world that we're just not serious about improving our business climate. We cannot afford to do that."