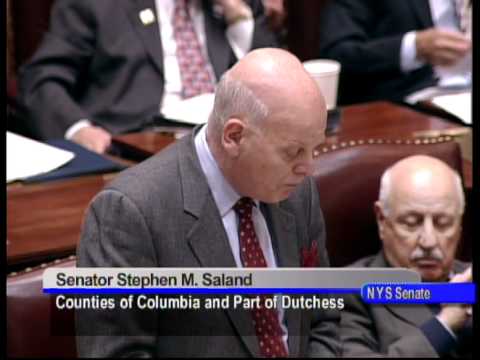

Senator Steve Saland Announces Passage Of Property Tax Relief Measures

Senate bill 8736 creates a property tax cap. The legislation would place a cap on the growth of school property taxes at four percent or 120 percent of Consumer Price Index (CPI), whichever is less, providing significant relief for taxpayers.

Also passed today is Senate Bill 8737 which includes relief from increasing pension costs; increased aid for construction of “green” schools and energy conservation improvements; incentives for consolidation of school districts; school superintendent sharing; a ban on unfunded mandates; and a moratorium on property reassessments.

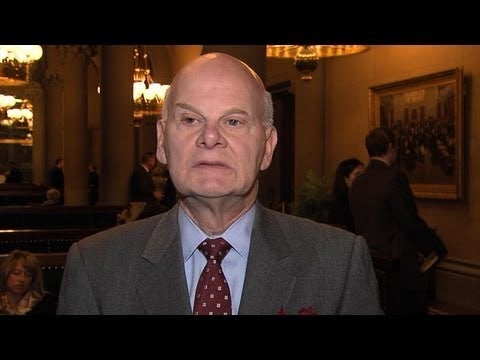

“For a number of years, I have fought to enact real property tax relief and reform,” said Senator Saland. “In 2005, I introduced the STAR Rebate initiative which has provided billions of dollars in relief since its enactment. In order to deal with the issue of spending, however, reform is critically necessary. I and my Senate Majority colleagues have been looking for a partner in this fight for reform and at long last we have found one in Governor Paterson. This tax cap proposal is a significant step forward, however the other matters we addressed today, not the least of which is comprehensive mandate relief, must be a vital part of the dialogue if we are to provide significant reform to the real property tax system.”

The bills have been sent to the Assembly, which elected not to come back into session today.

“Hard pressed property taxpayers throughout our State are demanding action. The Governor and our Senate Majority have recognized the need to deal with this issue now. The Assembly leadership must not be permitted to turn its back on this critical issue, but must act without further delay,” Saland concluded.