Senate-approved legislation targets auto insurance fraud

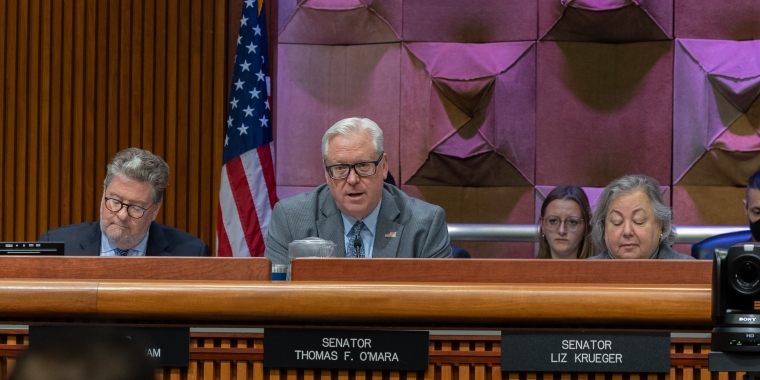

Albany, N.Y., March 22—The New York State Senate today approved legislation supported by Senator Tom O’Mara (R-C, Big Flats) to combat the epidemic of fraud that plaques New York’s automobile insurance industry, drives up insurance rates for every state motorist and costs New Yorkers more than $1 billion annually.

“New York is a leader among all states in cases of auto insurance fraud and we have to take steps to prevent it. We’ve seen estimates that as many as one-third of the auto insurance claims filed in New York involve fraud. It’s costing every consumer and it’s a major reason why insurance rates in New York are among the highest in America,” said O’Mara, a member of the Senate Consumer Protection Committee. “This legislation gets tough on a specific cottage industry of crime, staged accidents, that targets women and elderly drivers.”

O’Mara said that the Senate-approved legislation (S.1685) would establish a series of new, felony-level crimes for ‘staging a motor vehicle accident.’

Last month federal authorities broke up one of the largest-ever alleged crime rings in the New York City metropolitan region that’s accused of stealing more than $279 million in accident benefits over five years. The fraud scheme involved doctors, lawyers and patients who were coached to fake injuries in staged accidents.

"Criminals intentionally arrange these 'accidents,' file fraudulent insurance claims to collect on fake injuries and rip off insurance companies and policyholders," said O’Mara.

Advocates of the legislation note that women and elderly drivers are often the targets of these staged accidents.

The legislation is currently in the Assembly Codes Committee. It must be approved by the Assembly and signed by Governor Andrew Cuomo before becoming law.