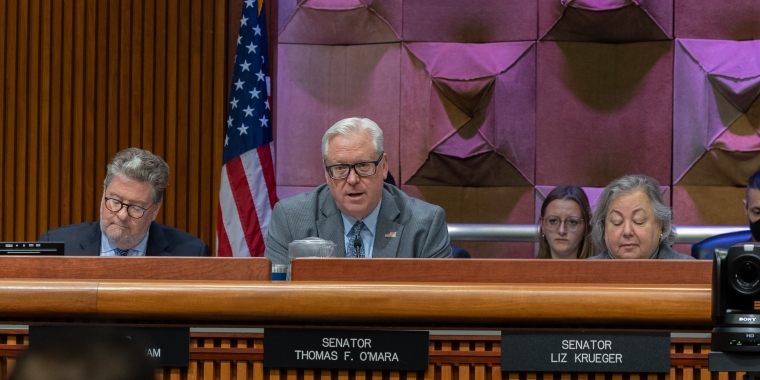

O'Mara, colleagues move to combat welfare abuses

Albany, N.Y., June 21—The New York State Senate has approved legislation co-sponsored by Senator Tom O’Mara (R-C, Big Flats), the “Public Assistance Integrity Act,” to prohibit public assistance recipients from using their cash assistance benefit to purchase tobacco, alcoholic beverages or lottery tickets, and to combat other abuses of the public welfare system.

"State taxpayers demand and deserve a zero-tolerance policy when it involves welfare fraud, abuse and waste. Welfare is intended as short-term, temporary assistance to help those in need address basic, fundamental responsibilities for their families until they can find work, get back on their feet and provide for themselves. Most individuals and families utilize the assistance responsibly,” said O’Mara. “But we still hear far too many reports about abuses.”

[Watch Senator O'Mara's comments on the legislation following a Senate news conference earlier this week.]

Welfare recipients receive both food stamps and cash assistance, each of which is frequently administered through the EBT (Electronic Benefit Transfer) debit card. Recipients can utilize cash assistance to purchase essential items that cannot be obtained with food stamps, such as paper products and school supplies, and to help defray the cost of housing and energy expenses.

However, current state law does not explicitly prohibit recipients from utilizing their cash allowance to purchase items like cigarettes, alcohol or lottery tickets. The Senate legislation (S.966) O’Mara co-sponsors, which is sponsored by Senator Tom Libous (R-Binghamton), would prohibit these purchases as well as prohibit the withdrawal and use of cash assistance funds from ATMs at specific locations including liquor stores, casinos and adult entertainment establishments.

Supporters of the legislation note that federal law enacted early last year requires states to take this action by 2014 or risk the loss of federal funding, which would cost New York State more than $100 million. Specifically, the federal “Middle Class Tax Relief and Job Creation Act of 2012” requires states to limit electronic benefit transactions in locations including liquor stores, casinos and adult clubs by welfare recipients before February 2014. If New York fails to comply, the State will forfeit $120 million in federal Temporary Assistance to Needy Families (TANF) funds. New York spends over $2.7 billion each year administering cash assistance.

Several states have already passed legislation to enact restrictions on the use of public assistance funds, including Arizona, California, Colorado, Indiana, Massachusetts, Minnesota, Missouri, Pennsylvania and Washington.

O'Mara has sponsored or co-sponsored a series of legislative initiatives this session to cut waste, fraud and abuse within state programs and services, especially Medicaid, as well as to keep attention focused on the ongoing need for comprehensive mandate relief for local governments, school districts and property taxpayers.