An Antidote to Donald Trump’s Secrecy on Taxes

President-elect Donald Trump refused to release his tax returns during the campaign and there is no sign that he will, ever. He broke longstanding tradition and set a terrible precedent for future presidential candidates.

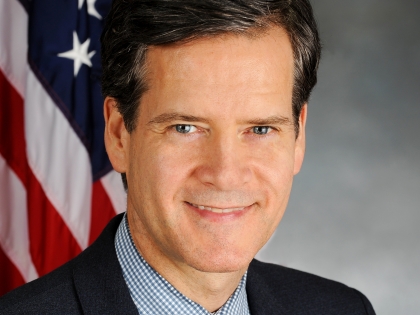

Good government groups have been wringing their hands about what to do. Now comes an excellent idea from a New York State senator, Brad Hoylman, a Democrat from Manhattan, that would could force candidates to disclose their tax returns by making it a requirement for getting on the ballot.

Mr. Hoylman says that he plans to introduce a bill that would require presidential and vice-presidential candidates to disclose up to five years of their tax returns 50 days before the general election. The state’s Board of Elections would publish the returns on its website.

Candidates who fail to provide the documents would not appear on the state ballot and the state’s Electoral College electors could not vote for them. This is a smart proposal not just for New York but for other states as well. Even if a handful of states imposed the requirement, all major party nominees would have to disclose their tax returns.

Mr. Trump might well challenge such a law if he seeks a second term and wants to continue hiding his tax returns. As drafted, the bill should withstand constitutional scrutiny, said Laurence Tribe, a constitutional law scholar at Harvard. “Ballot access requirements vary significantly from state to state, and it seems that N.Y. might be able to simply add tax disclosure as a procedural ballot access requirement,” he wrote in an email.

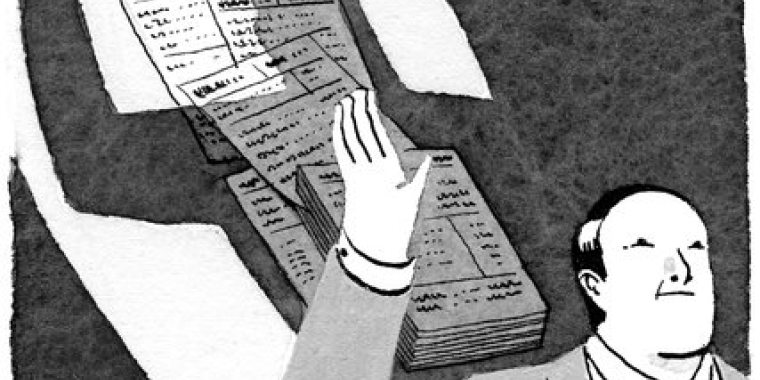

With the exception of Mr. Trump, every major party presidential candidate for nearly 40 years has made his or her tax returns public, because voters need to know how candidates made their money, how much they paid in taxes, and their use of tax shelters and deductions. Tax returns also provide information about a candidate’s financial ties to foreign businesses and governments, and other potential conflicts of interest.

We know, for example, that Mr. Trump has done business in many countries with people and firms linked to foreign governments. But without his tax returns, it’s impossible to understand the scope of those deals and how they might affect his decisions in office. His returns would also provide full details about how much he avoided paying over the years; his 1995 tax returns, which were leaked to The Times, showed that he reported a $916 million loss that could have allowed him to avoid paying taxes for up to 18 years.

The public wants this information. A Quinnipiac University poll from August found that 74 percent of all likely voters wanted to see his returns, and 62 percent of Republicans said the same thing.

In May, Senator Ron Wyden of Oregon introduced a bill that would have required major party presidential candidates to disclose up to three years of tax returns. But that legislation never went anywhere in the Republican-controlled Congress.

States can now take up this fight. If New York, California and several others pass bills similar to the one Mr. Hoylman has proposed, future candidates would find it difficult, if not impossible, to follow Mr. Trump’s dismal example and dodge financial transparency.

http://www.nytimes.com/2016/12/12/opinion/an-antidote-to-donald-trumps-secrecy-on-taxes.html?_r=1