License to tax

Remember the movie Groundhog Day? It’s the 1993 film where Bill Murray plays a weatherman maddeningly forced to relive the same day – Groundhog Day, to be exact – over and over, encountering the same pitfalls in a seemingly endless loop of frustration and aggravation.

Over-taxed, over-regulated, over-burdened New Yorkers can assuredly relate to Murray’s predicament.

Albany’s endless nickel-and-diming

Time after time, New York’s hard-working taxpayers have endured Albany’s endless nickel-and-diming. Taxes, surcharges, fees, fines, red tape, rules, regulations, paperwork. $50 here, $10 there. Property taxes, vehicle registrations, even death taxes. Everything and anything that Albany can tax, it does tax. Case in point: the 2019-20 State Budget – which I opposed – contained $1.4 billion in new taxes this year, on everything from Internet purchases to grocery bags and prescription drugs. Taxes, taxes, and more taxes. We are taxed to the max and them’s the facts!

Pushing taxpayers to the limit – and out of New York

It all adds up to a frustrating, costly burden that pushes taxpayers to the limit and pushes many of our neighbors (my mom included) and job creators away to less costly states like Florida, Georgia, South Carolina, and Tennessee. The latest example of Albany’s addiction to nickel-and-diming was unleashed August 19, when Governor Cuomo’s office announced that effective April 2020, New York motorists with license plates 10 years old or older will be required to turn them in and pay $25 for new plates.

Governor’s license plate mandate is a stealth tax

The Governor tried disguising his new license plate mandate in the form of a “contest” where New Yorkers could vote via e-mail on their “favorite” new license plate design. Don’t fall for this gimmick and personal data grab! The Governor’s license plate mandate is a stealth tax, plain and simple. Consider this: New York State pays inmates approximately $1.14 an hour to make the license plates that the Governor wants you to pay $25 for.

Like so many outraged motorists, I strongly oppose the Governor’s stealth tax.

The enacted 2019-20 State Budget (All Funds) was approximately $175.5 billion.

Without question, Albany already has plenty of your money. If the Governor believes the new license plates are so important then he should find a way to pay for his new mandate without digging deeper into taxpayer’s pockets. I’ll be introducing legislation to rescind the Governor’s stealth tax because enough is enough.

Odds & Ends

On Saturday, October 5, the Golden Gathering – a free health and wellness fair for senior citizens – will return for its 27th year. I’m partnering with my good friend Columbia County Clerk Holly Tanner to continue the tradition of this wonderful event at Columbia-Greene Community College located in Hudson. My colleague Assemblyman Jake Ashby also will be at the Golden Gathering, as well as over 60 health and wellness exhibitors, along with state and local government officials and representatives.

The Golden Gathering is a terrific celebration of health, wellness, and community and I invite you to be my special guest. My office is coordinating transportation for individuals who want to make the trip and receive free health care services like flu shots, as well as blood pressure and hearing screenings, provided by trained professionals at the Golden Gathering. To learn more, call my office at (518) 371-2751.

Contact and connect with me

If I can ever help, call me at (518) 371-2751, e-mail me at jordan@nysenate.gov, visit my Senate webpage at www.jordan.nysenate.gov, or stop by my district office located at 1580 Columbia Turnpike, Building 2, Suite 1, Castleton-On-The-Hudson, NY 12033. You can also connect with me on Facebook (Senator Daphne Jordan), Instagram (Senator_Jordan) and Twitter (NY Senator Jordan).

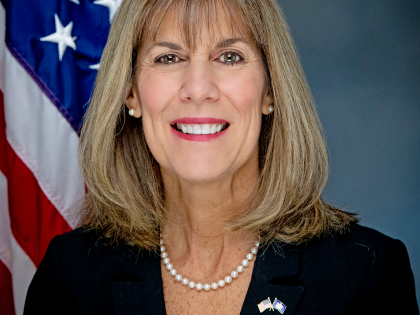

NYS Senator Daphne Jordan serves as the Ranking Minority Member on the Senate Racing, Gaming and Wagering Committee and represents the 43rd Senate District that includes parts of Rensselaer, Saratoga and Washington counties and all of Columbia County.