USA Today / lohud: Mortgage Forbearance, $100M in COVID-19 Rent Assistance Available in NY—What You Need to Know

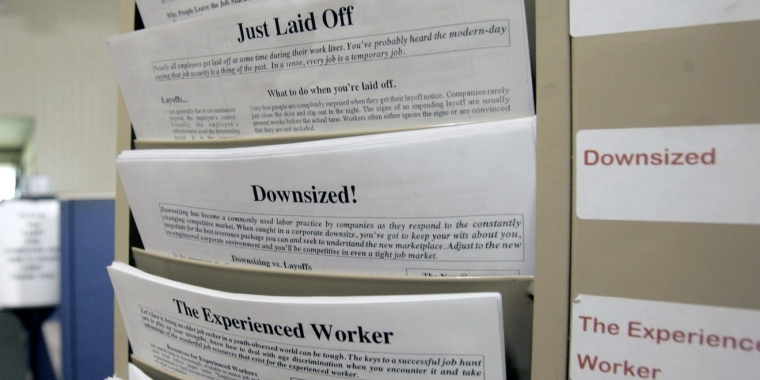

Unemployment claims are soaring as the coronavirus pandemic shuts down businesses, USA Today File Photo

On June 22, 2020, lohud, a publication of the USA Today Network, covered two pieces of legislation sponsored by Senator Kavnagh and recently signed into law by Governor Andrew Cuomo to address COVID-19's impact on housing. The full text of the story is below; the original version is available via the link above.

_______________

Mortgage Forbearance, $100M in COVID-19 Rent Assistance Available in NY. What You Need to Know

By David Robinson

June 22, 2020

New Yorkers suffering financial hardship due to the COVID-19 pandemic can access new government rental assistance and delay mortgage payments under new laws.

Gov. Andrew Cuomo last week signed a slate of bills related to the emergency response to the spread of coronavirus, which has killed more than 24,000 New Yorkers and eliminated thousands of jobs.

A new rental relief program provides up to $100 million in rent subsidies to eligible New Yorkers based on income and other criteria. The money comes from the historic $2 trillion federal stimulus package passed in March, called the Coronavirus Aid, Relief and Economic Security (CARES) Act.

A new mortgage forbearance law allows eligible New Yorkers to delay mortgage payments for up to 360 days and includes a variety of other related fiscal protections.

The new laws build upon pandemic-related executive orders issued by Cuomo, such as a ban on rental evictions due to COVID-19 that expires Aug. 20 and a 90-day mortgage forbearance measure.

State Sen. Brian Kavanagh, D-Manhattan, who spearheaded the laws, described the $100 million rent relief payments as a first step “toward meeting a huge need.”

Some renters and advocacy groups had unsuccessfully pushed for legislation that would have canceled unpaid rent connected to COVID-19 hardships, organizing under the #cancelrent social media campaign.

“It has been clear for weeks now that rents cannot be paid with money that doesn’t exist and therefore, rent will be canceled whether or not we authorize it by law,” said Sen. Michael Gianaris, D-Queens, said on April 22, referring to his bill seeking to suspend and forgive rent.

Meanwhile, New York's jobless rate improved slightly in May, coming in at 14.5%, which is down from 15.3% percent in April.

To understand the financial impact of COVID-19, consider the state’s unemployment rate was 4% a year ago.

The rental assistance program guidelines include:

- The program coverage period spans from April 1 through July 31.

- People will have to prove they lost income due to the pandemic and meet other criteria. The household income must be below 80% of the area median income, as adjusted for family size.

- Monthly rent must be more than 30% of the household income.

A rental subsidy voucher will be provided to the owner of the rental unit for those deemed eligible for the program. The monthly subsidy will be limited to 125% of the fair market rent, according to the law.

The program is administered by the state Division of Homes and Community Renewal, and the agency's rent administration office phone number is 1 (833) 499-0343.

Further regional contact information is listed on the agency’s website, www.hcr.ny.gov.

The mortgage program allows for New Yorkers who suffered COVID-19 financial hardships to apply for a 180-day forbearance, with an option to extend another 180 days.

The program includes a variety of options for repayment, including protections that waive associated interest and late fees. It allows for backdating the mortgage forbearance to March 7 for those who meet eligibility criteria.

The Division of Homes and Community Renewal website advises New Yorkers seeking information to contact their individual mortgage servicer, or call the agency at 1 (800) 382- 4663.

The state Department of Financial Services also has information available related to COVID- 19 mortgage relief efforts, at (800) 342-3736.