'We Have to Fix It': Lawmakers Call for Insurance Policies to Protect Against Lead in Rented Homes (New York Law Journal)

Credit: New York Law Journal

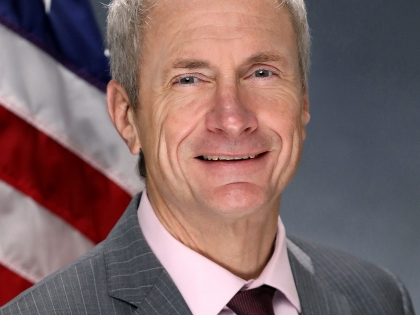

If a renter breaks his leg on a broken stair, the landlord’s liability insurer will cover medical costs while requiring the owner to fix the step, state Sen. Sean Ryan, D-Buffalo, said.

But in the case of a child’s elevated levels of lead poisoning in a lead-tainted home, the insurance company is held harmless, Ryan said, and that’s something that needs to change.

“It’s unfair, it’s unjust, and we have to fix it,” the lawmaker said Thursday in the Capitol Building, as part of a contingent of advocates asking the governor and lawmakers to support additional funding for childhood lead-poisoning prevention and mitigation.

...

Ryan is sponsoring S.3079A, which would require licensed and home rental insurers to provide losses or damages caused by exposure to lead-based paint. The proposal sits in the Senate Insurance Committee.

...

Ryan suggested that making insurance companies responsible for childhood lead poisoning would do little to raise premiums.

“We have one of the largest property-liability pools in all of the United States,” he said, “so if in fact, we say you have to cover this, that means everybody—from a 100-story sky-rise to a (duplex)—it all goes into the pool.”

While insurance companies have argued that the change would be too costly, the lawmaker said, “they have not produced one iota of evidence that it’s going to increase costs. They have… data, but they’re not sharing it—and I think they’re not sharing it because it shows that costs do not increase.”

To read the full story, click here.