Larkin Bill To Help Localities Collect Delinquent Taxes Passes Senate

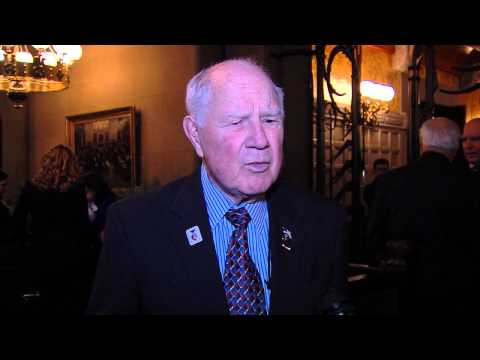

William J. Larkin Jr.

February 17, 2005

Senator Bill Larkin (R-C, Cornwall-on-Hudson) today announced that legislation (S.854) he sponsored to give local governments the option to collect delinquent tax liens on property by selling those liens to private entities has passed the Senate.

"Current law already allows municipalities to sell delinquent tax liens in bulk to the state sponsored Municipal Bond Bank Agency," explained Senator Larkin. "This bill would merely expand the number of organizations that can purchase and then collect those liens. Many municipalities are owed millions of dollars annually in unpaid property taxes. Having this option will help our cities, towns, and villages by giving them a new way to recuperate some of those lost taxes once a property has been foreclosed."

The bill now goes to the Assembly.

Share this Article or Press Release

Newsroom

Go to Newsroom2014-2015 EXECUTIVE BUDGET PROPOSAL INFORMATION

January 22, 2014

The New York State Senate Honors Dr. Martin Luther King, Jr.

January 17, 2014

Comments on the Jobs For Heroes Legislation

January 16, 2014