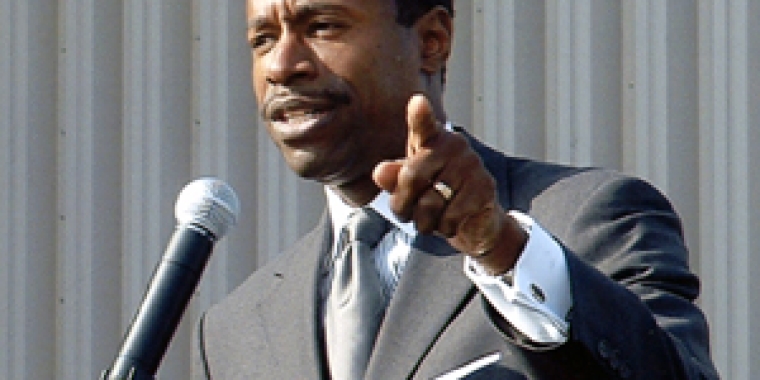

State Senator Malcolm Smith Offers Major Housing Initiative

Malcolm A. Smith

March 27, 2006

State Senator Malcolm Smith (D-Queens) today proposed what would be the first major affordable housing initiative for New York in more than 30 years. Smith's proposal would, over a ten-year period, create at least 3,250 low-income rental units and 15,000 affordable home purchases.

Smith said the State's existing housing programs, such as SONYMA and the Housing Trust Corporation, "have failed to keep up with rising home prices and do not provide enough support to first-time homebuyers and low-income renters."

Smith said "the world has changed a great deal since the State built the last Mitchell-Lama housing units." He noted that while average home prices increased by more than 30 percent ($166,000 to $221,000) between 2000 and 2004, median family income declined by about one and a half percent ($48,131 to $47,349).

Smith proposed two new programs that would create 1,000 rental units and finance up to 3,000 new homes in their first year. The first program, the $250 million Affordable Workforce Rental Development Program (AWORD) would require the Division of Housing and Community Renewal (DHCR) to contract with private developers to construct affordable rental housing units. Eighty percent of the units would be provided to tenants who earn 80 percent or less of the Area Median Income. The remaining 20 percent of the units would go to tenants who earn just 50 percent or less of the Area Median Income.

Smith noted that a tenant living in a region with an Area Median Income (AMI) of $55,000, who earns 50 percent or less of the AMI is currently paying approximately $1,031 dollars, per month in rent. That same tenant, under the AWORD program, would pay just $687 per month, a savings of $344 and an annual rent savings of $4,128.

The second program, Below Tax Exempt Rate Mortgage Program (BTRM) would create a financing vehicle for first time home buyers who are currently not eligible for SONYMA's low interest rate mortgage program.

With an initial investment of $500 million, the BTRM program would finance up to 3,000 new mortgages with values ranging from $150,000 to $300,000 at half the prevailing 30 year tax-exempt rate.

Eligible participants would also receive an additional interest free mortgage subsidy of up to $40,000 or 15 percent of the purchase price of the home, whichever is less.

Smith noted that under a 30 year, fixed rate mortgage (at 6 percent) a $150,000 loan would cost first time homebuyers approximately $899 per month. Under the BTRM program, they would pay only $632 per month, an annual savings of $3,203.

A $300,000 mortgage would cost a first time homebuyer approximately $1,799 per month, but only $1,265 per month under the BTRM program, providing an annual savings of $6,406 in mortgage payment savings.

After the first year, the mortgage income generated by the first 3,000 mortgages would help to finance the second round of mortgage financing. This cycle is repeated thereafter, with a smaller number of mortgages generated each time.

This will finance approximately 15,000 new mortgages over the next 10 years at no additional cost to the state beyond the initial $500 million seed money.

"Affordable housing is an investment," Smith said. "It helps to strengthen and stabilize families as well as communities, and even supports our local economic development efforts. Most importantly, though, these two programs would give another generation an opportunity to achieve the American Dream of homeownership."

Share this Article or Press Release

Newsroom

Go to Newsroom

Town Hall Meeting - Feb. 6

January 22, 2014