Free Middle Class Star Property Tax Rebate Workshops

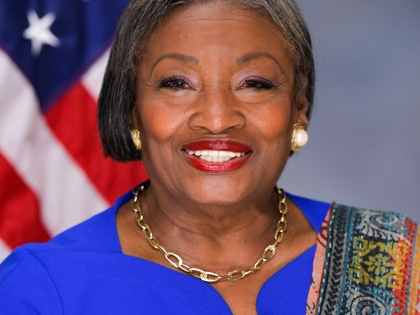

Andrea Stewart-Cousins

August 14, 2007

(35th District, NY) – Questions about the new 2007 Middle Class STAR Rebate? Get the answers you need at the STAR Rebate workshops sponsored by State Senator Andrea Stewart-Cousins (D-Yonkers). The workshops are free and open to the public. A workshop was held in Greenburgh on August 13, and now other locations have been added in Mount Pleasant and Yonkers.

Senator Stewart-Cousins’ free STAR Rebate workshops will be held at the following locations:

August 21st Mt. Pleasant Library

350 Bedford Road, Pleasantville

August 23rd Grinton I. Will Library

1500 Central Park Avenue, Yonkers

**ALL DATES 7 pm - 8:30 pm**

“The 2007 STAR Rebate Program is the largest tax cut in New York State history. My colleagues in the Legislature and I approved Governor Eliot Spitzer's plan to provide $1.3 billion direct tax relief across the state, and put money back in the pockets of New York taxpayers,” noted Senator Stewart-Cousins.

The rebate is available to homeowners who receive the basic STAR exemption on their property tax bill. Homeowners must apply to receive the new Middle Class STAR Rebate.

The state began sending STAR notification letters to property owners in Yonkers and Manhattan this month. The rest of the county will receive notification letters by mid-September. Once a homeowner receives the notification letter, which includes a STAR code, they can apply for the rebate via online or by mail. The deadline to apply is November 30, 2007.

Rebate checks are calculated on a sliding scale based on income, with the maximum benefit going to all upstate homeowners earning $90,000 or less, and southern region homeowners, including Westchester, earning $120,000 or less. Taxpayers earning over $250,000 are not eligible for new relief, but will continue to receive their current STAR benefit. Senior citizens who receive the enhanced STAR exemption do not need to apply. These homeowners will receive STAR rebate checks automatically.

“These workshops are designed to raise awareness of the program and ensure that property owners don’t miss out on the opportunity to reclaim their money,” said Senator Stewart-Cousins.

For more information, please log on to www.nystax.gov or call 1 (877) 678-2769.

Share this Article or Press Release

Newsroom

Go to NewsroomSenate Majority Protects New York Students And Pedestrians

March 19, 2019

Advancing New York Values & Protecting Taxpayers

March 12, 2019