Senators Johnson, Klein, Hold Predatory Lending Forum

Jeffrey D. Klein

August 7, 2007

Long Island.

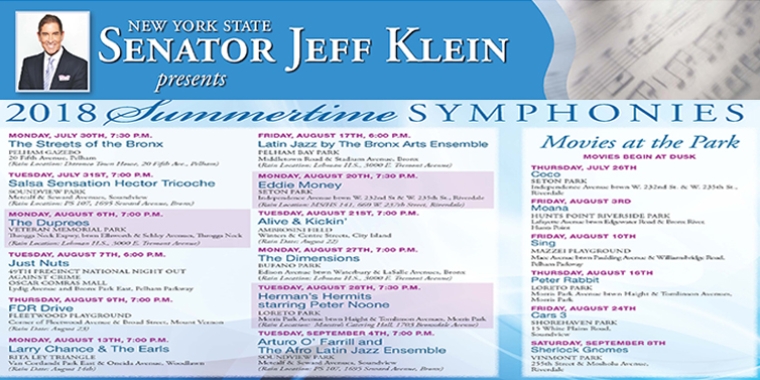

The forum, held at the Elmont Public Library, is the latest in a series of statewide public hearings headed by Senator Jeff Klein, (D-Bronx/Westchester) that examines the pitfalls of sub-prime mortgages.

The evidence and testimony gathered during these hearings will help develop legislative safeguards that will protect consumers and hold unscrupulous lenders accountable, Senator Johnson said.

“This is a part of the banking industry that currently operates with little transparency and accountability,” Johnson said. “Many sub-prime lenders operate ethically and fulfill a very important function of providing mortgages to those who are otherwise unable to receive one. But, we need to protect our residents from companies that seek to take advantage of those who want to fulfill the American Dream.”

“The sharp rise in foreclosures tells me that we’re failing to do this at the present time,” he continued.

Assemblyman Tom Alfano, (R-Elmont), Senate Democratic Leader Malcolm A. Smith, Senator

Towns, and Assemblywoman Annette Robinson joined Senators Johnson and Klein on the panel.

Residents and victims testified at the forums to the horrific practices that have stripped them of their equity and dreams such as, “packing” which refers to the practice of packing on excessive fees such as pre-payments and high penalties, “loan flipping”, in which a broker refinances the loan every two years at an increasing rate resulting in a downward spiral of debt and hidden balloon rates.

Long Island having the dubious distinction of leading of the state in sub-prime foreclosure rates.

New York’s sub prime mortgages that were issued in 2005 will end in foreclosure.

Long Island, that number jumps to 22 percent, making it the region with the highest rate of foreclosure in the state and the 15th highest in the country. In 1998-2001, only 7.2 percent of sub prime loans ended in default.

Falls (15.6 percent) and the Capital Region (17.4 percent).

Sub-prime loans are loans offered to individuals whose credit history prevents them from securing a low-rate loan. A typical sub-prime borrower has a low credit score and a history of late payments, charge-offs or bankruptcies. Since they are considered at high risk of default, they receive less-than favorable terms, including higher interest rates, regular fees or an upfront charge.

In some cases, sub-prime borrowers are drawn in by a low introductory rate, which then sharply increases within a few years, making it difficult if not impossible to keep up with monthly payments.

Westchester.