As Budget Deadline Nears, Larkin Says Governor's Budget Hurts Small Businesses

William J. Larkin Jr.

March 25, 2007

Senator Bill Larkin (R-C, Cornwall-on-Hudson) said today that the Governor’s proposed budget does not include any tax relief or assistance to help small businesses grow and create jobs.

"The Senate has passed a small business assistance package that will help encourage young people and families to stay in New York," said Senator Larkin. "It represents pro-growth, pro-job policies that will lower taxes and provide new economic incentives. The Senate budget provides more than $723 million in business tax cuts this year, growing to more than $1.8 billion next year. However, at this stage in the budget negotiations, the Governor has no intention of including these measures in the final state budget."

The Senate budget eliminates the corporate income and franchise tax for manufacturers, provides direct property tax relief checks to small businesses and provides tax credits to small businesses to help combat rising energy costs.

The Governor’s budget increases taxes on New Yorkers by over $800 million this year and over $2 billion next year.

The Governor’s budget would increase taxes and fees on the financial services industry that would damage the economy in New York City.

The Governor’s budget raises taxes and fees on investment companies, banks, insurance, LLCs, hospitals and nursing homes.

The Senate budget rejects all of these. "New Yorkers don’t want higher taxes in any form; they want tax relief," said Larkin. "We hare fighting hard to convince the Governor that his proposals would severely hurt small business in New York State."

Share this Article or Press Release

Newsroom

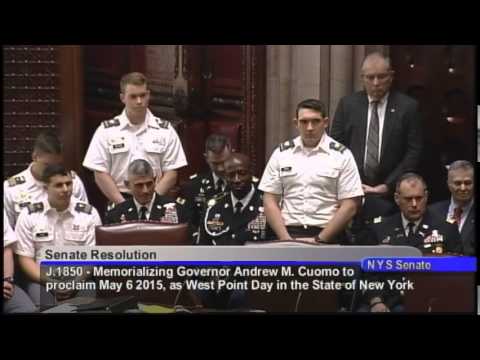

Go to Newsroom2015 West Point Day Remarks

May 7, 2015

West Point Day 2015

May 6, 2015

Uniformed Firefighters Association of Greater New York

April 28, 2015