Testimony: Hearing of the Commission On Real Property Tax Fairness

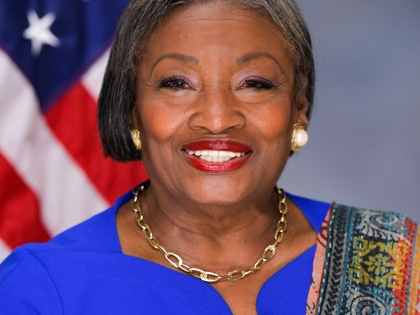

Andrea Stewart-Cousins

March 6, 2008

-

ISSUE:

- Local Government

- Taxes

Chairman Suozzi and Distinguished Members of the Commission, thank you for the opportunity to speak before you today.

The task you have been given is monumental, though it can be easily articulated. You have been charged with finding ways to provide real property tax relief to New York State residents without jeopardizing our ability to provide the quality of education necessary for our children to compete and succeed in the global marketplace.

I state this objective for the record, not because I think you are unaware of the enormity of your task, but to assure you that I am.

As you know, the alarming trend of property taxes escalating at the current rates, significantly impacts the 35th Senate District in Westchester County. This is a fact especially worth noting because this District, which I have been entrusted to represent, is as multifaceted and socio-economically diverse as the State of New York itself. It includes the City of Yonkers, the Town of Greenburgh, many of the Hudson River towns and villages in Westchester County, and the Town of Mount Pleasant. There is no sense in which this District would be described as homogeneous, yet the impact of rising property taxes has been felt by households and businesses across every income level in every community.

In light of the importance of this issue, and the responsibilities that I have to every one of my constituents to work toward the abatement of property tax increases, with full acknowledgment, again, of this Commission's tax-cutting objective, in January, I took the liberty of inviting my District's superintendants and board members to begin a discussion about the concerns related to this issue. The meeting successfully brought approximately fifty stakeholders together, in what I intend to be the beginning of an ongoing dialogue. Many of the sentiments, some of which I am sure you have heard echoed across the State, are worth reiterating here today. What was notable in our discussion was, first and foremost, the unwavering collective commitment to quality public education. In light of that, there was obviously opposition to capping property taxes, but, there was also an understanding that we need to balance this opposition with real property tax relief for residents and businesses. Both are simultaneously essential- a perfect illustration of the current conundrum.

In short, representatives of the school districts, all of whom seek enhanced educational excellence, voiced concerns over the future stability of both programming and academic offerings pending the implementation of a proposed property tax cap. The continuous reliance on government funding and shifting Statewide priorities--especially in districts where academic excellence has been achieved--presents a perpetual dilemma. Citing the recent retraction of the "hold-harmless" rate -- a 3% funding commitment by the State to many of these school districts -- further underscored the reality of broken promises by government, due to unanticipated State fiscal pressures and sometimes fluid objectives. These sentiments, many of which I'm sure you've already heard expressed here today, result from prior attempts to create partnerships for achieving quality public education, which have not always been reliable, or necessarily reflected adequate levels of funding -- perhaps best illlustrated by the Court's findings in the Campaign for Fiscal Equity lawsuit. Although strides have been made in terms of fairness in the current foundation formula, there is still a need for changes.

Working together, our objectives and our concerns, which resonate Statewide, require that property tax burdens and their impact on residents of the 35th Senate District and beyond, must abate. However, as the Governor has acknowledged in his charge to the Commission, any attempt by the State to curtail the trend of rising property taxes, absolutely requires that we focus our attention, with equal urgency, to the paramount issue of adequate public school funding. If, indeed, there were to be a cap on property taxes, it would be essential to ensure that the inherent burdens are alleviated, and not just reallocated.

The importance of this caveat is demonstrated by reference to New York State's constitutional restriction on local property tax levies. In its 2006 Annual Report on Local Governments, the Office of the State Controller (OSC) reported that 9 cities and 13 villages in New York State had exhausted more than 80% of their constitutional tax limits, including 5 villages that had exhausted more than 90% of their limits. The OSC noted several factors that drove property taxes to almost-legal capacity in those municipalities, foremost among them being costs related to operation of school districts. Those costs resulted in a 100% increase in total outstanding debt for local governments—from $16.6 billion to $31.3 billion—with school districts accounting for 46% of that total.

Therefore, a constitutionally imposed cap on municipal taxes or a cap on property taxes will not necessarily address school district needs. Due to this, we must continue to examine how school districts can both reign in costs and rely on adequate funding from multiple sources.

The Governor's foundation formula, adopted by the Legislature in 2007, reflected an earnest attempt to address the latter situation. It both increased total State funding to school districts and effected a redistribution of aid to reach those districts in greatest need. In an effort to ensure that high performing districts would not be harmed by such redistribution, the 2007-2008 budget established a "hold rate," reflecting the state's commitment that aid to any individual school district would increase by no less than 3% for that fiscal year. Again, as I stated earlier, the proposed budget does not confirm the principle. Burgeoning costs of public education, some of them attributable to unfunded mandates such as "No Child Left Behind" overwhelmed the aid provided by New York State. Many school districts in Westchester County —including those in so-called "wealthy property" districts—began the fiscal year in the red. In some districts, residents refused to pass a budget that reflected uncontrollable cost increases that would be passed on to their households; those districts were forced to operate at austerity levels. In both scenarios, there was an unavoidable impact on the quantity, if not the quality, of educational services school districts were able to provide to their students.

That is another alarming trend that should not be allowed to continue.

There are so many compelling concerns embedded in the task you have undertaken that it seems they cannot be overstated. However, as many of those concerns have already been stated at the hearings you have held, I will address my final remarks to a significant few.

As a former educator who has spent more than a decade in government listening to and working with people who have dedicated themselves to the profoundly important task of educating our children, I have not heard anyone challenge the importance of accountability; on the contrary, that principle is embedded in the strategic plans of school districts and in every school and classroom therein. What I have heard, consistently, is that we need to establish reliable funding sources that enable educational excellence.

And so, in closing, as you go about your task, I appeal to you to consider the possibility of short and long term solutions. In the short term, while devising a formula for limiting property taxes, please consider a mechanism that links any cap to the percentage of revenue provided to school districts by New York State and to the percentage of school district costs imposed by the state. There should also be serious consideration for creating incentives for school districts who successfully reduce costs without compromising academic excellence.

In the long-term, however, I hope we can seriously consider looking at income taxes and other sources as alternative ways to fairly absorb the cost of funding education. I see no reason for solely limiting the responsibility for education funding to property owners. We all benefit from an educated society.

I thank you again for this opportunity to present to you the concerns of my constituents, for allowing many of them the opportunity to be heard on this very important issue, and I look forward to working with all of you, the Governor and my colleagues in government, as we continue to expand the dialogue around these very important issues.