Empire Zone “Fix Legislation” Needed to Protect Businesses and Jobs in Western New York

Dale M. Volker

May 6, 2009

Letter To Governor, Majority Leader & Speaker Calls Attention

To Gouging Businesses for Interest-Free Loans

(ALBANY, NY) Senator Dale M. Volker (R-C-I, Depew) today announced that he and the members of the Senate Republican Conference have sent a letter to Governor David Paterson, Senate Majority Leader Malcolm Smith and Assembly Speaker Sheldon Silver, urging them to address a problem created in the state budget, that is forcing businesses located in Empire Zones to give the state what amounts to an interest-free loan of more than half a billion dollars.

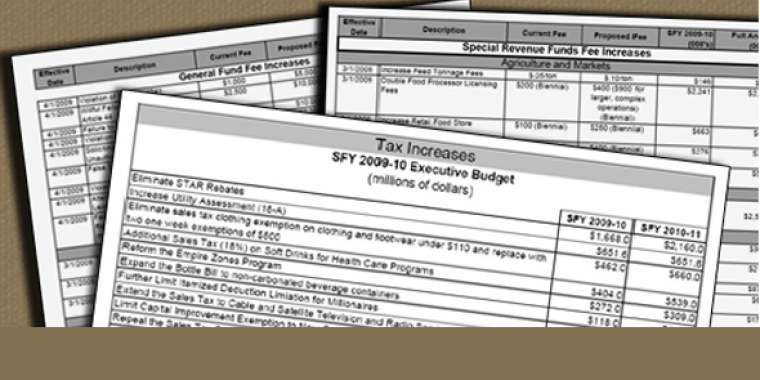

New language in the state budget decertifies businesses located in Empire Zones, retroactive to January 1, 2008, takes away their zone tax credits, and requires them to reapply for certification to receive the tax credits if they meet new criteria for investment and job creation. It could take ESDC as long as six months to recertify businesses and another six months after recertification to provide tax refunds to businesses.

“The budget that was rushed through with no public comment has created enormous problems for businesses and their employees,” said Senator Dale M. Volker. “Businesses are seeing hidden tax increases, fees and surcharges that are killing their bottom lines. This Empire Zone portion of the state budget is icing on the cake. It now places those businesses located in an Empire Zone at a complete disadvantage and will significantly increase the cost of doing business in western New York. The Governor and the Democratic leadership in the State Senate and Assembly seem focused on driving businesses out of our state.”

The letter states:

“This means that businesses that have done everything the law requires to maintain Empire Zone status and are expecting tax credits for tax returns they filed before this law was enacted, instead will have to pay larger state tax bills now, and receive their zone benefits later.

This situation essentially creates at least a year-long, interest free loan. Many businesses are calling it a “last straw” issue that could force them to leave the state or go out of business entirely. It also damages the state’s credibility in the eyes of out-of-state businesses that may be considering locating here.”

During this year’s budget process, Senate Republicans fought a plan in the Executive Budget which would have completely eliminated Empire Zone benefits. Governor Paterson assured those businesses that this problem had been fixed, however the final adopted budget included the new provisions addressed in the letter.

The letter also states:

“This situation must be corrected to restore fairness to a program that is crucial to our economy. Many communities, especially Upstate, have effectively managed Empire Zones to create economic growth and new jobs. Either the budget language should be amended or removed or the time frame for recertification of businesses in Empire Zones should be significantly shortened.

The problems created by the changes in the Empire Zone program are just the tip of an iceberg that could sink many businesses. The 2009-10 state budget raised their utility taxes, took away low-cost power and will subject thousands of small businesses that pay the personal income tax to a record increase. All this without a single proposal to promote economic development.”

Senate Republicans have advanced a job creation plan that reduces taxes on businesses, makes us more economically competitive and would position New York’s economy for a rebound.

Share this Article or Press Release

Newsroom

Go to NewsroomVolker, Senate Majority Unveil New Job Creation Plan

September 25, 2008