Senate Republicans Propose Budget Cutting Measures

Dean G. Skelos

October 14, 2009

SENATE REPUBLICANS PROPOSE BUDGET CUTTING MEASURES

Senate Republican Leader Dean Skelos today outlined a plan to close

the state’s projected budget deficit resulting from a budget that raised

spending by more than $13 billion and taxes by more than $8 billion.

“Just as I warned last spring, the Democrats’ decision to raise taxes

and spending hurt our economy, caused more pain for taxpayers, and still

left us with an enormous budget deficit,” Senator Skelos said. “Despite

billions in federal stimulus aid, we now find ourselves in a deficit

situation that is largely the result of spending money we don’t have and

taxing people and businesses who can’t afford to pay any more. Our only

course of action is to cut spending.”

At a leaders meeting last month, Senator Skelos was the only one to

propose specific spending reductions to help close the deficit. Today, he

offered new proposals that would result in additional savings.

Specifically he proposed:

> Cutting back the $2.2 billion in general fund spending added to the

2009-10 budget by legislative Democrats;

> Cutting state agency non-personal services by ten percent to save

$480 million;

> Freezing state purchases of recreational lands to save $78 million;

> Freezing planned Medicaid expansions to save $200 million;

> Reinstating welfare and Medicaid anti-fraud protections to save $34

million;

> Cutting Medicaid optional services to save $150 million; and

> Cutting state agency contract balances by five percent to save $300

million.

“In cutting state spending we cannot simply off-load costs to local

governments that would force them to raise property taxes,” Senator Skelos

said. “In addition, we should not take any action that hinders our ability

to create jobs.”

Senator Skelos said he was disappointed that there have been no

proposals by Legislative Democrats to close the deficit that was largely of

their making. “Speaker Silver is still not ruling out tax increases and is

refusing to put any ideas forward to cut spending. As for Senate

Democrats, waiting for their plans is like waiting for a slow boat to

China.”

Senator John A. DeFrancisco, Ranking member of the Senate Finance

Committee said: “If New York City leadership had had open budget

discussions and adopted the proposals in the

2009-10 budget made by the Republican Conference, we wouldn't be in the

deficit situation that now exists. Hopefully, these Republican proposals

will now be part of the solution, and the tough choices that most of our

residents are making will now be made by State leadership to

comprehensively attack the budget deficit."

Senate Republican Recommendations For Cost Cutting and Budget Savings

- Review $2.2 billion in General Fund spending added to the 2009-10 Budget

by the Legislature for possible reductions (table attached).

The SFY 2009-10 budget includes over $2.2 billion in General Fund spending

that was added to Governor Paterson’s Executive budget proposal by the

Democrat majorities in the Senate and Assembly. In other words, more than

$2.2 billion in General Fund spending which was not originally proposed by

Governor Paterson was included in the final adopted budget. All of this

additional spending was discretionary and was not required under the

American Recovery and Reinvestment Act.

Approximately $1.2 billion was used to restore reductions proposed by the

Governor in his Executive budget and approximately $1 billion was used to

finance new spending. All of these spending items should be immediately

reviewed for potential reductions. Freezing all funds for new and increases

to current spending programs alone would save hundreds of millions of

dollars. In addition, the Democrats in both houses rejected many of

Governor Paterson’s proposed legislative changes in the budget that would

have saved over $100 million this year. Lastly Governor Paterson proposed

$700 million in health care savings initiatives that were not included in

the adopted budget which should be revisited.

(See attached file: legaddstoexec09_10.pdf)

- 10% Cut in State Agency Non-Personal Service - $480 million

Efficiency savings of 10% are assumed under this proposal. Selected

categories include: equipment spending; employee travel; lease, maintenance

and repairs; supplies and materials; telephone services; employee benefits

and general state charges and utilities and centralized services. Potential

actions include: Freeze all new vehicle purchases; Freeze all new

equipment/furniture purchases; Suspend all unnecessary travel for State

employees; Limit agency printing to essential services only; Limit agency

mailings/postage expenses to essential services only; Eliminate all agency

non emergency blackberry/cell phone usage; Turn down the heat in state

buildings everyday and not just weekends; Freeze agency spending from state

operation reappropriations; Freeze agency spending for employee training;

Close agency regional offices; Reduce the size of agency public information

offices; Freeze agency spending for conferences; Freeze all pending State

rental agreements- new or renewal - to reduce space; Freeze all State

agency advertising and marketing spending; Freeze all state agency public

information office spending; Eliminate all State agency intern program

spending; Freeze all new technology spending; Freeze equipment leases not

executed; Freeze nonessential building repairs; Freeze all agency

subscription service spending; Freeze agency membership payments for

professional entities; Competitively bid State Employee medical/ hospital/

dental programs.

- Freeze State Purchases of Recreational Land – Savings $78 million

This proposal would freeze the purchase of additional recreational land by

the State. Given the State Fiscal Year (SFY) 09-10 Executive proposal to

renege on the State’s current local tax obligation on existing State owned

lands, the State cannot continue to purchase land. Current cash balances

for this purpose would be transferred from the Environmental Protection

Fund.

- Freeze Planned Medicaid Expansions – $200 million by 2011-12.

All initiatives to expand the State’s Medicaid program should be stopped

immediately as the State cannot afford the current program which is the

most expansive in the nation. The Paterson administration is seeking to

expand eligibility for Family Health Plus (FHP) to 200 percent of the

federal poverty level. FHP enrollment in New York is projected to grow by

another 128,000 families over the next four years. Expansions in

eligibility to the Child Health Plus program should also be reevaluated.

Higher Medicaid enrollment and use will add $975 million to the

state-taxpayers' share of Medicaid costs by 2011-12, according to the

governor's financial plan. Meanwhile, federal stimulus aid is supposed to

expire the year after next, which will leave New Yorkers to cover more than

$3 billion a year now temporarily underwritten by federal stimulus aid.

- Reinstitute Medicaid and Welfare Anti-Fraud / Taxpayer Protections - $34

million

The adopted budget includes an initiative to “streamline access to

coverage”. This “streamlining” of the Medicaid and welfare application

process works by eliminating mechanisms designed to protect the taxpayers

from fraud, waste and abuse such as the requirement for face-to-face

interviews, fingerprinting and asset tests for determining eligibility.

All of these safeguards should remain in place to insure that those

receiving Medicaid and welfare benefits are indeed eligible under the law.

- Cut Medicaid Optional Services - $150 million

The New York State Medicaid program offers nearly 2 dozen optional services

not required under the Federal Medicaid program. Reducing the number of

optional services to those required by the Federal government would reduce

costs. Eliminating all optional services would save the state $150 million.

- Cut 5% from Select Agency Contract Balances - $300 million

As of September of 2009, the undisbursed balance of existing state

contracts totals more than $129 Billion. This proposal excludes the

following types of contracts: authority, revenue generating, repayments to

state contracts, community project fund, construction, construction

related, non general fund, Department of Health, State Ed, and contracts

with zero balance. The proposal assumes a 5% reduction in all undisbursed

balances, of which 1% would be General Fund savings.

#####

Share this Article or Press Release

Newsroom

Go to NewsroomStatement From Senate Majority Leader Dean Skelos

January 15, 2015

Senate Passes Women’s Equality Package

January 12, 2015

Hire a Veteran Tax Credit

January 12, 2015

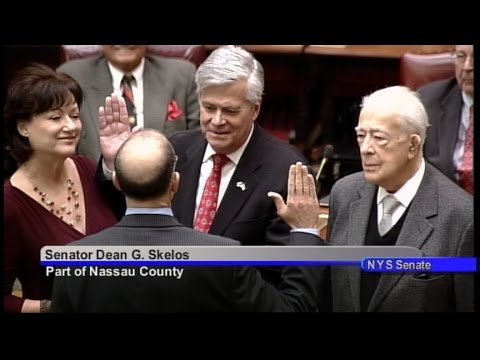

Senate Majority Leader Dean Skelos' Oath of Office

January 7, 2015