Governor's DRP Misses The Mark

James L. Seward

October 15, 2009

-

ISSUE:

- Budget

ONEONTA, 10/15/09— Senator James L. Seward (R/C/I- Oneonta) today commented on the governor’s deficit reduction plan:

“Since last spring when the governor signed off on a record spending budget that raised taxes by more than $8 billion, I have been calling for commonsense cuts, tax rollbacks and real help for our small businesses to improve our state’s economy. It’s about time the governor and other Democrat leaders who came up with the out of control budget get the message.

“The governor’s deficit reduction plan released today relies heavily on mid-year cuts to our schools, local governments, healthcare institutions and higher education – these devastating cuts will only transfer more costs onto the backs of taxpayers driving more families and businesses out of the state. The governor’s plan also fails to offer any substantial mandate relief that could cushion the blow to local municipalities.

“New Yorkers need reasons to stay and rebuild for their future. Rolling back some of the $8 billion in tax and fee hikes included in the bad state budget and returning money to our cash strapped families would be a good start. Economic development initiatives aimed at jump starting our upstate businesses are also needed to increase tax revenue and produce a healthier bottom line for the state.

“I am pleased the governor is calling for a state spending cap, an idea I have long supported, and I feel his proposed cuts to Medicaid are a step in the right direction. However, we need to go further; reinstating welfare and Medicaid anti-fraud protections and freezing planned Medicaid expansions would save money and ensure that only those who deserve benefits receive them. A close examination of the very generous services provided in New York is also necessary.

“Sensible cuts to state spending, a concept that is part of the Senate Better Plan released last spring, must also be enacted. Consolidating redundant and underutilized state agencies, cutting agency contracts and reducing non-personnel state spending are all feasible cost-savers. We also need to make better use of federal stimulus dollars which so far have been spent randomly and unproductively.

“Transferring the deficit to our local governments and increasing taxes again cannot be options. State government needs to look in the mirror and make tough choices just as families and businesses have been doing. I stand ready to work with the governor in meeting New York’s fiscal challenges, but only if he is ready to institute the real reforms we need to emerge with a productive long-term solution.”

-30-

Attached is a list of budget cutting measures proposed by senate Republicans.

Senate Republican Recommendations For

Cost Cutting and Budget Savings

Review $2.2 billion in general fund spending added to the 2009-10 budget by the legislature for possible reductions.

The SFY 2009-10 budget includes over $2.2 billion in general fund spending that was added to Governor Paterson’s executive budget proposal by the Democrat majorities in the senate and assembly. In other words, more than $2.2 billion in general fund spending which was not originally proposed by Governor Paterson was included in the final adopted budget. All of this additional spending was discretionary and was not required under the American Recovery and Reinvestment Act.

Approximately $1.2 billion was used to restore reductions proposed by the governor in his executive budget and approximately $1 billion was used to finance new spending. All of these spending items should be immediately reviewed for potential reductions. Freezing all funds for new and increases to current spending programs alone would save hundreds of millions of dollars. In addition, the Democrats in both houses rejected many of Governor Paterson’s proposed legislative changes in the budget that would have saved over $100 million this year. Lastly Governor Paterson proposed $700 million in health care savings initiatives that were not included in the adopted budget which should be revisited.

10% Cut in State Agency Non-Personal Service - $480 million

Efficiency savings of 10% are assumed under this proposal. Selected categories include: equipment spending; employee travel; lease, maintenance and repairs; supplies and materials; telephone services; employee benefits and general state charges and utilities and centralized services. Potential actions include: Freeze all new vehicle purchases; Freeze all new equipment/furniture purchases; Suspend all unnecessary travel for state employees; Limit agency printing to essential services only; Limit agency mailings/postage expenses to essential services only; Eliminate all agency non emergency blackberry/cell phone usage; Turn down the heat in state buildings everyday and not just weekends; Freeze agency spending from state operation reappropriations; Freeze agency spending for employee training; Close agency regional offices; Reduce the size of agency public information offices; Freeze agency spending for conferences; Freeze all pending state rental agreements- new or renewal - to reduce space; Freeze all state agency advertising and marketing spending; Freeze all state agency public information office spending; Eliminate all state agency intern program spending; Freeze all new technology spending; Freeze equipment leases not executed; Freeze nonessential building repairs; Freeze all agency subscription service spending; Freeze agency membership payments for professional entities; Competitively bid state employee medical/ hospital/ dental programs.

Freeze State Purchases of Recreational Land – Savings $78 million

This proposal would freeze the purchase of additional recreational land by the state. Given the state fiscal year (SFY) 09-10 executive proposal to renege on the state’s current local tax obligation on existing state owned lands, the state cannot continue to purchase land. Current cash balances for this purpose would be transferred from the Environmental Protection Fund.

Freeze Planned Medicaid Expansions – $200 million by 2011-12

All initiatives to expand the state’s Medicaid program should be stopped immediately as the state cannot afford the current program which is the most expansive in the nation. The Paterson administration is seeking to expand eligibility for Family Health Plus (FHP) to 200 percent of the federal poverty level. FHP enrollment in New York is projected to grow by another 128,000 families over the next four years. Expansions in eligibility to the Child Health Plus program should also be reevaluated. Higher Medicaid enrollment and use will add $975 million to the state-taxpayers' share of Medicaid costs by 2011-12, according to the governor's financial plan. Meanwhile, federal stimulus aid is supposed to expire the year after next, which will leave New Yorkers to cover more than $3 billion a year now temporarily underwritten by federal stimulus aid.

Reinstitute Medicaid and Welfare Anti-Fraud / Taxpayer Protections - $34 million

The adopted budget includes an initiative to “streamline access to coverage”. This “streamlining” of the Medicaid and welfare application process works by eliminating mechanisms designed to protect the taxpayers from fraud, waste and abuse such as the requirement for face-to-face interviews, fingerprinting and asset tests for determining eligibility. All of these safeguards should remain in place to insure that those receiving Medicaid and welfare benefits are indeed eligible under the law.

Cut Medicaid Optional Services - $150 million

The New York State Medicaid program offers nearly 2 dozen optional services not required under the federal Medicaid program. Reducing the number of optional services to those required by the federal government would reduce costs. Eliminating all optional services would save the state $150 million.

Cut 5% from Select Agency Contract Balances - $300 million

As of September of 2009, the undisbursed balance of existing state contracts totals more than $129 billion. This proposal excludes the following types of contracts: authority, revenue generating, repayments to state contracts, community project fund, construction, construction related, non general fund, Department of Health, State Ed, and contracts with zero balance. The proposal assumes a 5% reduction in all undisbursed balances, of which 1% would be general fund savings.

Share this Article or Press Release

Newsroom

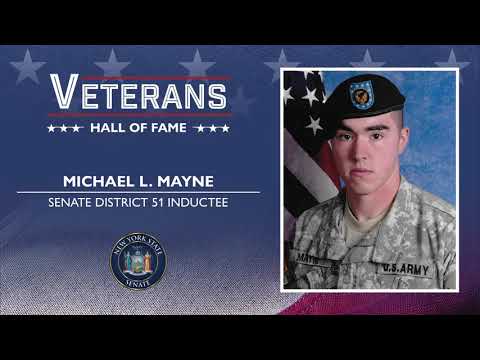

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020