Senate Holds Rochester Hearing on Corporate Franchise Tax Reform

Liz Krueger

April 28, 2009

Fiscal Policy Institute, Unshackle Upstate, and others to testify on creating a fairer business tax code

State Senator Liz Krueger, Chairwoman of the Senate’s Select Committee on Budget and Tax Reform, announced today that the Senate will hold a hearing on Thursday, April 30th in Rochester to consider changes to the state’s Corporate Franchise Tax (Article 9-A of the Tax Law).

Facing a loss of more than 161,000 private sector jobs in the last year, New York now faces the dilemma of declining tax revenues at a time of heightened need to attract new businesses and generate new jobs. The committee will consider proposals that would allow the state to more strategically employ tax benefits.

WHERE: Monroe County Office Building, Room 407, 39 West Main Street, Rochester, NY

WHEN: Thursday, April 30, 2009 @ 12:30 P.M. to approximately 5 P.M.

AMONG THOSE EXPECTED TO TESTIFY:

Frank Mauro: Executive Director, Fiscal Policy Institute

Ken Pokalsky: Senior Director of Government Affairs, Business Council of New York State

Jon Greenbaum: Lead Organizer, Metro Justice

Brian Sampson: Executive Director, Unshackle Upstate

Christopher Koetzle: Vice President of Membership Services, Support Services Alliance

Randy Wolken or Kathryn Burns: Manufacturing Association of Central New York

James Bertolone: Director, Rochester and Genesee Area Labor Federation

Chris Wiest: Vice President of Public Policy and Advocacy, Rochester Business Alliance

###

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Krueger's Community Bulletin - October 2019

October 4, 2019

Senators Press State Comptroller On Fossil Fuel Divestment

September 26, 2019

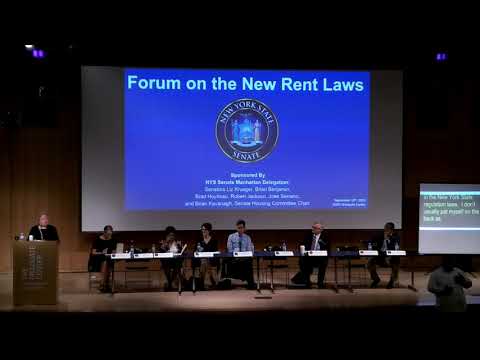

Manhattan Senate Delegation Holds Forum On New Rent Laws

September 12, 2019