Senate's Historic Rehabilitation Tax Credit Signed Into Law

Malcolm A. Smith

July 29, 2009

PROGRAM BRINGS REDEVELOPMENT TO DISTRESSED NEIGHBORHOODS

(Albany, NY) The Senate’s Historic Rehabilitation Tax Credit (S6056) was signed into law today by Governor Paterson, establishing a nationally competitive rehabilitation and preservation program that will benefit property owners and communities who seek to renovate properties that are run down and dilapidated.

Sponsored by Senator David Valesky (D-Oneida), the program will trigger the revitalization of our state’s urban areas by attracting new investment, businesses, and jobs at a time when state legislators are working to get our economy back on track.

The legislation increases the value of tax credits available to developers and investors for residential and commercial properties with funds targeted to “distressed” areas.

After passing the Senate unanimously, members of the Upstate Caucus worked closely with Governor Paterson to ensure the bill would be signed into law; highlighting the program’s ability to attract new investment, business, and jobs.

Senate President Malcolm A. Smith said: “Given our ongoing efforts to turn the economy around and put New York on a sensible path toward long-term economic growth, this is exactly the kind of smart economic development program we need to strengthen our communities. Every region of this state will benefit from the reinvestment and beautification of our neighborhoods. I give Senator Valesky and Assemblyman Hoyt credit for their thoughtful approach to economic revitalization, and to the Governor for recognizing the significance of this legislation.”

Senator Valesky, Vice President Pro-Tempore of the State Senate said: “This program has the potential to transform the economic landscape of Upstate New York at a time when we need it most. Investment in our urban cores and villages will stimulate the kind of economic activity necessary to rebuild the Upstate economy, brick by brick.”

HRTC strengthens the State program first launched in 2006 and will make New York State more competitive against the nearly 30 other state’s with similar programs, who have had more success. The changes will allow the state to target reinvestment to distressed communities, as determined by the U.S. Census, and incorporate cost savings to the administration of the program.

Because of these changes, New York State will have among the most productive and cost-effective redevelopment programs in the country.

Nationally, historic rehabilitation tax credits have proven to be one of the most successful policy tools in economic and community development. In Rhode Island, where the historic rehabilitation tax credit program is hailed as the most effective economic redevelopment program in state history, it has generated $795.25 million in new economic activity ($5.47 million per $1.0 million in credits) and has so far created more than 11,000 new jobs.

The Senate’s legislation will:

·Increase the cap on commercial credit value from $100,000 to $5 million; the residential credit value will increase from $25,000 to $50,000. These are over the course of the program, which is 5 years.

·Limit the availability of the residential and commercial credit of the program to “distressed” areas, which is defined as being located within a Census tract identified at or below one hundred percent of the median family income.

·Increase the percent of qualified rehabilitation costs that can be claimed for the credit from 6-percent to 20-percent, allowing for a higher percentage of qualified rehabilitation costs.

·Make the credit assignable, transferable, and conveyable within business partnerships, to allow for greater flexibility on the part of the investor, and attract out-of-state financing for in-state rehabilitation projects.

·Offer the rehabilitation tax credit as a rebate to make the program a stronger financial incentive for homeowners without significant income tax liability.

Senate Majority Leader Pedro Espada, Jr. (D-Bronx) said: "Targeting reinvestment to distressed communities will help jump-start local economies because it translates into the creation of new jobs for local residents, work for small businesses and tax revenue streams for individual governments and the State. This law will provide desperately needed relief during these difficult economic times.”

Democratic Conference Leader John L. Sampson (D-Brooklyn) said: “With this legislation, the once vibrant buildings that have fallen into disrepair and neglect in communities across New York State, shall be restored to their original splendor. These historic fixtures stand as symbols of times of great development in New York. They should be provided with the needed care and attention that they deserve. I congratulate Senator Valesky and Assemblyman Hoyt for this bill, and I thank Governor Paterson for signing it into law.”

Senator Neil Breslin (D-Albany) said: “The Historic Rehabilitation Tax Credit Program is one that already serves several purposes and can now do even more. It preserves our rich heritage by creating an incentive to rehabilitate our beautiful historic homes, and the increased tax cap on commercial credit will help better stimulate our economy, creating new jobs. This program is truly a win-win for New York’s distressed neighborhoods.”

Senator Darrel J. Aubertine (D-Cape Vincent) said: “This legislation opens up new opportunities to create jobs while restoring historic buildings. This Historic Preservation Tax Credit will help to attract new business and investment. This program and other incentives for historic preservation will help to improve our economy and build on our sense of community. I’m quite pleased to see this program signed into law because it will benefit many new and existing projects in Central and Northern New York.”

Senator William T. Stachowski (D-Lake View), Chairman of the Senate Committee on Commerce, Economic Development and Small Business said: “As a cosponsor of this important legislation, I support the effort to create economic stimulus and community redevelopment especially in western New York. Many historic buildings throughout upstate are currently vacant, underutilized, and deteriorating. By providing a tax credit for the rehabilitation of these properties, we can encourage their restoration to their former beauty and build up many distressed neighborhoods.”

Senator Andrea Stewart-Cousins (D-Yonkers) said: “My Senate district is a prime candidate for the Historic Rehabilitation Tax Credit because of its historic city, towns, and village. I was pleased to support this crucial legislation because it will help to strengthen, preserve, and stabilize historic communities while creating jobs. It is an important economic development tool especially needed during these challenging economic times.”

Senator Antoine Thompson (D-parts of Erie and Niagara Counties) said: "The Historic Rehabilitation Tax Credit will greatly benefit Western New York and I'm proud to be a co-sponsor of the bill. This tax credit will not only rehabilitate Western New York's historic properties, it will also create jobs and stimulate the economy.”

Senator Liz Krueger (D-Manhattan) said: "In these difficult economic times it is more important than ever to pass legislation that will stimulate the economy. This bill will significantly promote growth in distressed communities by creating an incentive to rehabilitate deteriorating historic buildings."

--Additional quotes--

Peg Breen, President of The New York Landmarks Conservancy said: "An important step was taken today in expanding a program that has proven its worth as an economic stimulus in other states. Providing enhanced tax credits for the rehabilitation of historic homes and neighborhoods will benefit all parts the state."

Ben Walsh, Executive Director of the New York State Urban Council said, “This bill represents a rare opportunity to breathe new life into New York State’s historic urban cores. The expanded historic rehabilitation tax credit program will produce a predictable and reliable economic development incentive that will target private investment and job growth in the distressed communities that need it most.”

Jay DiLorenzo, President of the Preservation League of New York State said: “We have every reason to believe that the New York State Rehabilitation Tax Credit will prove one of the most effective economic and community development programs in the state. We are enormously grateful to Assemblymember Hoyt and Senator Valesky for shepherding this important Smart Growth initiative through their respective houses and to the leadership of the Senate and the Assembly for their vision in passing this legislation. We thank New York’s mayors, county executives and other municipal leaders who have shown unwavering support for this effort. Finally, we express our great admiration for Governor Paterson for signing these historic tax credits into law today.”

Robert M. Simpson, president and CEO of the Metropolitan Development Association of Syracuse and Central New York said,: “The enhanced New York State historic rehabilitation tax credit provides a significant stimulus that will enable pivotal downtown redevelopment projects to move forward. By signing this legislation into law, Governor Paterson has given Syracuse, and all of our region’s urban cores, an essential reinvestment tool that will spur economic development across the state.”

Share this Article or Press Release

Newsroom

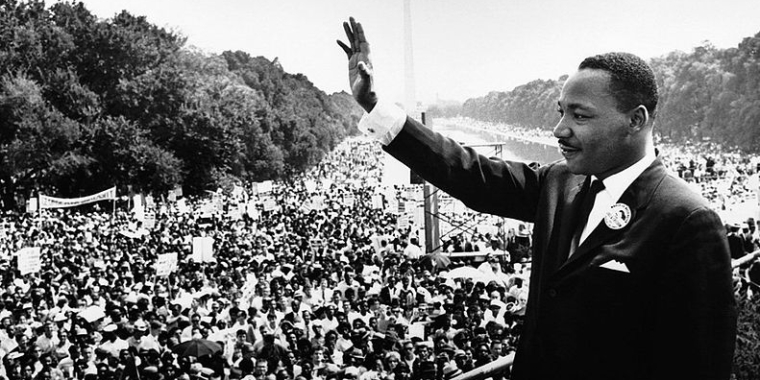

Go to NewsroomRemembering the Rev. Dr. Martin Luther King Jr.

January 22, 2014

The 10th Annual Jump & Ball Basketball Tournament 2014

January 8, 2014