Putting New York Back To Work

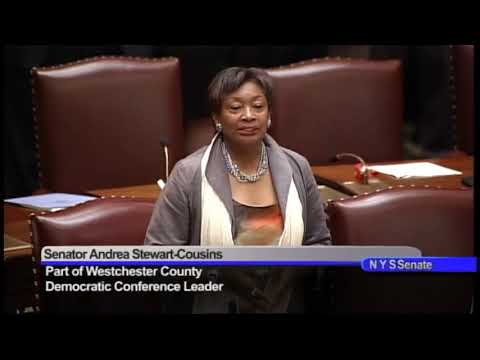

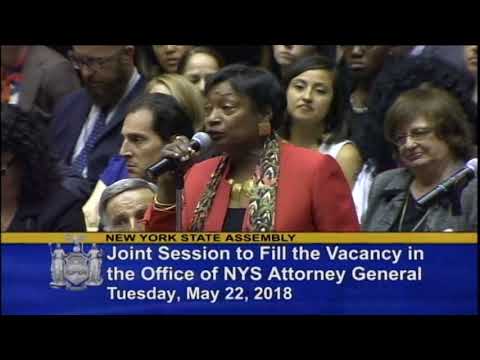

Andrea Stewart-Cousins

March 25, 2010

-

ISSUE:

- Labor

- Unemployment

- Green Jobs

(Albany, NY) Today, Senator Andrea Stewart-Cousins joined Senators William Stachowski, Darrel Aubertine, David J. Valesky and Brian X. Foley to unveil an innovative jobs and economic development program to get New Yorkers back to work. The New Jobs New York program is comprised of three initiatives that can bring support to local small businesses, create job growth and attracting new investment through tax incentives.

“One of our top priorities for the State of New York is to stimulate the economy in ways that creates jobs and makes our businesses competitive,” said Senator Andrea Stewart-Cousins. “The New Jobs New York initiative provides small business with necessary tools for creating the jobs that are vital to New York’s long term economic strength. I am proud to stand with Senator Sampson and my colleagues in the Majority Conference to support this initiative which can help put New Yorkers back to work.”

Through three targeted initiatives New Jobs New York will:

- Create jobs immediately to provide a much-needed economic boost out of this recession;

- Boost the confidence of small businesses owners to grow;

- Implement a tax incentivization program that works for businesses already in New York, and attracts new investments and jobs for the future.

RESTORE NY II

Legislation is necessary to create jobs quickly.

Restore NY II will establish thousands of new jobs within nine weeks of implementation by funding small-scale transformational demolition, restoration, and construction projects with an emphasis on small community construction and restoration projects.

Preference will be given to: (1) projects in blighted or distressed areas; (2) projects that incorporate the principles of smart growth, energy efficiency, urban agriculture and green building design; and (3) projects that incorporate an accompanying workforce development component. Projects must be ready to commence construction within 60 days of award.

Eligible applicants will be either municipalities or not-for-profit entities assigned by a resolution of the governing body of a municipality. Eligible activities are the same as Restore NY, but will also include green markets and urban agriculture, the development/restoration of urban parks or green spaces, and affordable housing renovation projects.

The timeline for job creation will begin when the first applications are approved by ESDC – in about nine weeks, or 63 days, after the enabling legislation becomes law.

About 75 jobs will be created for every million dollars invested in the RestoreNY II Program. The Program cost will be $50 million, in capital funding, which is expected to create about 3,750 jobs.

MAIN STREET INITIATIVE

Small businesses are the first to get us out of a recession.

The Main Street Initiative creates over 1,900 new jobs, allow businesses to retain an additional 2,220 existing positions and includes a growth model for grants and technical assistance which will give small business owners the confidence and resources to cultivate new business opportunities and begin hiring again. Comprised of five basic elements, components of the plan include New York Boost, an Incubator Network, Customized Funds, tax incentives for high-tech businesses, and a mobile jobs training program. These elements combine to improve access to capital resources and expertise, provide workforce training in crucial skill sets, and leverage private capital for investment in jobs and infrastructure.

The Main Street Initiative small business program is comprised of five basic elements:

- New York Boost – Makes an investment to existing providers of services to small business clients that have increased needs in the economic downturn. Provides funding to existing programs supporting a total of 43 centers that provide quality services to small businesses throughout the State.

- Customized Funds – Provides specialized funds to address specific regional, capital program structure or market failure issues.

o CDFI Revolving Loan Fund - creates micro-loans to businesses not eligible for bank loans, as well as one-on-one counseling and business development assistance.

o North Country Revolving Loan Fund - tailored to the unique needs of businesses and communities in distressed areas in the North Country, including Tug Hill.

o Biofuel Incentive Fund -jump-starts conversion of underutilized agricultural land to production for bio-energy production or for capital costs for building methane biodigesters for the conversion of energy from bio-waste on agricultural lands.

- Training-On-The-Go – Funds portable skills training facilities, comprised of semi-trailers with all necessary instructional equipment, to make training in high value occupations a reality for students in rural areas, incumbent workers, and those enrolled in educational institutions without the resources to equip cutting-edge training facilities.

- Incubator Network - Modeled on NYSTAR’s successful Centers for Advanced Technology (CATs) program this initiative provides operating funds for five years to statewide network of ten designated university affiliated incubators.

- START UP – Tax incentives for new high-tech businesses.

OPEN FOR BUSINESS NY

To stimulate our economy and maintain economic growth over the long-term, Open for Business NY supports targeted job creation in both legacy and innovation-based industries employing attractive business incentives and investments that will be the cornerstone of New York’s future in the global economy.

Replacing the flawed Empire Zone program, this plan implements the intent of the Empire Zones, to support existing businesses and attract new investments in a targeted manner, Open for Business NY, enrollment in this program allows participants to earn access to a variety of refundable tax incentive options, including:

- Jobs Tax Credit: Program participants are eligible for a Jobs Tax Credit ranging between $2,500 and $10,000 for each new job to cover a portion of the associated payroll cost.

- Investment Tax Credit: Participants receive a 10-percent tax credit on investments that improve physical plants.

- Research & Development Tax Credit: The federal government offers a 30 percent tax credit for investment in research and development. Firms participating in the program will are eligible for a research and development tax credit of 10 percent of their federal credit.

- Property Tax Credit: Firms who locate in distressed communities are eligible for real property tax incentives.

Open for Business NY will create and/or retain approximately 30,000 jobs for every $50 million invested. A total of 210,000 jobs will be created or retained by the time Open for Business sunsets in 2017

“Job creation and support for small businesses are essential for the families living in Westchester County and across the entire state. The New Jobs New York program will provide local businesses with the opportunity to expand, create incentives needed to attract outside businesses and support rapid job creation,” concluded Senator Andrea Stewart-Cousins.

###

Share this Article or Press Release

Newsroom

Go to Newsroom

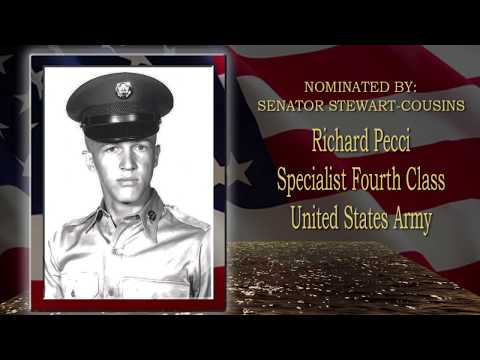

Richard Pecci

May 15, 2018