Wage Theft Prevention Act Signed Into Law

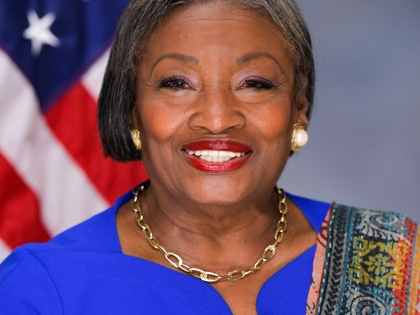

Andrea Stewart-Cousins

December 14, 2010

-

ISSUE:

- Labor

- Minimum Wage

Today, Senator Andrea Stewart-Cousins announced Wage Theft Prevention Act (S8380), legislation she co-sponsored in the Senate, has been signed into law by Governor David A. Paterson. This new law will effectively expand workplace rights of employees by requiring employers not only to provide employees with necessary wage information, but put in place sanctions for employers who fail to properly pay their workers full earned wages and overtime.

Studies indicate that a large number of employees are earning less than state-mandated minimum wage in New York, are being paid less than their correct wage and are not receiving the appropriate amount of overtime compensation. Employers often take advantage of employees by not informing them of what their wages are and how they are calculated. Also, past sanctions on employers found in violation were not strong enough, nor enforced properly, and therefore failed to deter employers from such discriminatory conduct.

“This new law will provide employees with the opportunity for legal recourse against employers that unfairly withhold wages and overtime pay,” said Senator Andrea Stewart-Cousins (35th District – D/WF). “In passing this legislation, New York sends a clear message to employers that practices that undermine workers and put honest businesses at a competitive disadvantage will not be tolerated.”

The new law will require annual notifications of wages (as well as expansion of these notifications), increase the availability of remedies for wage law violations and create stronger whistleblower protections. Moreover, the law will enforce stricter sanctions on employers who fail to provide employees with proper compensation for their work.

The Wage Theft Prevention Act:

- Enacts more stringent and transparent record-keeping and employer notification requirements on all employers;

- Increases the amount of wages that can be recovered as damages in a suit for non-payment over and above the lost wages themselves - from 25 percent to 100 percent, the amount allowable under Federal law;

- Creates stronger collection tools;

- Raises criminal penalties for failure to pay minimum wage to up to a year in prison and $5,000 fine.

- Strengthens protections for whistleblowers in cases involving wage violations.

Share this Article or Press Release

Newsroom

Go to Newsroom