Senator Valesky Supports Tax Department Plan to Regulate Amount of Tax-Free Cigarettes Supplied to Indian Nations/Tribes

David J. Valesky

February 24, 2010

SYRACUSE, N.Y.—State Senator David J. Valesky (D-Oneida) today announced his support for recent actions undertaken by the New York State Department of Taxation and Finance that would move the state closer to collecting sales tax on cigarettes sold by Native American businesses to non-Native Americans.

“I have been strongly urging the Governor to enforce the law since it was signed, and I believe these actions signify that we are finally moving in the right direction,” said Senator Valesky. “The law unequivocally states that sales tax should be collected, and I will continue to be a vocal advocate for upholding the law.”

According to the Department of Taxation and Finance, the proposed regulations would limit the amount of tax-free cigarettes available on Native American reservation retailers, ensuring tribe members the ability to buy tax-free cigarettes for personal consumption, and help preventing wider sales to non-tribe members.

The Department also took action to revoke an advisory opinion issued in 2006 which supported non-enforcement of the collection law. However, judicial injunctions preventing enforcement still stand.

“Though these recent events represent a step in the right direction, there is more work to be done. I strongly urge the Governor and Department of Taxation and Finance to expedite the process and bring this issue to closure,” Senator Valesky said.

The Department of Taxation and Finance has invited interested parties to comment on the content of the regulations. Contents of the regulations and information for comment procedure is available at www.nystax.gov.

###

Share this Article or Press Release

Newsroom

Go to NewsroomSen. Valesky’s Sixth Annual Free Senior Fair is October 19 in Madison County

September 25, 2018

Harmful Algal Blooms: What to Know, How to Report

June 29, 2018

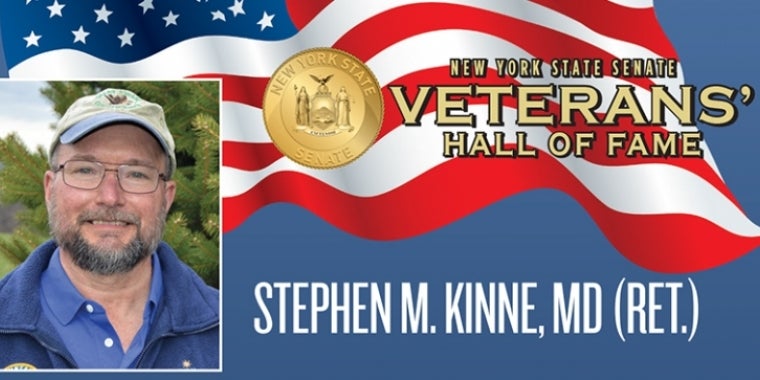

Stephen M. Kinne, MD (Ret.)

May 15, 2018